A) $2,940

B) $2,952

C) $2,400

D) $2,352

Correct Answer

verified

Correct Answer

verified

Essay

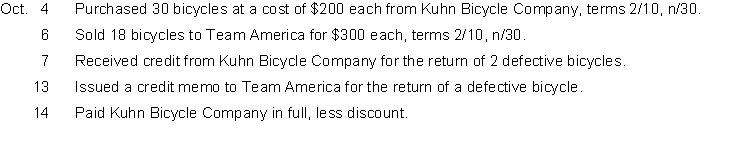

On October 1, Belton Bicycle Store had an inventory of 20 ten speed bicycles at a cost of $200 each.During the month of October, the following transactions occurred.  Instructions

Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system.

Instructions

Prepare the journal entries to record the transactions assuming the company uses a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered a merchandising company?

A) Retailer

B) Wholesaler

C) Service firm

D) Dot Com firm

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Touch Tronix, Inc.sells component parts to Advanced Communications, Inc.a cell phone manufacturer.On December 10, 2011, Touch Tronix, Inc.sold €680,000 of goods to Advanced Communications, Inc.on account for €880,000.Terms of the sale were 2/10, net 30.Advanced Communications, Inc.paid €13,000 in freight charges.On December 13, 2011, Advanced Communications, Inc.returned 5% of the goods due to inferior quality.On December 18, 2011, Advanced Communications, Inc.paid the account in full.Advanced Communications, Inc.uses a perpetual inventory system.If Advanced Communications, Inc.has not yet sold any of these goods, what is the ending balance in the inventory account after the payment is made?

A) €0

B) €646,080.

C) €832,280.

D) €865,720.

Correct Answer

verified

Correct Answer

verified

Essay

196 Assume that Vangundy Company uses a periodic inventory system and has these account balances: Purchases €490,000; Purchase Returns and Allowances €14,000; Purchase Discounts €9,000; and Freight-in €15,000.Determine net purchases and cost of goods purchased.

Correct Answer

verified

Correct Answer

verified

True/False

Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs.

Correct Answer

verified

Correct Answer

verified

Essay

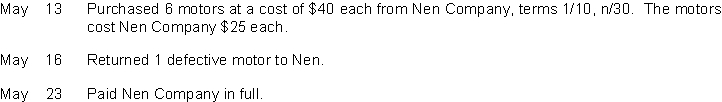

198

Slater Brothers Supply uses a periodic inventory system.During May, the following transactions and events occurred.  Instructions

Journalize the May transactions for Slater Brothers.You may omit explanations.

Instructions

Journalize the May transactions for Slater Brothers.You may omit explanations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company is given credit terms of 2/10, n/30, it should

A) hold off paying the bill until the end of the credit period, while investing the money at 10% annual interest during this time.

B) pay within the discount period and recognize a savings.

C) pay within the credit period but don't take the trouble to invest the cash while waiting to pay the bill.

D) recognize that the supplier is desperate for cash and withhold payment until the end of the credit period while negotiating a lower sales price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

International Financial Reporting Standards call for companies to mark the recorded values of certain types of assets and liabilities to fair value each period.These unrealized gains and losses are excluded from net income but included in comprehensive income and include all of the following except

A) Adjustments to pension plan assets.

B) Gains from foreign currency translation.

C) Unrealized losses on certain types of investments.

D) Adjustment to fixed assets for depreciation.

Correct Answer

verified

Correct Answer

verified

True/False

Under International Financial Reporting Standards (IFRS) operating expenses may be presented by nature or by function.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial information is presented below:  Gross profit would be

Gross profit would be

A) €154,000.

B) €140,000.

C) €128,000.

D) €166,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a worksheet for a merchandising company, Merchandise Inventory would appear in the

A) trial balance and adjusted trial balance columns only.

B) trial balance and statement of financial position columns only.

C) trial balance, adjusted trial balance, and statement of financial position columns.

D) trial balance, adjusted trial balance, and income statement columns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record a credit sale is

A) Cash Sales

B) Cash Service Revenue

C) Accounts Receivable Service Revenue

D) Accounts Receivable Sales

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan Company made a purchase of merchandise on credit from Claude Corporation on August 3, for $3,000, terms 2/10, n/45.On August 10, Logan makes the appropriate payment to Claude.The entry on August 10 for Logan Company is

A) ![]()

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Detailed records of the cost of each inventory purchase and sale are not maintained under a

A) perpetual inventory system.

B) periodic inventory system.

C) double entry accounting system.

D) single entry accounting system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company determines cost of goods sold each time a sale occurs, it

A) must have a computer accounting system.

B) uses a combination of the perpetual and periodic inventory systems.

C) uses a periodic inventory system.

D) uses a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Touch Tronix, Inc.sells component parts to Advanced Communications, Inc.a cell phone manufacturer.On December 10, 2011, Touch Tronix, Inc.sold €680,000 of goods to Advanced Communications, Inc.on account for €880,000.Terms of the sale were 2/10, net 30.On December 18, 2011, Advanced Communications, Inc.paid the account in full.Which of the following is true regarding the impact on the statement of financial position for Touch Tronix, Inc.when the payment is made on December 18, 2011?

A) Assets decreased by €880,000.

B) Assets decreased by €17,600.

C) Assets increased by €862,400.

D) Assets decreased by €13,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During August, 2011, Joe's Supply Store generated revenues of $60,000.The company's expenses were as follows: cost of goods sold of $24,000 and operating expenses of $4,000.The company also had rent revenue of $1,000 and a gain on the sale of a delivery truck of $2,000. Joe's income from operations for the month of August, 2011 is

A) $60,000.

B) $39,000.

C) $37,000.

D) $32,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cartier Company purchased inventory from Pissaro Company.The shipping costs were $400 and the terms of the shipment were FOB shipping point.Cartier would have the following entry regarding the shipping charges:

A) There is no entry on Cartier's books for this transaction.

B) ![]()

C) ![]()

D) ![]()

Correct Answer

verified

Correct Answer

verified

True/False

Under a perpetual inventory system, inventory shrinkage and lost or stolen goods are more readily determined.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 201

Related Exams