Correct Answer

verified

Correct Answer

verified

Multiple Choice

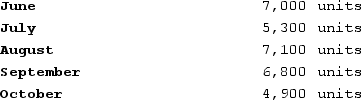

Harden, Incorporated, has budgeted sales in units for the next five months as follows:  Past experience has shown that the ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on May 31 contained 1,050 units. The company needs to prepare a production budget for the next five months.The beginning inventory for September should be:

Past experience has shown that the ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on May 31 contained 1,050 units. The company needs to prepare a production budget for the next five months.The beginning inventory for September should be:

A) 1,020 units

B) 1,050 units

C) 1,065 units

D) 735 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Haylock Incorporated bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 7,600 direct labor-hours will be required in August. The variable overhead rate is $1.40 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $100,420 per month, which includes depreciation of $8,930. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $10,640

B) $102,130

C) $91,490

D) $111,060

Correct Answer

verified

Correct Answer

verified

Multiple Choice

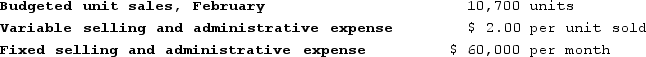

Yerkey Corporation makes one product and has provided the following information to help prepare the master budget:  The estimated selling and administrative expense for February is closest to:

The estimated selling and administrative expense for February is closest to:

A) $81,400

B) $21,400

C) $54,270

D) $60,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sedita Incorporated is working on its cash budget for July. The budgeted beginning cash balance is $46,000. Budgeted cash receipts total $175,000 and budgeted cash disbursements total $174,000. The desired ending cash balance is $50,000. The excess (deficiency) of cash available over disbursements for July will be:

A) $47,000

B) $221,000

C) $45,000

D) $1,000

Correct Answer

verified

Correct Answer

verified

True/False

The selling and administrative expense budget lists all costs of production other than direct materials and direct labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Murie Corporation makes one product and has provided the following information:  The estimated net operating income (loss) for February is closest to:

The estimated net operating income (loss) for February is closest to:

A) $5,800

B) $42,000

C) $35,500

D) $85,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

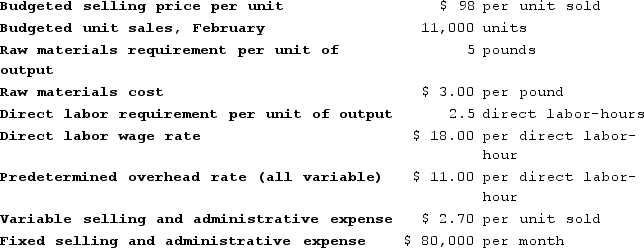

Caspion Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 2.5 kilograms of the raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows:  The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 10,800 kilograms of Jurislon were on hand. The cost of Jurislon is $18.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.The total cost of Jurislon to be purchased in August is:

The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 10,800 kilograms of Jurislon were on hand. The cost of Jurislon is $18.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.The total cost of Jurislon to be purchased in August is:

A) $1,839,600

B) $1,014,300

C) $1,208,700

D) $1,017,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

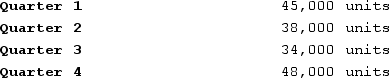

The Jung Corporation's production budget calls for the following number of units to be produced each quarter for next year:Budgeted production  Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be:

Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be:

A) 114,600 pounds

B) 89,400 pounds

C) 38,200 pounds

D) 29,800 pounds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stefanovich Corporation makes one product. The company has provided the following information concerning its raw materials needs:The ending raw materials inventory should equal 20% of the following month's raw materials production needs.Each unit of finished goods requires 2 pounds of raw materials.The raw materials cost $3.00 per pound.The company will need 26,440 pounds of raw material to satisfy production needs in March.The raw materials inventory balance at the end of February should be closest to:

A) $74,136

B) $14,568

C) $88,704

D) $15,864

Correct Answer

verified

Correct Answer

verified

Multiple Choice

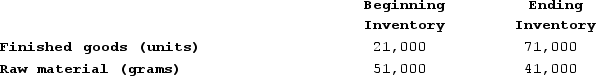

Sarafiny Corporation is in the process of preparing its annual budget. The following beginning and ending inventory levels are planned for the year.  Each unit of finished goods requires 2 grams of raw material. The company plans to sell 560,000 units during the year.How much of the raw material should the company purchase during the year?

Each unit of finished goods requires 2 grams of raw material. The company plans to sell 560,000 units during the year.How much of the raw material should the company purchase during the year?

A) 1,231,000 grams

B) 1,210,000 grams

C) 1,261,000 grams

D) 1,220,000 grams

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The selling and administrative expense budget of Choo Corporation is based on budgeted unit sales, which are 4,600 units for August. The variable selling and administrative expense is $7.30 per unit. The budgeted fixed selling and administrative expense is $51,980 per month, which includes depreciation of $6,440 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the August selling and administrative expense budget should be:

A) $85,560

B) $45,540

C) $79,120

D) $33,580

Correct Answer

verified

Correct Answer

verified

Multiple Choice

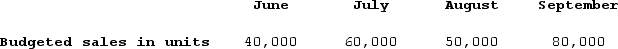

Masde Corporation produces and sells Product CharlieD. To guard against stockouts, the company requires that 25% of the next month's sales be on hand at the end of each month. Budgeted sales of Product CharlieD over the next four months are:  Budgeted production for August would be:

Budgeted production for August would be:

A) 57,500 units

B) 107,000 units

C) 77,000 units

D) 80,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Petrini Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations:The budgeted selling price per unit is $110. Budgeted unit sales for January, February, March, and April are 7,500, 10,600, 12,000, and 11,700 units, respectively. All sales are on credit.Regarding credit sales, 30% are collected in the month of the sale and 70% in the following month.The ending finished goods inventory equals 30% of the following month's sales.The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $4.00 per pound.Regarding raw materials purchases, 40% are paid for in the month of purchase and 60% in the following month.The direct labor wage rate is $23.00 per hour. Each unit of finished goods requires 2.6 direct labor-hours.Manufacturing overhead is entirely variable and is $8.00 per direct labor-hour.The variable selling and administrative expense per unit sold is $1.70. The fixed selling and administrative expense per month is $70,000.The estimated direct labor cost for February is closest to:

A) $253,460

B) $456,000

C) $658,996

D) $28,652

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sparks Corporation has a cash balance of $18,000 on April 1. The company must maintain a minimum cash balance of $10,000. During April, expected cash receipts are $98,000. Cash disbursements during the month are expected to total $112,000. Ignoring interest payments, during April the company will need to borrow:

A) $8,000

B) $2,000

C) $6,000

D) $4,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

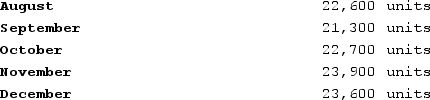

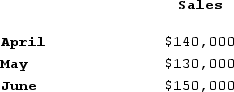

The BRS Corporation makes collections on sales according to the following schedule:30% in month of sale60% in month following sale10% in second month following saleThe following sales have been budgeted:  Budgeted cash collections in June would be:

Budgeted cash collections in June would be:

A) $137,000

B) $85,000

C) $45,000

D) $123,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dilly Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow:Sales are budgeted at $290,000 for November, $310,000 for December, and $210,000 for January.Collections are expected to be 65% in the month of sale and 35% in the month following the sale.The cost of goods sold is 80% of sales.The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.Other monthly expenses to be paid in cash are $21,100.Monthly depreciation is $21,000.Ignore taxes.  Expected cash collections in December are:

Expected cash collections in December are:

A) $310,000

B) $101,500

C) $303,000

D) $201,500

Correct Answer

verified

Correct Answer

verified

Multiple Choice

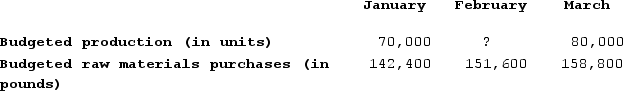

Marst Corporation's budgeted production in units and budgeted raw materials purchases over the next three months are given below:  Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 42,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:

Two pounds of raw materials are required to produce one unit of product. The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs. The company is expected to have 42,000 pounds of raw materials on hand on January 1. Budgeted production for February should be:

A) 103,400 units

B) 80,600 units

C) 80,000 units

D) 74,000 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wasilko Corporation produces and sells one productThe budgeted selling price per unit is $114. Budgeted unit sales for February is 9,900 units.Each unit of finished goods requires 6 pounds of raw materials. The raw materials cost $4.00 per pound.The direct labor wage rate is $24.00 per hour. Each unit of finished goods requires 2.4 direct labor-hours.Manufacturing overhead is entirely variable and is $9.00 per direct labor-hour.The variable selling and administrative expense per unit sold is $1.60. The fixed selling and administrative expense per month is $70,000.The estimated net operating income (loss) for February is closest to:

A) $50,000

B) $91,080

C) $21,080

D) $36,920

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT correct concerning the Cash Budget?

A) It is not necessary to prepare any other budgets before preparing the Cash Budget.

B) The Cash Budget should be prepared before the Budgeted Income Statement.

C) The Cash Budget should be prepared before the Budgeted Balance Sheet.

D) The Cash Budget builds on earlier budgets and schedules as well as additional data.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 284

Related Exams