A) The NPV and IRR methods will select the same project if the required rate of return is greater than 10 percent; for example, 18 percent.

B) The NPV and IRR methods will select the same project if the cost of capital is less than 10 percent; for example, 8 percent.

C) To determine if a ranking conflict will occur between the two projects the required rate of return is needed as well as an additional piece of information.

D) Project L should be selected at any required rate of return, because it has a higher IRR.

E) Project S should be selected at any required rate of return, because it has a higher IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal rate of return of a capital investment

A) Changes when the required rate of return changes.

B) Is equal to the annual net cash flows divided by one half of the project's cost when the cash flows are an annuity.

C) Must exceed the required rate of return in order for the firm to accept the investment.

D) Is similar to the yield to maturity bond.

E) Answers c and d are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you are comparing two mutually exclusive projects.Which of the following statements is most correct?

A) The NPV and IRR rules will always lead to the same decision unless one or both of the projects are "non-conventional" in the sense of having only one change of sign in the cash flow stream, i.e., one or more initial cash outflows (the investment) followed by a series of cash inflows.

B) If a conflict exists between the NPV and the IRR, the conflict can always be eliminated by dropping the IRR and replacing it with the payback period.

C) There will be a meaningful (as opposed to irrelevant) conflict only if the projects' NPV profiles cross, and even then, only if the required rate of return is to the left of (or lower than) the discount rate at which the crossover occurs.

D) Statements a, b, and c are all true.

E) None of the above is a correct statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The discounted payback is generally shorter than the regular payback.

B) Any type of project might have multiple rates of return if the IRR is sufficiently high.

C) The NPV and IRR methods can lead to conflicting and accept/reject decisions only if (1) mutually exclusive projects are being evaluated and (2) if the projects' NPV profiles cross at a rate less than the firm's cost of capital.

D) The NPV and IRR methods can lead to conflicting accept/reject decisions only if (1) mutually exclusive projects are being evaluated and (2) if the projects' NPV profiles cross at a rate greater than the firm's cost of capital.

E) None of the above is a correct statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) There can never be a conflict between NPV and IRR decisions if the decision is related to a normal, independent project, i.e., NPV will never indicate acceptance if IRR indicates rejection.

B) To find the MIRR, we first compound CFs at the regular IRR to find the TV, and then we discount the TV at the required rate of return to find the PV.

C) The NPV and IRR methods both assume that cash flows are reinvested at the required rate of return.However, the MIRR method assumes reinvestment at the MIRR itself.

D) If you are choosing between two projects which have the same cost, and if their NPV profiles cross, then the project with the higher IRR probably has more of its cash flows coming in the later years.

E) A change in the required rate of return would normally change both a project's NPV and its IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Richard evaluated a capital budgeting project-a new machine needed to manufacture inventory-using his firm's required rate of return, he discovered that the project's net present value (NPV) is negative.Based on this information, which of the following must be correct?

A) The project's internal rate of return is also negative.

B) The project's discounted payback period is greater than its economic life.

C) As long as the new machine's initial investment outlay is fairly low, the firm should purchase if it is used to replace an older machine that is required to produce inventory.

D) The project's traditional payback period must be greater than the maximum payback period that the firm has established.

E) Two or more of these scenarios must be correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Discounted payback's primary advantage over traditional payback is that

A) discounted payback considers cash flows that occur after the discounted payback period.

B) discounted payback is always shorter than traditional payback making more projects acceptable.

C) discounted payback does consider the time value of money.

D) discounted payback will let you accept projects whose discounted payback period is longer than the useful of the project.

E) all of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a rationale for using the NPV method in capital budgeting?

A) An NPV of zero signifies that the project's cash flows are just sufficient to repay the invested capital and to provide the required rate of return on that capital.

B) A project whose NPV is positive will increase the value of the firm if that project is accepted.

C) A project is considered acceptable if it has a positive NPV.

D) A project is not considered acceptable if it has a negative NPV.

E) All of the above are true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

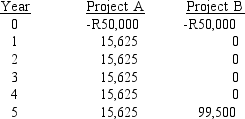

Two projects being considered are mutually exclusive and have the following cash flows:  If the required rate of return on these projects is 10 percent, which would be chosen and why?

If the required rate of return on these projects is 10 percent, which would be chosen and why?

A) Project B because of higher NPV.

B) Project B because of higher IRR.

C) Project A because of higher NPV.

D) Project A because of higher IRR.

E) Neither, because both have IRRs less than the cost of capital.

Correct Answer

verified

Correct Answer

verified

True/False

NPV and IRR will always lead to the same accept/reject decision for mutually exclusive projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The modified IRR (MIRR) is normally

A) Less than the regular IRR if IRR > r.

B) Greater than the regular IRR if IRR > r.

C) Equal to the regular IRR if IRR = r.

D) Answers a and c are both correct.

E) Answers b and c are both correct.

Correct Answer

verified

Correct Answer

verified

True/False

The modified IRR (MIRR) method has wide appeal to professors, but most business executives prefer the NPV method to either the regular or modified IRR.

Correct Answer

verified

Correct Answer

verified

True/False

Project S has a pattern of high cash flows in its early life, while Project L has a longer life, with large cash flows late in its life.At the current required rate of return, normal Projects S and L have identical NPVs.Now suppose interest rates and money costs generally decline.Other things held constant, this change will cause L to become preferred to S.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most correct? The modified IRR (MIRR) method:

A) Always leads to the same ranking decision as NPV for independent projects.

B) Overcomes the problem of multiple rates of return.

C) Compounds cash flows at the required rate of return.

D) Overcomes the problem of cash flow timing and the problem of project size that leads to criticism of the regular IRR method.

E) Answers b and c are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following capital budgeting methods might not consider the salvage value of a machine being considered for purchase?

A) Internal rate of return.

B) Net present value.

C) Payback.

D) Discounted payback.

E) Answers c and d are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the capital budgeting director for Chapel Hill Coffins Company, you are evaluating construction of a new plant.The plant has a net cost of R5 million in Year 0 (today) , and it will provide net cash inflows of R1 million at the end of Year 1, R1.5 million at the end of Year 2, and R2 million at the end of Years 3 through5.Within what range is the plant's IRR?

A) 14-15%

B) 15-16%

C) 16-17%

D) 17-18%

E) 18-19%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following factors can complicate the post-audit process except

A) each element of the cash flow forecast is subject to uncertainty.

B) projects sometimes fail to meet expectations for reasons beyond the control of operating executives.

C) it is often difficult to separate the operating results of one investment from those of a larger system.

D) executives who were responsible for a given decision might have moved on by the time the time the results of the long term project are known.

E) the most successful firms, on average, are the ones that put the least emphasis on the post-audit.

Correct Answer

verified

Correct Answer

verified

True/False

Any capital budgeting investment rule should depend solely on forecasted cash flows and the opportunity rate of return.The rule itself should not be affected by managers' tastes, the choice of accounting method, or the profitability of other independent projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net present value is preferred to internal rate of return for capital budgeting decisions because

A) the internal rate of return does not allow you to determine if the project is acceptable.

B) the net present value is the only method that allows you to determine which independent project is acceptable.

C) the net present value allows you to compare mutually exclusive projects.

D) the internal rate of return for a project is different for each firm.

E) NPV contains information about a projects "safety margin" which is not inherent in

IRR)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) When dealing with independent projects, discounted payback (using a payback requirement of 3 or less years) , NPV, IRR, and modified IRR always lead to the same accept/reject decisions for a given project.

B) When dealing with mutually exclusive projects, the NPV and modified IRR methods always rank projects the same, but those rankings can conflict with rankings produced by the discounted payback and the regular IRR methods.

C) Multiple rates of return are possible with the regular IRR method but not with the modified IRR method, and this fact is one reason given by the textbook for favoring MIRR (or modified IRR) over IRR.

D) Statements a, b and c are all false.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 94

Related Exams