A) providing a legal system.

B) determining the wage rate for most jobs.

C) promoting competition in the market.

D) providing public goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a public good?

A) Flood control

B) Post Office

C) Health care

D) Welfare

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm that produces chemical solvents creates some air pollution because of the emissions from its manufacturing facilities. A tax is imposed on the firm, equal to the costs of environmental damage caused by a unit of the emissions. What is the result?

A) The quantity of chemical solvents produced now will be the efficient amount.

B) Demand for the chemical solvents will increase.

C) Demand for the chemical solvents will decrease.

D) Consumers of the chemical solvents will be willing to pay the full amount of the tax, and so the quantity produced will be unaffected.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public goods are desired because

A) people want and value them but the private sector will not make them available.

B) we want the government to spend our tax dollars.

C) they came in small units.

D) they make supply equal to demand for private goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over the past 40 years, there has been an increase in spending on public education without a significant increase in student performance. One explanation given by economists on why student performance has not improved is that

A) not enough funds have been spent on public education.

B) schools are providing high-priced services that are not valued by parents.

C) the quantity of educational services has not increased beyond the pre-subsidy equilibrium.

D) too much competition for educational services.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When misallocation of resources for production of a good results in spillover effects on third parties, there is a

A) market failure.

B) government failure.

C) legislative failure.

D) productive failure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A difference between the market and the public sector is that

A) competition exists only in the market sector.

B) resources are only scarce for the market sector.

C) decision making is by majority rule in the public sector but not in the market sector.

D) only the public sector produces private goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In graphical form,the effect of imposing a tax on a good is shown as

A) a leftward shift of the market supply curve.

B) a rightward shift of the market supply curve.

C) a downward movement along the market supply curve.

D) no change to the market supply curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What type of policy does the government adopt in dealing with government-inhibited goods?

A) It subsidizes their consumption.

B) It subsidizes their production.

C) It provides them as public goods.

D) It taxes, regulates, or prohibits their use.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a transfer payment? I. Social Security II. Unemployment benefits

A) I only

B) II only

C) Both I and II

D) Neither I nor II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

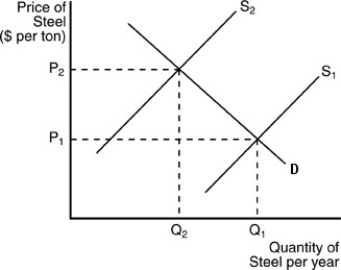

-According to the above figure, if steel mills ignore the cost of pollution, the equilibrium quantity of steel will most likely be

-According to the above figure, if steel mills ignore the cost of pollution, the equilibrium quantity of steel will most likely be

A) Q1.

B) Q2.

C) Q2 - Q1.

D) none of the above.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A possible solution to the problems of external benefits is

A) to tax those receiving the extra benefits.

B) production of the good by government.

C) effluent fees.

D) to restrict the amount of the good through direct government regulation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If production of an item results in negative external costs, then

A) the market price is below the socially preferred price that reflects the external costs.

B) the market price is above the socially preferred price that reflects the external costs.

C) market forces will always correct the problem.

D) the market quantity is too low from society's point of view.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

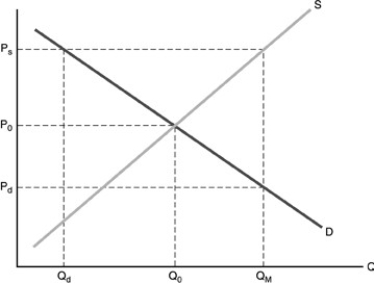

-Refer to the above figure. Medicare subsidies have increased the price of medical services to

-Refer to the above figure. Medicare subsidies have increased the price of medical services to  . The quantity demanded of medical services is

. The quantity demanded of medical services is

A) ![]() .

.

B) ![]() .

.

C) ![]() .

.

D) undetermined without more information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following ways is the private market sector similar to the public sector in terms of decision making?

A) Prices determine the demand for goods and services in each sector.

B) There is competition for scarce resource in both sectors.

C) Both sectors may use a type of "force" if necessary.

D) Votes by individual voters are basically equal in importance with dollars spent by individuals on goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Receiving a voucher for an apartment in a public housing project would be an example of a good that satisfies

A) the principle of rival consumption.

B) the definition of a public good.

C) the definition of a good with a positive externality.

D) the nonexclusion principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

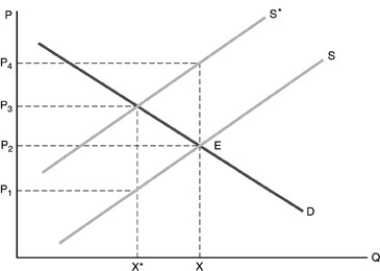

-In the above figure, market equilibrium at point E yields the quantity X. The quantity

-In the above figure, market equilibrium at point E yields the quantity X. The quantity  is the socially optimal quantity. Point E indicates that currently there is

is the socially optimal quantity. Point E indicates that currently there is

A) a negative externality.

B) a positive externality.

C) a public good.

D) a positive externality with subsidy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A friend of yours receives a government voucher for an apartment in a public housing project. This apartment represents

A) a government-sponsored good.

B) the free-rider problem.

C) a public good.

D) the drop-in-the-bucket problem.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality such as pollution can be corrected by

A) a subsidy to producers.

B) a tax on producers.

C) a subsidy to consumers.

D) a stimulus to production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most important characteristics of the price system is that

A) consumers are the ones who ultimately decide what is produced.

B) politicians are the ones who ultimately decide what is produced.

C) competition among sellers is reduced.

D) all exchanges are regulated by the government.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 359

Related Exams