Correct Answer

verified

Correct Answer

verified

Short Answer

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question.a.Increase cash from operating activities b.Decrease cash from operating activities c.Increase cash from investing activities d.Decrease cash from investing activities e.Increase cash from financing activities f.Decrease cash from financing activities g.Noncash investing and financing activity -Gain on sale of investments

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be on the statement of cash flows?

A) cash flows from investing activities

B) cash flows from financing activities

C) cash flows from operating activities

D) cash flows from contingent activities

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from investing activities, as part of the statement of cash flows, would include any receipts from the issuance of bonds payable.

Correct Answer

verified

Correct Answer

verified

Essay

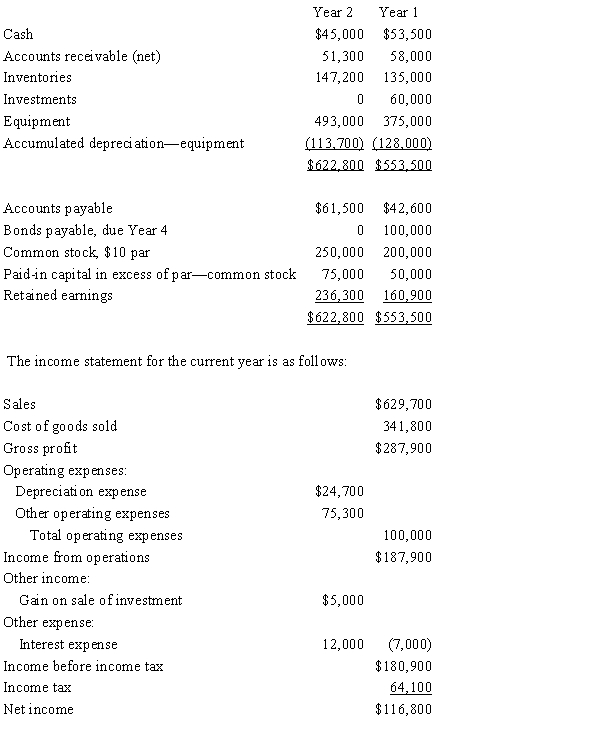

The comparative balance sheet of ConnieJo Company, for December 31, Years 1 and 2 ended December 31 appears below in condensed form:  Additional data for the current year are as follows:

(a)Fully depreciated equipment costing $39,000 was scrapped, no salvage, and equipment was purchased for $157,000.(b)Bonds payable for $100,000 were retired by payment at their face amount.(c)5,000 shares of common stock were issued at $15 for cash.(d)Cash dividends declared were paid $41,400.(e)All sales are on account.

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Additional data for the current year are as follows:

(a)Fully depreciated equipment costing $39,000 was scrapped, no salvage, and equipment was purchased for $157,000.(b)Bonds payable for $100,000 were retired by payment at their face amount.(c)5,000 shares of common stock were issued at $15 for cash.(d)Cash dividends declared were paid $41,400.(e)All sales are on account.

Prepare a statement of cash flows, using the indirect method of reporting cash flows from operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under GAAP, cash receipts from interest and dividends are classified as

A) financing activities

B) operating activities

C) investing activities

D) either financing or investing activities

Correct Answer

verified

Correct Answer

verified

True/False

In preparing the cash flows from operating activities section of the statement of cash flows by the indirect method, the amortization of bond discount for the period is deducted from the net income for the period.

Correct Answer

verified

Correct Answer

verified

Essay

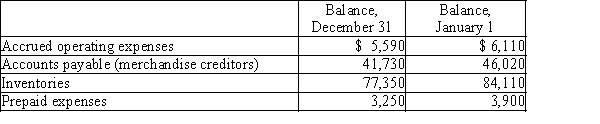

Selected data taken from the accounting records of Laser Inc. for the current year ended December 31 are as follows:  During the current year, the cost of goods sold was $448,500, and the operating expenses other than depreciation were $78,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(a) Cash payments for merchandise

(b) Cash payments for operating expenses

During the current year, the cost of goods sold was $448,500, and the operating expenses other than depreciation were $78,000. The direct method is used for presenting the cash flows from operating activities on the statement of cash flows.

Required:

Determine the amount reported on the statement of cash flows for:

(a) Cash payments for merchandise

(b) Cash payments for operating expenses

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had net income of $252,000. Depreciation expense is $26,000. During the year, accounts receivable and inventory increased by $15,000 and $40,000, respectively. Prepaid expenses and accounts payable decreased by $2,000 and $4,000, respectively. There was also a loss on the sale of equipment of $3,000. How much was the net cash flow from operating activities on the statement of cash flows using the indirect method?

A) $217,000

B) $224,000

C) $284,000

D) $305,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net income reported on the income statement for the current year was $250,000. Depreciation recorded on fixed assets and amortization of patents for the year were $40,000, and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:  What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

A) $271,000

B) $279,000

C) $327,000

D) $256,000

Correct Answer

verified

Correct Answer

verified

True/False

If $475,000 of bonds payable are sold at 101, $475,000 would be reported in the cash flows from financing activities section of the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norris Company declared cash dividends of $60,000 during the year. Cash dividends payable were $20,000 at the beginning of the year and $25,000 at the end of the year. The amount of cash Norris Co. used for payment of dividends during the year was

A) $55,000

B) $80,000

C) $105,000

D) $65,000

Correct Answer

verified

Correct Answer

verified

Short Answer

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question.a.Increase cash from operating activities b.Decrease cash from operating activities c.Increase cash from investing activities d.Decrease cash from investing activities e.Increase cash from financing activities f.Decrease cash from financing activities g.Noncash investing and financing activity -Increase in accounts receivable balance

Correct Answer

verified

Correct Answer

verified

Showing 181 - 193 of 193

Related Exams