B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

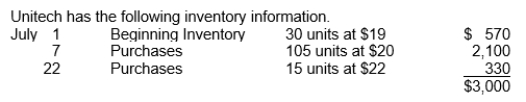

A physical count of merchandise inventory on July 31 reveals that there are 45 units on hand.Using the average-cost method, the value of ending inventory is

A physical count of merchandise inventory on July 31 reveals that there are 45 units on hand.Using the average-cost method, the value of ending inventory is

A) $870.

B) $900.

C) $915.

D) $930.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overstating ending inventory will overstate all of the following except

A) assets.

B) cost of goods sold.

C) net income.

D) equity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The pool of inventory costs consists of the beginning inventory plus the cost of goods purchased.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

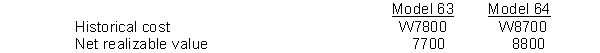

At December 31, 2011, Bosan Corporation has 3,500 units of model 63 and 2,500 units of model 64 in its ending inventory.Specific data with respect to each product follows:  What amount will be reported for inventory on Boson's statement of financial position after the company applies LCNRV?

What amount will be reported for inventory on Boson's statement of financial position after the company applies LCNRV?

A) W54,250,000.

B) W49,300,000.

C) W48,950,000.

D) W48,700,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Inventory turnover is calculated as cost of goods sold divided by ending inventory.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The moving-average cost flow assumption for a perpetual inventory system and the average-cost cost flow assumption for a periodic inventory system will allocate the same amounts to ending inventory and cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

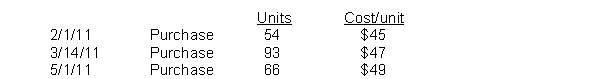

Lee Industries had the following inventory transactions occur during 2011:  The company sold 153 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

The company sold 153 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used, what is the company's gross profit using FIFO? (rounded to whole dollars)

A) $7,323

B) $7,095

C) $2,544

D) $2,316

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct with respect to inventories?

A) The FIFO method assumes that the costs of the earliest goods acquired are the last to be sold.

B) It is generally good business management to sell the most recently acquired goods first.

C) Under FIFO, the ending inventory is based on the latest units purchased.

D) FIFO seldom coincides with the actual physical flow of inventory.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a perpetual inventory system, the cost of goods sold under the FIFO method is based on the cost of the latest goods on hand during the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The retail inventory method requires a company to value its inventory on the statement of financial position at retail prices.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an error understates the beginning inventory, net income will also be understated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of falling prices, which inventory method would result in the lowest tax burden?

A) Average-cost.

B) FIFO.

C) No difference.

D) Cannot be determined.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the FIFO method, the costs of the earliest units purchased are the first charged to cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

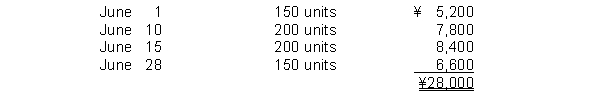

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the FIFO inventory method, the amount allocated to cost of goods sold for June is

A) ¥8,700.

B) ¥16,960.

C) ¥19,300.

D) ¥20,850.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The average cost method costs units using a weighted-average unit cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An error that overstates the ending inventory will also cause net income for the period to be overstated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reinhoff Inc.reported total assets of €2,600,000, including €435,000 for inventory, and equity of €1,490,0000 on the December 31, 2011 statement of financial position.Reinhoff subsequently determined that the ending inventory was understated by €63,000.What is the corrected amount of equity for the year?

A) €0.

B) €1,427,000.

C) €1,490,000.

D) €1,553,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available for Park Company at December 31, 2011: beginning inventory $80,000; ending inventory $120,000; cost of goods sold $900,000; and sales $1,200,000.Park's inventory turnover in 2011 is

A) 12 times.

B) 11.3 times.

C) 9 times.

D) 7.5 times.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At May 1, 2011, Deitrich Company had beginning inventory consisting of 100 units with a unit cost of €3.50.During May, the company purchased inventory as follows:  The company sold 500 units during the month for €6 per unit.Deitrich uses the average cost method.The value of Deitrich's inventory at May 31, 2011 is

The company sold 500 units during the month for €6 per unit.Deitrich uses the average cost method.The value of Deitrich's inventory at May 31, 2011 is

A) €350.

B) €375.

C) €400.

D) €2,250.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 156

Related Exams