A) permanent accounting record.

B) optional device used by accountants.

C) part of the general ledger.

D) part of the journal.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

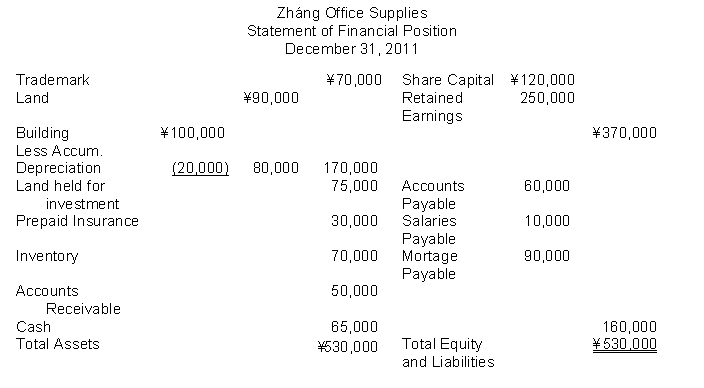

The following information (in thousands) is for Zháng Office Supplies:  The total dollar amount of assets to be classified as current assets is

The total dollar amount of assets to be classified as current assets is

A) ¥290,000.

B) ¥215,000.

C) ¥180,000.

D) ¥145,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities

A) are obligations that the company is to pay within the forthcoming year.

B) are listed in the statement of financial position in order of their expected maturity.

C) are listed in the statement of financial position starting with accounts payable.

D) should not include long-term debt that is expected to be paid within the next year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 25, Carlin Company received a $550 check from Andy Jeter for services to be performed in the future.The bookkeeper for Carlin Company incorrectly debited Cash for $550 and credited Accounts Receivable for $550.The amounts have been posted to the ledger.To correct this entry, the bookkeeper should:

A) debit Cash $550 and credit Unearned Service Revenue $550.

B) debit Accounts Receivable $550 and credit Service Revenue $550.

C) debit Accounts Receivable $550 and credit Cash $550.

D) debit Accounts Receivable $550 and credit Unearned Service Revenue $550.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The steps in the preparation of a worksheet do not include

A) analyzing documentary evidence.

B) preparing a trial balance on the worksheet.

C) entering the adjustments in the adjustment columns.

D) entering adjusted balances in the adjusted trial balance columns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sub-classifications for assets on the company's classified statement of financial position would include all of the following except:

The sub-classifications for assets on the company's classified statement of financial position would include all of the following except:

A) Current Assets.

B) Property, Plant, and Equipment.

C) Intangible Assets.

D) Long-term Assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of the post-closing trial balance is to

A) prove that no mistakes were made.

B) prove the equality of the statement of financial position account balances that are carried forward into the next accounting period.

C) prove the equality of the income statement account balances that are carried forward into the next accounting period.

D) list all the statement of financial position accounts in alphabetical order for easy reference.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an optional step in the accounting cycle?

A) Adjusting entries

B) Closing entries

C) Correcting entries

D) Reversing entries

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements about the post-closing trial balance are correct except it

A) shows that the accounting equation is in balance.

B) provides evidence that the journalizing and posting of closing entries have been properly completed.

C) contains only permanent accounts.

D) proves that all transactions have been recorded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An error has occurred in the closing entry process if

A) revenue and expense accounts have zero balances.

B) the retained earnings account is credited for the amount of net income.

C) the dividends account is closed to the retained earnings account.

D) the Statement of financial position accounts have zero balances.

Correct Answer

verified

Correct Answer

verified

True/False

Long-term investments would appear in the property, plant, and equipment section of the statement of financial position.

Correct Answer

verified

Correct Answer

verified

True/False

If a worksheet is used, financial statements can be prepared before adjusting entries are journalized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement about closing the books of a corporation?

A) Expenses are closed to the Expense Summary account.

B) Only revenues are closed to the Income Summary account.

C) Revenues and expenses are closed to the Income Summary account.

D) Revenues, expenses, and the dividends account are closed to the Income Summary account.

Correct Answer

verified

Correct Answer

verified

True/False

A worksheet is a mandatory form that must be prepared along with an income statement and statement of financial position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is not true that current assets are assets that a company expects to

A) realize in cash within one year.

B) sell within one year.

C) use up within one year.

D) acquire within one year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

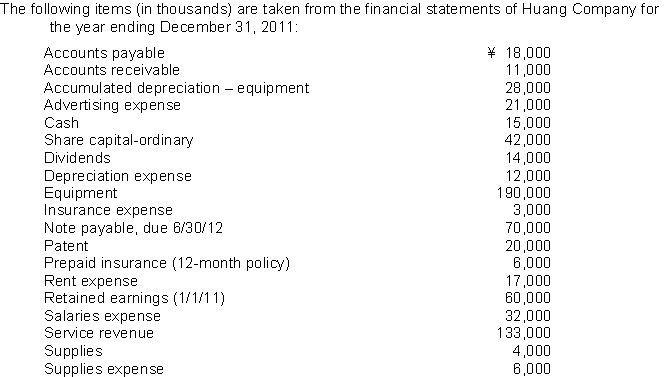

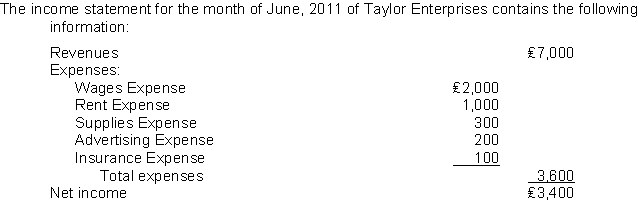

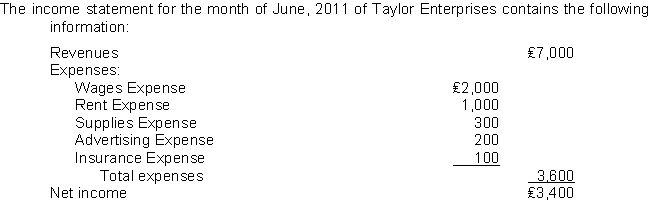

After the revenue and expense accounts have been closed, the balance in Income Summary will be

After the revenue and expense accounts have been closed, the balance in Income Summary will be

A) ₤0.

B) a debit balance of ₤3,400.

C) a credit balance of ₤3,400.

D) a credit balance of ₤7,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At June 1, 2011, Taylor reported Retained Earnings of ₤35,000.The company paid no dividends during June.At June 30, 2011, the company will report Retained Earnings of

At June 1, 2011, Taylor reported Retained Earnings of ₤35,000.The company paid no dividends during June.At June 30, 2011, the company will report Retained Earnings of

A) ₤35,000.

B) ₤42,000.

C) ₤38,400.

D) ₤31,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current assets should be listed on Dinkel's statement of financial position in the following order:

The current assets should be listed on Dinkel's statement of financial position in the following order:

A) accounts receivable, prepaid insurance, equipment, cash.

B) accounts receivable, prepaid insurance, supplies, cash.

C) prepaid insurance, supplies, accounts, receivable, cash.

D) equipment, supplies, prepaid insurance, accounts receivable, cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing closing entries

A) each revenue account will be credited.

B) each expense account will be credited.

C) the retained earnings account will be debited if there is net income for the period.

D) the dividends account will be debited.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement about long-term investments is not true?

A) They will be held for more than one year.

B) They are not currently used in the operation of the business.

C) They include investments in stock of other companies and land held for future use.

D) They can never include cash accounts.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 167

Related Exams