A) rise; upward-sloping

B) rise; downward-sloping

C) fall; upward-sloping

D) fall; downward-sloping

Correct Answer

verified

Correct Answer

verified

True/False

With a progressive income tax, as taxable income rises (up to a certain point), one's tax rate rises.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A curve showing the relationship between tax rates and tax revenues is called a __________ curve.

A) Phillips

B) Keynesian

C) Gaussian

D) Laffer

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy refers to

A) efforts to balance a government's budget.

B) changes in the money supply to achieve particular economic goals.

C) changes in government expenditures and taxation to achieve particular economic goals.

D) the change in private expenditures that occurs as a consequence of changes in government spending.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The transmission lag is the time between

A) the implementation of a policy and when the impact of the policy is felt.

B) the enactment of a policy (getting a policy passed by Congress with the president's approval) and the implementation of the policy (putting a policy into effect) .

C) realizing a policy is needed and enacting the policy.

D) the occurrence of an event and policymakers realizing the event has occurred.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is complete crowding out, the change in Real GDP that results from a given change in autonomous spending will be

A) zero.

B) greater than if there was incomplete crowding out.

C) infinite.

D) There is not enough information to answer the question.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A permanent marginal tax decrease is likely to

A) shift the short-run aggregate supply curve to the left and the long-run aggregate supply curve to the right.

B) shift both the short-run and the long-run aggregate supply curves to the left.

C) shift the short-run aggregate supply curve to the right, and the long-run aggregate supply curve to the left.

D) shift both the short run and the long run aggregate supply curves to the right.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

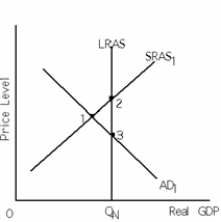

Exhibit 11-1

-Refer to Exhibit 11-1. The economy is currently at point 1. In this situation, Keynesian economists would most likely propose

-Refer to Exhibit 11-1. The economy is currently at point 1. In this situation, Keynesian economists would most likely propose

A) an increase in government purchases.

B) a decrease in government purchases.

C) an increase in taxes.

D) a and c

E) b and c

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The economy is in a recessionary gap, there is incomplete crowding out, and government implements expansionary fiscal policy. It follows that

A) Real GDP will fall.

B) the AD curve will shift to the right.

C) the price level will fall.

D) the recessionary gap will necessarily be completely eliminated.

E) b and d

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income tax revenues rise as income tax rates fall. It follows that the

A) percentage cut in the tax rate is greater than the percentage increase in the tax base.

B) percentage cut in the tax rate is less than the percentage increase in the tax base.

C) percentage cut in the tax rate is equal to the percentage increase in the tax base.

D) marginal tax rate is equal to the average tax rate

E) b and d

Correct Answer

verified

Correct Answer

verified

True/False

Tax revenues equal the (average) tax rate multiplied by the tax base.

Correct Answer

verified

Correct Answer

verified

True/False

As a result of crowding out, demand-side fiscal policy may be ineffective at achieving certain macroeconomic goals.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Some economists believe that permanently lower marginal income tax rates __________ the incentive to work and thus shift the __________.

A) increase; LRAS curve to the right

B) increase; AD curve to the right

C) increase; SRAS curve to the left

D) decrease; LRAS curve to the right

E) decrease; AD curve to the left

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a taxable income of $50,000 Mari's income tax is $10,500. When her taxable income rises to $55,000 her income tax is $11,750. Based on this information, what is Mari's marginal tax rate?

A) 18.7 percent

B) 39 percent

C) 10 percent

D) 25 percent

E) 20 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Congress increases income taxes. This is an example of

A) expansionary fiscal policy.

B) expansionary monetary policy.

C) contractionary fiscal policy.

D) contractionary monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A "flat tax" is another term for __________ tax.

A) a progressive

B) a proportional

C) a regressive

D) the inflation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of crowding out?

A) A decrease in the rate of growth of the money supply which causes a decrease in Real GDP.

B) A budget deficit causes an increase in interest rates, which causes a decrease in investment spending.

C) An increase in tariffs which causes a decrease in imports.

D) A decrease in government housing subsidies which causes an increase in private spending on housing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an example of crowding out?

A) Government purchases rise, the budget deficit rises, the federal government's demand for loanable funds rises, the interest rate rises, and investment falls.

B) Government spends more on X, prompting individuals to spend less on X.

C) Taxes decline, the budget deficit rises, the federal government's demand for loanable funds rises, the interest rate rises, the demand rises for U.S.dollars, the dollar appreciates, and net exports decline.

D) Business firms spend more on X, prompting households to spend less on Y.

E) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxable income rises by $2,500 and taxes rise by $825. What is the marginal tax rate?

A) 4 percent

B) 29 percent

C) 10 percent

D) 33 percent

E) 25 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy is implemented primarily by

A) local governments alone.

B) the defense department.

C) state governments alone.

D) the federal government.

E) state and local governments.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 167

Related Exams