A) $4,800.

B) $10,667.

C) $8,000.

D) $6,400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill can be recorded

A) when customers keep returning because they are satisfied with the company's products.

B) when the company acquires a good location for its business.

C) when the company has exceptional management.

D) only when there is an exchange transaction involving the purchase of an entire business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research and development costs

A) are classified as intangible assets.

B) must be expensed when incurred under generally accepted accounting principles.

C) should be included in the cost of the patent they relate to.

D) are capitalized and then amortized over a period not to exceed 20 years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

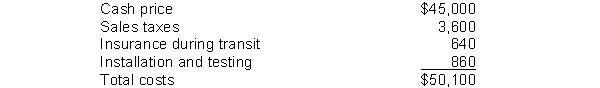

Rodgers Company purchased equipment and these costs were incurred:  Rodgers will record the acquisition cost of the equipment as

Rodgers will record the acquisition cost of the equipment as

A) $45,000.

B) $48,600.

C) $49,240.

D) $50,100.

Correct Answer

verified

Correct Answer

verified

True/False

Additions and improvements to a plant asset that increase the asset's operating efficiency, productive capacity, or expected useful life are generally expensed in the period incurred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brevard Corporation purchased a taxicab on January 1, 2013 for $25,500 to use for its shuttle business. The cab is expected to have a five-year useful life and no salvage value. During 2014, it retouched the cab's paint at a cost of $1,200, replaced the transmission for $3,000 (which extended its life by an additional 2 years) , and tuned-up the motor for $150. If Brevard Corporation uses straight-line depreciation, what annual depreciation will Brevard report for 2014?

A) $5,100.

B) $3,900.

C) $4,125.

D) $4,100.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An asset that cannot be sold individually in the market place is

A) a patent.

B) goodwill.

C) a copyright.

D) a trade name.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Machinery was purchased for $170,000 on January 1, 2013. Freight charges amounted to $7,000 and there was a cost of $20,000 for building a foundation and installing the machinery. It is estimated that the machinery will have a $30,000 salvage value at the end of its 5-year useful life. What is the amount of accumulated depreciation at December 31, 2014, if the straight-line method of depreciation is used?

A) $66,800.

B) $33,400.

C) $28,600.

D) $57,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is included in the cost of constructing a building?

A) Cost of paving a parking lot.

B) Cost of repairing vandalism damage incurred shortly after construction is complete.

C) Interest incurred during construction.

D) Cost of removing the demolished building existing on the land when it was purchased.

Correct Answer

verified

Correct Answer

verified

True/False

The IRS does not require the taxpayer to use the same depreciation method on the tax return that is used in preparing financial statements.

Correct Answer

verified

Correct Answer

verified

True/False

When purchasing land, the costs for clearing, draining, filling, and grading should be charged to a Land Improvements account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following items is not a consideration when recording periodic depreciation expense on plant assets?

A) Salvage value.

B) Estimated useful life.

C) Cash needed to replace the plant asset.

D) Cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment with a cost of $480,000 has an estimated salvage value of $30,000 and an estimated life of 4 years or 15,000 hours. It is to be depreciated using the units-of-activity method. What is the amount of depreciation for the first full year, during which the equipment was used 3,300 hours?

A) $120,000.

B) $135,600.

C) $99,000.

D) $112,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compton Inc. made a $500 ordinary repair to a piece of equipment. Compton's accountant debited this amount to the asset account, Equipment and credited Cash. Was this the correct entry and if not, why not?

A) Yes, this was the correct entry.

B) No, the correct entry would be a debit to Maintenance and Repairs Expense and a credit to Cash.

C) No, the correct entry would be a debit to Cash and a credit to Maintenance and Repairs Expense.

D) No, the correct entry would be a debit to Service Revenue and a credit to Cash.

Correct Answer

verified

Correct Answer

verified

True/False

Ordinary repairs should be recognized when incurred as revenue expenditures.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A factory machine was purchased for $70,000 on January 1, 2014. It was estimated that it would have a $14,000 salvage value at the end of its 5-year useful life. It was also estimated that the machine would be run 40,000 hours in the 5 years. If the actual number of machine hours ran in 2014 was 4,000 hours and the company uses the units-of-activity method of depreciation, the amount of depreciation expense for 2014 would be

A) $7,000.

B) $11,200.

C) $14,000.

D) $5,600.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest may be included in the acquisition cost of a plant asset

A) during the construction period of a self-constructed asset.

B) if the asset is purchased on credit.

C) if the asset acquisition is financed by a long-term note payable.

D) if it is a part of a lump-sum purchase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in the Accumulated Depreciation account represents the

A) cash fund to be used to replace plant assets.

B) amount to be deducted from the cost of the plant asset to arrive at its fair market value.

C) amount charged to expense in the current period.

D) amount charged to expense since the acquisition of the plant asset.

Correct Answer

verified

Correct Answer

verified

True/False

The book value of a plant asset is the amount originally paid for the asset less anticipated salvage value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mitchell Corporation bought equipment on January 1, 2014. The equipment cost $180,000 and had an expected salvage value of $30,000. The life of the equipment was estimated to be 6 years. The depreciation expense using the straight-line method of depreciation is

A) $35,000.

B) $36,000.

C) $25,000.

D) none of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 276

Related Exams