A) to determine when to start withholding the tax from an employee's pay

B) to determine the amount of Social Security tax to withhold from an employee's pay

C) to establish a maximum salary level for application of the tax to employee pay

D) to compute the total amount of Social Security tax that a firm must pay

Correct Answer

verified

Correct Answer

verified

True/False

The regular Medicare tax deduction is 1.45% for employee and employer and must be paid by all employees.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paolo is a part-time security guard for a local facility. He earned $298.50 during the most recent weekly pay period and has earned $5,296.00 year-to-date. He is married with four withholding allowances. What is his Medicare tax liability for the pay period?

A) $10.54

B) $4.33

C) $43.23

D) $8.65

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best practices for paying employees by check include which of the following? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong Answer. Any boxes left with a question mark will be automatically graded as incorrect.)

A) Maintenance of a separate checking account for payroll purposes.

B) Keeping a single check register for the firm's checking accounts.

C) Logging the number, amount, and purpose of each check used.

D) Establishing an unclaimed property account for uncashed checks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jesse is a part-time nonexempt employee in Austin, Texas, who earns $12.50 per hour. During the last biweekly pay period he worked 35 hours. He is married with zero withholding allowances, which means his federal income tax deduction is $21.00, and has additional federal tax withholding of $30 per pay period. What is his net pay? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

A) $354.28

B) $374.03

C) $378.03

D) $353.03

Correct Answer

verified

Correct Answer

verified

True/False

A firm has headquarters in Indiana but has offices in California and Utah. For employee taxation purposes, it may choose which of those three states income tax laws it wishes to use.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Danny is a full-time exempt employee in Alabama, where his state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) . Assuming that he has no other deductions, what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the Wage-bracket table for the state income tax. Do not round intermediate calculations. Round your final answer to 2 decimal places.) Table 5. Percentage Method-2019 Amount for one Withholding Allowance One Withholding Payroll Period Allowance Weekly $80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) - (b) MARRIED person- If the amount of wages (after If the amount of wages (after Subtracting withholding subtracting withholding Allowances) is: The amount of income tax to withhold is: allowances) is: The amount of income tax to withhold is Not over $158...... $0 Not over $492...... $0 Over- But not over- Of excess over- Over- But not over- of excess ov $ 158 −$ 563 $ 0.00 plus 10% −$ 158 $ 492 -$ 1,300 $ 0.00 plus 10% $ 563 −$ 1,803 $ 40.50 plus 12% −$ 563 $ 1,300 -$ 3,781 $ 80.80 plus 12% $ 1,803 −$ 3,667 $ 189.30 plus 22% −$ 1,803 $ 3,781 -$ 7,508 $ 378.52 plus 22% $ 3,667 −$ 6,885 $ 599.38 plus 24% −$ 3,667 $ 7,508 -$ 13,885 $ 1,198.46 plus 24% $ 6,885 −$ 8,663 $ 1,364.50 plus 32% −$ 6,885 $ 13,885 -$ 17,500 $ 2,728.94 plus 32% $ 8,663 −$ 21,421 $ 1,943.06 plus 35% −$ 8,663 $ 17,500 -$ 26,006 $ 3885.74 plus 35% $ 21,421 $ 6,408.36 plus 37% −$ 21,421 $ 26,006 $ 6,862.84 plus 37%

A) $2,403.94

B) $2,178.90

C) $2,245.53

D) $2,278.94

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Julian is a part-time nonexempt employee in Nashville, Tennessee, who earns $21.50 per hour. During the last biweekly pay period he worked 45 hours, 5 of which are considered overtime. He is single with one withholding allowance (use the wage-bracket table) . What is his net pay? (Do not round intermediate

Calculations. Round your final answer to 2 decimal places.)

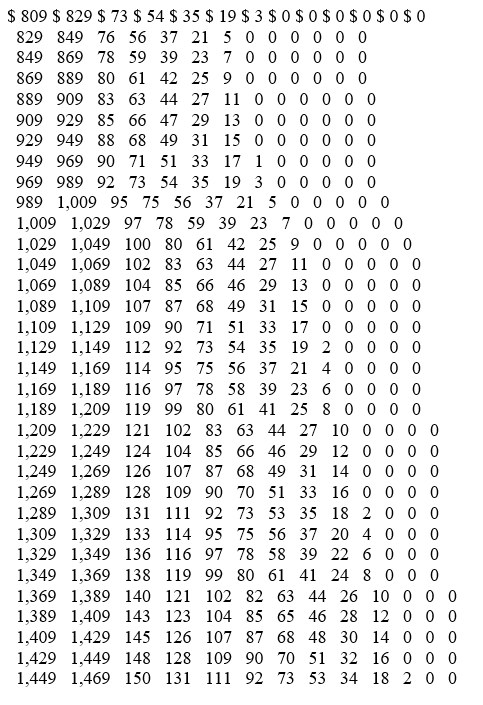

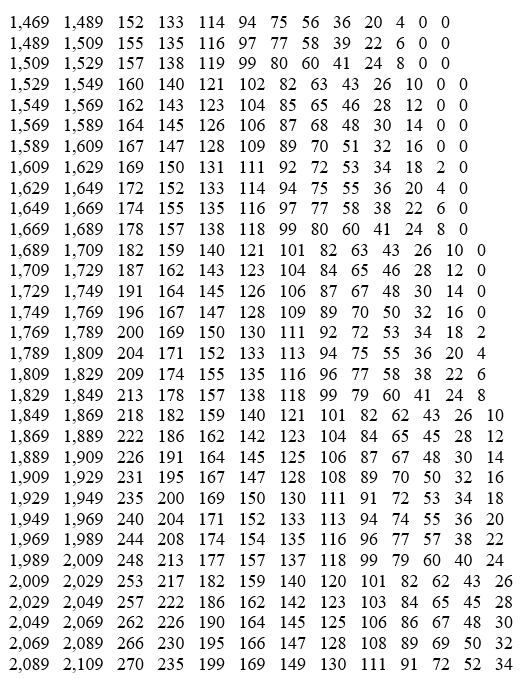

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $865.11

B) $825.99

C) $797.18

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nickels Company is located in West Virginia has employees who live in Ohio, Florida, Tennessee, and West Virginia. For which state(s) should the company collect and remit state income tax? (You may select more than one answer. Single click the box with the question mark to produce a check mark for A correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will Be automatically graded as incorrect.)

A) Florida

B) Ohio

C) West Virginia

D) Tennessee

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Natalia is a full-time exempt employee who earns $215,000 annually, paid monthly. Her year-to-date pay as of November 30 is $197,083.33. How much will be withheld from Natalia for FICA taxes for the December 31 pay date? (Social Security maximum wage is $132,900. Do not round intermediate calculations. Round Your final answer to 2 decimal places.)

A) $1,370.63

B) $292.04

C) $421.04

D) $394.79

Correct Answer

verified

Correct Answer

verified

True/False

Federal income tax, Medicare tax, and Social Security tax amounts withheld from employee pay are computed based on gross pay, less pre-tax deductions, and deducted to arrive at net pay.

Correct Answer

verified

Correct Answer

verified

True/False

The use of paycards as a means of transmitting employee pay began in the 1990s with over-the-road drivers out of a need to transmit funds reliably on payday.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How are income taxes and FICA taxes applied to gross-up pay? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left With a question mark will be automatically graded as incorrect.)

A) Subtract the sum of the income tax rate and FICA tax rate from 100 percent.

B) Compute the sum of the income tax and FICA tax rates.

C) Divide the net pay by the net tax rate.

D) Multiply the gross pay by the sum of the income tax and FICA tax rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sammy contributes 4% of her salary to a 401(k) plan, $50 per pay period to a charitable contribution, $140 per pay period to union dues, and $50 per pay period to a section 125 qualified insurance plan offered by her employer. Which contributions must be taken on a post-tax basis? (You may select more Than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the Question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

A) Section 125 insurance plan

B) 401(k) contribution

C) Charitable contribution

D) Union dues

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam is a part-time employee who earned $495.00 during the most recent pay period. He is married with two withholding allowances. Prior to this pay period, his year-to-date pay is $6,492.39. How much should be withheld from Adam's gross pay for Social Security tax?

A) $30.69

B) $28.46

C) $40.02

D) $37.92

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage of the Medicare tax withholding ________.

A) changes every year in response to industry needs

B) is the same for every employee, earning less than $200,000

C) is subject to change based on the firm's profitability

D) is always the same for both employer and employee

Correct Answer

verified

Correct Answer

verified

True/False

The wage-bracket of determining federal tax withholding yields more accurate amounts than the percentage method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Disposable income is defined as:

A) An employee's pay after legally required deductions have been withheld.

B) An employee's net pay less living expenses like rent and utilities.

C) An employee's gross pay less Identify Pre-Tax Deductions.

D) An employee's taxable income less Understand Post-Tax Deductions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olga earned $1,558.00 during the most recent weekly pay period. She is single with 2 withholding allowances and no pre-tax deductions. Using the percentage method, compute Olga's federal income tax for the period. (Do not round intermediate calculations. Round final answer to 2 decimal places.) Table 5. Percentage Method-2019 Amount for one Withholding Allowance Payroll Period One Withholding Allowance Weekly $80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) − (b) MARRIED person− If the amount of wages (after If the amount of wages (after Subtracting withholding subtracting withholding Allowances) is: The amount of income tax to withhold is: allowances) is: The amount of income tax to withhold is: Not over $73...... $0 Not over $227...... $0 Over− But not over− of excess over− Over− But not over− of excess over− $ 73 −$ 260 $ 0.00 plus 10% −$ 73 $ 227 −$ 588 $ 0.00 plus 10% $ 260 −$ 832 $ 18.70 plus 12% −$ 260 $ 600 −$ 1,711 $ 37.30 plus 12% $ 832 −$ 1,692 $ 87.34 plus 22% −$ 832 $ 1,745 −$ 3,395 $ 174.70 plus 22% $ 1,692 −$ 3,164 $ 276.54 plus 24% −$ 1,692 $ 3,465 −$ 6,280 $ 553.10 plus 24% $ 3,164 −$ 3,998 $ 629.82 plus 32% −$ 3,164 $ 6,409 −$ 7,914 $ 1,259.66 plus 32% $ 3,998 −$ 9,887 $ 896.70 plus 35% −$ 3,998 $ 8,007 −$ 11,761 $ 1,793.42 plus 35% $ 9,887 $ 2,957.85 plus 37% −$ 9,887 $ 12,003 $ 3,167.52 plus 37%

A) $239.25

B) $211.51

C) $214.75

D) $217.93

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage method of determining an employee's Federal income tax deductions ________.

A) allows payroll accountants to determine Federal income tax for the firm itself

B) is used to promote complexity in payroll practices

C) is less accurate than the results gained from using the wage-bracket method

D) is used primarily for high wage earners and computerized payroll programs

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 64

Related Exams