A) +$69,206.92

B) −$70,903.30

C) +$68,975.55

D) −$56,254.37

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation expense will be recorded in the accounts of the

A) lessee for operating leases.

B) lessor for operating leases.

C) lessor for direct financing leases.

D) lessor for sales-type leases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account Unearned Interest: Leases should be reported on the lessor's financial statements as

A) other revenue.

B) an asset.

C) a contra-asset.

D) a liability.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lessor enters into a sales-type lease. Which of the following statements is true if the leased asset has an unguaranteed residual value?

A) The gross profit recognized is less than it would be if the residual was guaranteed.

B) The gross profit recognized is more than it would be if the residual was guaranteed.

C) The lessor should decrease the cost of goods sold by the amount of the unguaranteed residual value.

D) The gross profit is the same as it would be if the residual was guaranteed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-1 On January 1, 2016, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2016. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively. -Refer to Exhibit 20-1. What would be the balance of the lease obligation on January 1, 2017, for financial reporting purposes after the lease payment? Round answers to the nearest dollar)

A) $0

B) $166,779

C) $227,447

D) $233,379

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-1 On January 1, 2016, Pearson Company signed a lease agreement requiring six annual payments of $60,000, beginning December 31, 2016. Pearson's incremental borrowing rate was 9% and the lessor's implicit rate, known by Pearson, was 10%. The present value factors of an ordinary annuity of $1 for six periods for interest rates of 9% and 10% are 4.48592 and 4.35526, respectively. -Refer to Exhibit 20-1. What would be the balance of the lease obligation for financial reporting purposes on December 31, 2017, after the lease payment round answers to the nearest dollar) ?

A) $194,383

B) $167,979

C) $190,192

D) $233,379

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning direct financing leases is true?

A) The net investment in the lease should be adjusted each year by material increases but not decreases) in estimated unguaranteed residual values.

B) The lessor reports only interest revenue on the income statement.

C) Initial direct costs result in an increase in Unearned Interest Revenue-Leases by an amount equal to these costs in the year the costs are incurred.

D) The lessor's gross margin is amortized over the life of the lease.

Correct Answer

verified

Correct Answer

verified

True/False

From the lessee's point of view, leasing provides a method of making a sale while still maintaining the advantages of ownership, including security in the asset and tax benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-5

The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2016. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2016. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2020. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7%  -Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, how should the lease be classified?

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, how should the lease be classified?

A) operating lease

B) direct financing lease

C) sales-type lease

D) leveraged lease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Executory costs

A) are included in the minimum lease payments by the lessee.

B) should normally be borne by the party that is, in substance, the owner of the asset.

C) are the costs incurred by the lessor that are directly associated with negotiating and completing the lease transaction.

D) are always paid by the lessee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-2

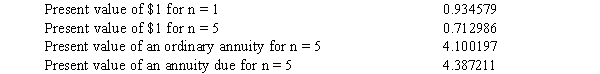

On January 1, 2016, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2016. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:  -Refer to Exhibit 20-2. What would be the debit to Leased Equipment under Capital Leases on January 1, 2016? Round amounts to the nearest dollar.)

-Refer to Exhibit 20-2. What would be the debit to Leased Equipment under Capital Leases on January 1, 2016? Round amounts to the nearest dollar.)

A) $72,096

B) $76,635

C) $100,000

D) $110,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the calculation of the lessee's depreciation expense for a capital lease is true?

A) The bargain purchase option price is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

B) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the estimated economic life of the asset.

C) The unguaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

D) The guaranteed residual value is deducted from the original cost capitalized, and the difference is allocated over the term of the lease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Luke, Inc. leased equipment, signing a five-year lease that requires five payments of $40,000 due on January 1 of each year with the first payment due January 1, 2016. Luke accounted for the lease as a capital lease. Using a rate of 9%, Luke determined the present value on January 1, 2016, to be $169,589. What is the amount of the long-term lease obligation that Luke should report on its December 31, 2017 balance sheet?

A) $70,364

B) $101,252

C) $112,915

D) $129,589

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a direct-financing lease, the lessor:

A) does not transfer complete control to the lessee because a third party is involved.

B) transfers complete control to the lessee.

C) does not depreciate the leased equipment over its estimated economic life.

D) includes the leased equipment on its balance sheet as part of property, plant, and equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Mark Company leased equipment by signing a five-year lease that required five payments of $85,000 due on December 31 of each year. The equipment remains the property of the lessor at the end of the lease, and Mark does not guarantee any residual value. Using a rate of 11%, Mark capitalized the lease on January 1, 2016, in the amount of $314,152. What is the amount of the lease obligation on December 31, 2017?

A) $263,709

B) $207,717

C) $279,595

D) $225,350

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any initial direct costs incurred by the lessor for a sales-type lease should be

A) expensed in the same period that the lease receivable is recognized.

B) recorded as a prepaid asset and allocated to expense over the lease term.

C) deferred and recognized as a reduction in the interest rate implicit in the lease.

D) directly charged debited) to Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 116 of 116

Related Exams