Correct Answer

verified

Correct Answer

verified

Multiple Choice

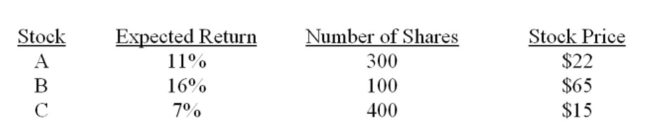

What is the expected return on this portfolio?

A) 9.63%

B) 9.91%

C) 10.08%

D) 10.62%

E) 11.45%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following measures is relevant to the systematic risk principle?

A) Variance.

B) Alpha.

C) Standard deviation.

D) Theta.

E) Beta.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reward-to-risk ratio for Stock X exceeds that of Stock Y. Stock X has a beta of 1.37 and Stock Y has a beta of .98. Given this, you know for certain that:

A) Stock X is undervalued as compared to Stock Y.

B) Stock Y is undervalued as compared to Stock X.

C) Stock X is overvalued and has more risk than stock Y.

D) Stock X is undervalued and has less risk than stock Y.

E) Stock X will plot above the security market line and Stock Y will plot below the line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

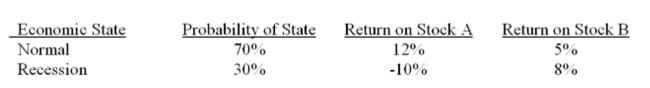

What is the expected return on a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

A) 5.40%

B) 5.70%

C) 6.40%

D) 7.80%

E) 8.10%

Correct Answer

verified

Correct Answer

verified

True/False

Unsystematic risk is rewarded by the marketplace.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Systematic risks are defined as:

A) The unique risks inherent to a particular industry or firm.

B) Unexpected events which affect the price of a limited number of securities.

C) Risks which are eliminated in a diversified portfolio.

D) Unexpected events which affect almost all assets.

E) Risks which go unrewarded by the marketplace.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of unsystematic risk?

A) The inflation rate increases unexpectedly.

B) The federal government lowers income taxes.

C) An oil tanker runs aground and spills its cargo.

D) Interest rates decline by one-half of one percent.

E) The GDP rises by 2% more than anticipated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the expected return for asset A?

A) 1.2%

B) 4.0%

C) 8.0%

D) 8.8%

E) 9.3%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market risk premium can be defined as the:

A) Return on the market plus the risk-free rate of return.

B) Amount of return received for accepting unsystematic risk.

C) Beta multiplied by the risk-free rate of return.

D) Slope of the market portfolio's security market line.

E) Intercept point of the security market line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

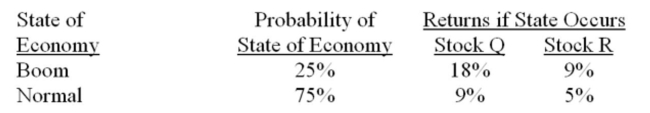

What is the standard deviation of a portfolio that is invested 40% in stock Q and 60% in stock R?

A) 0.7%

B) 1.4%

C) 2.6%

D) 6.8%

E) 8.1%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best definition of unsystematic risk

A) A theory showing that the expected return on any risky asset is a linear combination of various factors.

B) A risk that affects at most a small number of assets. Also called unique or asset-specific risks.

C) A risk that influences a large number of assets. Also called market risk.

D) Positively sloped straight line displaying the relationship between expected return and beta.

E) Principle stating that spreading an investment across a number of assets eliminates some, but not all, of the risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment firm is considering a portfolio with equal weighting in a cyclical stock and a countercyclical stock. It is expected that there will be three economic states; Good, Average and Bad, each with equal probabilities of occurrence. The cyclical stock is expected to have returns of 12%, 5% and 1% in Good, Average and Bad economies respectively. The countercyclical stock is Expected to have returns of -8%, 2% and 14% in Good, Average and Bad economies respectively. Given this information, calculate portfolio standard deviation.

A) 7.33%

B) 6.33%

C) 5.33%

D) 4.33%

E) 3.33%

Correct Answer

verified

Correct Answer

verified

True/False

Diversifiable risks are generally associated with an individual firm or industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The returns on the common stock of Cycles, Inc. are quite cyclical. In a boom economy, the stock is expected to return 27% in comparison to 13% in a normal economy and a negative 20% in a Recessionary period. The probability of a recession is 30% while the probability of a boom is 5%. The remainder of the time the economy will be at normal levels. What is the standard deviation of The returns on this stock?

A) 11.40%

B) 14.79%

C) 15.87%

D) 18.27%

E) 22.46%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock with an actual return that lies above the security market line:

A) Has more systematic risk than the overall market.

B) Has more risk than warranted based on the realized rate of return.

C) Has yielded a higher return than expected for the level of risk assumed.

D) Has less systematic risk than the overall market.

E) Has yielded a return equivalent to the level of risk assumed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based upon the capital asset pricing model, an asset which has more systematic risk than the market:

A) Will earn a rate of return that is greater than the risk-free rate but less than the market rate.

B) Will have a beta greater than 0 but less than 1.

C) Should have a reward-to-risk ratio which is greater than that of the market.

D) Should earn a rate of return which places it on the security market line.

E) Should earn a rate of return which places it above the security market line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ____________ return is that portion of total return attributable to information surprises.

A) Unexpected.

B) Expected.

C) Actual.

D) Systematic.

E) Non-diversifiable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total risk equals _________________.

A) market risk plus firm-specific risk,

B) firm-specific risk plus diversifiable risk,

C) systematic risk minus unsystematic risk,

D) diversifiable risk plus unsystematic risk,

E) market risk plus non-diversifiable risk,

Correct Answer

verified

Correct Answer

verified

Multiple Choice

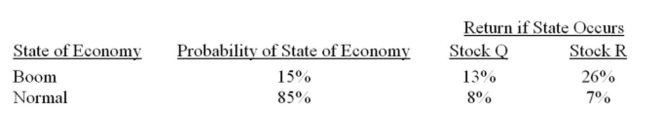

What is the standard deviation of a portfolio that is invested 30% in stock Q and 70% in stock R?

A) 1.22%

B) 3.93%

C) 5.28%

D) 8.03%

E) 11.47%

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 417

Related Exams