A) stockholders' equity will be overstated by $800.

B) expenses will be understated by $750.

C) assets will be understated by $250.

D) net income will be understated by $800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unearned revenue is classified as

A) an asset account.

B) a revenue account.

C) a contra-revenue account.

D) a liability account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2022, Superfuzz Company purchased equipment for $40,000.The company is depreciating the equipment at a rate of $800 per month.The book value of the equipment at December 31, 2022 is

A) $0.

B) $9,600.

C) $30,400.

D) $40,000.

Correct Answer

verified

Correct Answer

verified

True/False

Accrued revenues are revenues that have been recognized and received before financial statements have been prepared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At December 31, 2022, before any year-end adjustments, Murmur Company's Insurance Expense account had a balance of $2,450 and its Prepaid Insurance account had a balance of $3,800.It was determined that $2,800 of the Prepaid Insurance had expired.The adjusted balance for Insurance Expense for the year would be

A) $2,450.

B) $3,450.

C) $2,800.

D) $5,250.

Correct Answer

verified

Correct Answer

verified

True/False

The expense recognition principle requires that expenses be matched with revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alternative adjusting entries do not apply to

A) accrued revenues and accrued expenses.

B) prepaid expenses.

C) unearned revenues.

D) prepaid expenses and unearned revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

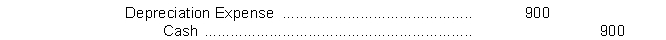

A new accountant working for Spirit Walker Company records $900 Depreciation Expense on store equipment as follows:  The effect of this entry is to

The effect of this entry is to

A) adjust the accounts to their proper amounts on December 31.

B) understate total assets on the balance sheet as of December 31.

C) overstate the book value of the depreciable assets at December 31.

D) understate the book value of the depreciable assets as of December 31.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a business pays rent in advance and debits a Prepaid Rent account, the company receiving the rent payment will credit

A) Cash.

B) Prepaid Rent.

C) Unearned Rent Revenue.

D) Rent Revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjusting entries can be classified as

A) postponements and advances.

B) accruals and deferrals.

C) deferrals and postponements.

D) accruals and advances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expense recognition principle matches

A) customers with businesses.

B) expenses with revenues.

C) assets with liabilities.

D) creditors with businesses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crue Company had the following transactions during 2022: Sales of $4,800 on account to 1. Collected $2,000 for services to 1. Paid $1,625 cash in salaries Purchased airline tickets for $250 in December for a trip to take place in 2023 What is Crue's 2022 net income using accrual accounting-basis?

A) $2,925

B) $3,175

C) $4,925

D) $5,175

Correct Answer

verified

Correct Answer

verified

True/False

The economic entity assumption states that economic events can be identified with a particular unit of accountability.

Correct Answer

verified

Correct Answer

verified

True/False

Adjusting entries are recorded in the general journal but are not posted to the accounts in the general ledger.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company fails to make an adjusting entry to record supplies expense, then

A) stockholders' equity will be understated.

B) expense will be understated.

C) assets will be understated.

D) net income will be understated.

Correct Answer

verified

Correct Answer

verified

True/False

The time period assumption states that the economic life of a business entity can be divided into artificial time periods.

Correct Answer

verified

Correct Answer

verified

Essay

Blue Guitar Music School borrowed $30,000 from the bank signing an 8%, six-month note on November 1.Principal and interest are payable to the bank on May 1.If the company prepares monthly financial statements, what adjusting entry should the company make at November 30 with regard to the note (round answer to the nearest dollar)?

Correct Answer

verified

Correct Answer

verified

True/False

The revenue recognition principle dictates that revenue be recognized in the accounting period in which cash is received.

Correct Answer

verified

Correct Answer

verified

True/False

A common application of the cost constraint is weighing the factual nature of cost figures versus the relevance of fair value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an adjusting entry is not made for an accrued revenue,

A) assets will be overstated.

B) expenses will be understated.

C) stockholders' equity will be understated.

D) revenues will be overstated.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 204

Related Exams