A) $30 million

B) $70 million

C) $100 million

D) zero

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed buys U.S.government bonds from the public, it

A) increases the volume of reserves in the banking system and the money supply tends to grow.

B) decreases the volume of reserves in the banking system and the money supply tends to grow.

C) increases the volume of reserves in the banking system and the money supply tends to fall.

D) decreases the volume of reserves in the banking system and the money supply tends to fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve buys $10,000 of government securities from commercial banks.If the required reserve ratio is 25%, what is the maximum amount of change in the nation's money supply? Assume that no banks keep excess reserves and no individuals or firms hold cash.

A) expand by $10,000

B) expand by $30,000

C) expand by $40,000

D) expand by $7,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A system in which banks hold reserves whose value is less than the sum of claims on those reserves is called

A) speculative banking.

B) leveraged banking.

C) fractional reserve banking.

D) international banking.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is any item that

A) serves as a medium of exchange for goods and services.

B) can be converted into silver with relatively little loss in value.

C) can be converted into gold with relatively little loss in value.

D) facilitates a connecting link between credit instruments and debt instruments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any item that serves as a medium of exchange is called

A) gold.

B) capital.

C) silver.

D) money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions Exhibit: Fed Buys Bonds Scenario 1: Fed Buys Bonds from Sheila Jones Consider a banking system in which the reserve requirement is 10%, banks try not to hold excess reserves, consumers and firms hold money only in the form of checking account balances, and all loan proceeds are spent.Suppose initially all banks in the system are loaned up.Now, suppose that the Fed buys a $100,000 bond from Sheila Jones, who banks at the Perez Bank, and that she deposits her check in her checking account at Perez Bank. -(Exhibit: Fed Buys Bonds) Which of the following happens when Sheila Jones deposits the proceeds from the sale of her bond to the Fed into her checking account at the Perez Bank?

A) Perez Bank's checkable deposits increases by $100,000 and its reserves increases by $90,000.

B) Perez Bank's checkable deposits and reserves increase by $100,000 each.

C) Perez Bank's checkable deposits increases by $90,000 and its reserves increases by $100,000.

D) Perez Bank's checkable deposits and reserves increase by $90,000 each.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A primary function of a central bank is to

A) regulate dividend payments by corporations.

B) control the bond market.

C) set monetary policy.

D) publish statistics on banking and related financial matters.

Correct Answer

verified

Correct Answer

verified

True/False

The money supply is the total amount of checkable deposits in the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a bank has $50,000 in deposits and $6,000 in reserves.The required reserve ratio is 10%.Which of the following occurs if the required reserve ratio is increased to 12%?

A) The bank's total reserves will fall.

B) The bank will now be fully loaned up.

C) The bank will have insufficient required reserves.

D) The bank's profit will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity of reserves that banks must hold against deposits is called

A) the reserve ratio.

B) excess reserves.

C) total reserves.

D) required reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

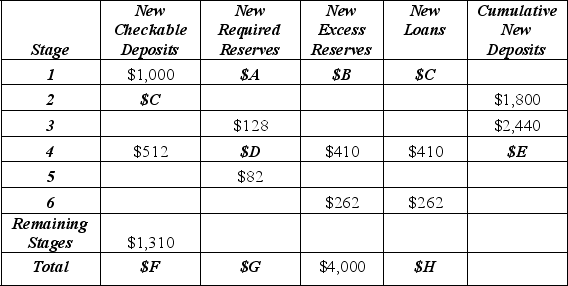

Use the following to answer questions

Exhibit: Deposit Expansion Stages

-(Exhibit: Deposit Expansion Stages)

What is the value of $H (the total loans)

?

-(Exhibit: Deposit Expansion Stages)

What is the value of $H (the total loans)

?

A) $1,000

B) $4,000

C) $5,000

D) $6,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve does all of the following except

A) make loans to individuals

B) influence the supply of money

C) influence the value of money

D) regulate the banking system

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a function of the Federal Reserve System?

A) It acts as a central bank.

B) It acts as a banker to banks.

C) It determines tax levels in conjunction with the U.S.Treasury.

D) It sets monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You spend $20 to buy a used textbook at the college bookstore.What function does money perform here?

A) medium of exchange

B) store of value

C) unit of account

D) standard of deferred payment

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items serve as a medium of exchange in the United States? I.$100 cash II.50 euros III.the balance in your checking account IV.a $1,000 corporate stock that you own

A) I only

B) I and II

C) I, II, and III

D) I and III

E) I, II, III, and IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following to answer questions Exhibit: Fed Sells Bonds Scenario 2: Fed sells bonds to Henry Hyde Consider a banking system in which the reserve requirement is 10%, banks try not to hold excess reserves, consumers and firms hold money only in the form of checking account balances, and all loan proceeds are spent.Suppose initially all banks in the system are loaned up.Now, suppose that the Fed sells a $50,000 bond to Henry Hyde, who pays for the bond by writing a check drawn against Jekyll Bank. -(Exhibit: Fed Sells Bonds) As a result of the open market sale, Jekyll Bank

A) can create $50,000 of new loans.

B) will have $45,000 of excess reserves.

C) will have to borrow reserves to replenish its reserve deficiency.

D) will have an increase in checkable deposits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money that some authority, generally a government, has ordered to be accepted as a medium of exchange is called _______ money.

A) fiat

B) intrinsic

C) commodity

D) debt

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The functions of money are

A) a conductor of economic activity, a medium of exchange, and a store of value.

B) a medium of exchange, a store of value, and a factor of production.

C) a store of value, a medium of exchange, and a determinant of investment.

D) a store of value, a unit of account, and a medium of exchange.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a bank's liabilities?

A) its reserves

B) its loans

C) checkable deposits

D) its holdings of U.S.government bonds

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 219

Related Exams