A) demand, right.

B) demand, left.

C) supply, right.

D) supply, left.

Correct Answer

verified

Correct Answer

verified

True/False

When a central bank sets a maximum and minimum for its target short term interest rate, it is using the channel system.

Correct Answer

verified

Correct Answer

verified

Essay

Why does the demand for reserves slope down with respect to the federal funds rate?

Correct Answer

verified

If the federal funds...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

Lowering the discount rate always lowers the federal funds rate.

Correct Answer

verified

Correct Answer

verified

Essay

On a graph of the supply and demand for reserves, what would shift the supply curve down?

Correct Answer

verified

a decrease...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Which of these policy tools can a central bank use?

A) QE

B) SPV

C) TSLF

D) FFR

Correct Answer

verified

Correct Answer

verified

True/False

Raising the discount rate raises the equilibrium federal funds rate if the demand for reserves intersects the vertical portion of the supply for reserves.

Correct Answer

verified

Correct Answer

verified

True/False

If banks fear a run, the demand for reserves shifts to the left.

Correct Answer

verified

Correct Answer

verified

True/False

To effectively implement the channel system, a central bank must pay interest on reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed raises the reserve requirement, the _____ of reserves shifts to the

A) demand, right.

B) demand, left.

C) supply, right.

D) supply, left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the channel system, a shift in the demand for reserves can change the equilibrium overnight rate if that rate is

A) equal to the discount rate.

B) equal to the interest rate on reserves.

C) between the discount rate and the interest rate on reserves.

D) all of the above.

Correct Answer

verified

C

Correct Answer

verified

True/False

The demand for reserves slopes down with respect to the federal funds rate, since the Fed tends to make more loans when the federal funds rate is low.

Correct Answer

verified

Correct Answer

verified

Essay

List the unconventional tools a central bank might employ, and tell when they would use them.

Correct Answer

verified

Central banks have the forward...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

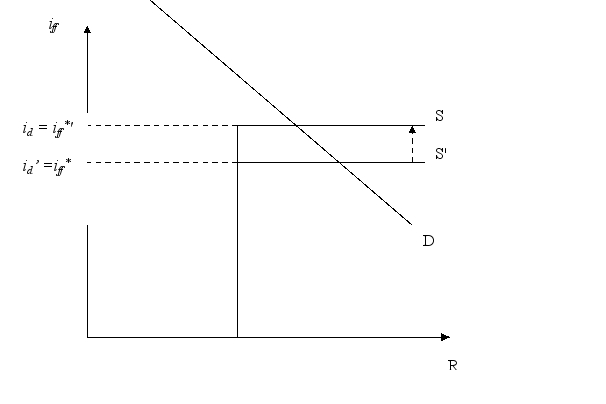

Show a graph for supply and demand for reserves where there is discount lending. Show and explain the effect on equilibrium of raising the discount rate.

Correct Answer

verified

Raising the discount rate shifts the sup...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

The part of the Federal Reserve that implements open market operations is

A) the FRBNY.

B) the Board of Governors.

C) the FRBSF.

D) Congress.

Correct Answer

verified

Correct Answer

verified

True/False

The supply of reserves is horizontal at the equilibrium federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a program developed by the Fed during the 2008 financial crisis?

A) TAF

B) PDCF

C) CPFF

D) TRAPS

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The goal of quantitative easing is to _____.

A) increase the prices of (increase the yields of) Treasury bonds in order to control inflation

B) decrease the prices of (increase the yields of) Treasury bonds in order to control inflation

C) increase the prices of (decrease the yields of) Treasury bonds and influence the money supply directly

D) decrease the prices of (increase the yields of) Treasury bonds and influence the money supply directly

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

When the Fed raises the discount rate, the _____ of reserves shifts to the

A) demand, up.

B) demand, down.

C) supply, up.

D) supply, down.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate used by the ECB that is analogous to the discount rate for the Federal Reserve is the

A) repo rate.

B) marginal lending rate.

C) federal funds rate.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams