A) increase the prime interest rate.

B) decrease the size of the monetary multiplier.

C) increase the Fed's discount rate.

D) decrease the prime interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Taylor rule, when real GDP is at its potential and inflation is at its target rate of 2 percent, the Fed should

A) carefully lower the federal funds rate in an attempt to stimulate noninflationary real GDP growth.

B) raise the federal funds rate in an attempt to eliminate the remaining inflation.

C) lower the federal funds rate to lower borrowing costs for the federal government.

D) keep the federal funds rate at 4 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Answer the question on the assumption that the legal reserve ratio is 20 percent.Suppose that the Fed sells $500 of government securities to commercial banks (paid for out of commercial bank reserves) and buys $500 of securities from individuals, who deposit the cash in checking accounts.As a result of the given transactions, excess reserves in the banking system will

A) remain unchanged.

B) rise by $100.

C) fall by $100.

D) rise by $1,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal, an increase in productivity will

A) reduce aggregate supply and increase real output.

B) reduce both the interest rate and the international value of the dollar.

C) increase both aggregate supply and real output.

D) increase net exports, increase investment, and reduce aggregate demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The Federal funds rate is derived based on the prime rate.

B) The Federal funds rate is the rate banks charge their most creditworthy customers.

C) The discount rate is the rate banks charge one another on overnight loans.

D) The prime rate involves longer, more risky loans than the Federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate that banks charge one another on overnight loans is called the

A) discount rate.

B) prime lending rate.

C) overnight lending rate.

D) federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does it mean when economists say that the Fed has attempted to "normalize" monetary policy after the Great Recession?

A) The Fed has tried to use monetary policy to restore the unemployment rate to its normal full employment rate of around 5 percent.

B) The Fed has tried to use monetary policy to raise excess reserves back up to normal prerecession levels.

C) The Fed has tried to make all of the monetary policy actions used during the financial crisis a normal part of the monetary policy tool kit.

D) The Fed has tried to use monetary policy to bring interest rates back to the historically normal range of 3 percent or higher.

Correct Answer

verified

Correct Answer

verified

True/False

The Fed reduces interest rates mainly by selling government securities.Topic: Tools of Monetary Policy

Correct Answer

verified

Correct Answer

verified

True/False

If the monetary authority wished to rein in inflation, it would buy government securities in the open market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct? Other things equal,

A) a decline in real output will shift both the transactions demand curve for money and the total money demand curve to the right.

B) a decline in the interest rate will shift the asset demand curve for money to the right but leave the total money demand curve unchanged.

C) deflation will shift both the transactions demand curve for money and the total money demand curve to the left.

D) inflation will shift the transactions demand curve for money to the right but leave the total money demand curve unchanged.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The Federal funds rate is higher than the prime interest rate.

B) The prime interest rate is higher than the Federal funds rate.

C) The Federal funds rate and the prime interest rate are often the same.

D) The prime interest rate is often the same as the discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal, an increase in input prices will

A) reduce aggregate supply and reduce real output.

B) increase the interest rate and lower the international value of the dollar.

C) increase aggregate supply and increase the price level.

D) increase net exports, increase investment, and reduce aggregate demand.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equilibrium rate of interest in the market for money is determined by the intersection of the

A) supply-of-money curve and the asset-demand-for-money curve.

B) supply-of-money curve and the transactions-demand-for-money curve.

C) supply-of-money curve and the total-demand-for-money curve.

D) investment-demand curve and the total-demand-for-money curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the dollars held for transactions purposes are, on the average, spent four times a year for final goods and services, then the quantity of money people will wish to hold for transactions purposes is equal to

A) 4 percent of nominal GDP.

B) 25 percent of nominal GDP.

C) nominal GDP multiplied times 4.

D) nominal GDP divided by 25.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Fed sells bonds to the bank and the public, the expected result is that

A) the supply of federal funds will fall, the federal funds rate will rise, and a contraction of the money supply will occur.

B) the supply of federal funds will rise, the federal funds rate will fall, and an expansion of the money supply will occur.

C) the supply of federal funds will fall, the federal funds rate will fall, and an expansion of the money supply will occur.

D) the supply of federal funds will rise, the federal funds rate will rise, and a contraction of the money supply will occur.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

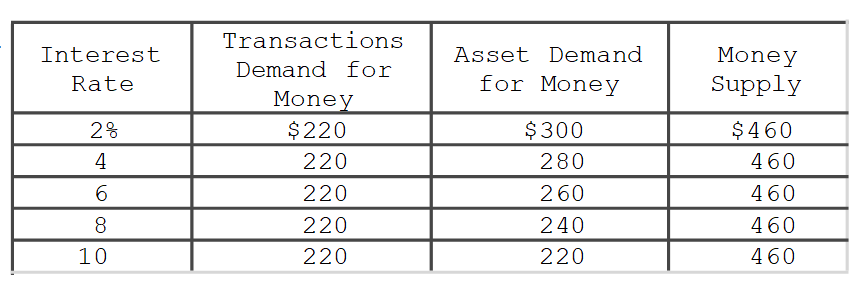

Based on the given table, an increase in the money supply of $20 billion will cause the equilibrium interest rate to

Based on the given table, an increase in the money supply of $20 billion will cause the equilibrium interest rate to

A) fall by 4 percentage points.

B) fall by 2 percentage points.

C) rise by 4 percentage points.

D) rise by 2 percentage points.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is one of the advantages of monetary policy over fiscal policy?

A) its control over the size of Federal budget deficits

B) the quickness with which it can be used

C) the opportunity for broad political influence

D) It can guarantee an expansion of aggregate demand when needed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the effect of the zero interest rate policy implemented in December 2008?

A) Its effectiveness was limited by the zero lower bound problem.

B) It created a surge in inflation.

C) It forced nominal interest rates to below zero.

D) It had the desired effect, promoting full recovery by 2010.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Open-market operations refer to

A) purchases of stocks in the New York Stock Exchange.

B) the purchase or sale of government securities, as well as collateralized money loans, by the Fed.

C) central bank lending to commercial banks.

D) the specifying of loan maximums on stock purchases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A money loan is said to be collateralized when

A) an asset is pledged by the borrower to the lender in case of default.

B) the borrower pays periodic repayments of principal plus interest to the lender.

C) the loan is used to purchase a capital asset.

D) interest on the loan is compounded on an annual basis.

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 360

Related Exams