A) $26,667

B) $11,112

C) $22,000

D) $12,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a lessee classifies a lease as a capital lease and uses the straight-line method of depreciation, what is the amount to be amortized over the lease term?

A) the original amount capitalized less the present value of the guaranteed residual value if applicable)

B) the original amount capitalized less the unguaranteed residual value

C) the original amount capitalized less the guaranteed residual value if applicable)

D) fair value of the leased property

Correct Answer

verified

Correct Answer

verified

True/False

Risks and benefits of ownership transfer to the lessee with an operating lease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

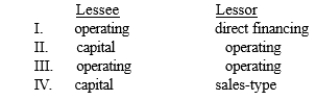

Depreciation expense will be recorded in the accounts of the lessee and lessor for which type of leases?

A) I

B) II

C) III

D) IV

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-2

On January 1, 2016, Mary Company leased equipment, signing a five-year lease that requires annual lease payments of $20,000. The lease qualifies as a capital lease. The payments are made at year-end, and the first payment will be made at December 31, 2016. In addition, Mary guarantees the residual value to be $8,000 at the end of the lease term. Mary correctly uses the lessor's implicit interest rate, which is 12%. The present value factors for five periods at 12% are as follows:  -Refer to Exhibit 20-2. If the Mary Company uses the straight-line method of depreciation for its assets, what is the amount of depreciation expense for the leased equipment for the year ending December 31, 2016?

-Refer to Exhibit 20-2. If the Mary Company uses the straight-line method of depreciation for its assets, what is the amount of depreciation expense for the leased equipment for the year ending December 31, 2016?

A) $15,554

B) $14,419

C) $13,727

D) $12,419

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a lessee makes periodic cash payments for an operating lease, which of the following accounts is increased?

A) Rent Expense

B) Leased Equipment

C) Capital Lease Obligation

D) Interest Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Stacie signed a lease agreement with Amy. Amy will use the equipment and make ten annual payments of $25,000 beginning December 31, 2016. The lease is considered to be a capital lease. When reading the Amy income statement, you would expect to find which of the following accounts?

A) Rent Revenue

B) Interest Revenue

C) Rental Expense

D) Interest Expense

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between a direct-financing lease and a sales-type lease?

A) Unlike a direct-financing lease, a sales-type lease includes a manufacturer's or a dealer's profit or loss.

B) Unlike in a direct-financing lease, the depreciation expense on the leased asset in a sales-type lease is recorded in the accounts of the lessor.

C) Unlike in a sales-type lease, the lessee in a direct-financing lease recognizes a right-of-use asset and a lease liability at the commencement of the lease.

D) Unlike a sales-type lease, a direct-financing lease involves the transfer of ownership to the lessee.

Correct Answer

verified

Correct Answer

verified

True/False

Lease accounting rules may apply if an arrangement or contract does not explicitly state that it is a lease.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Greenway Company signs a six-year lease with Gearup Company that requires a payment of $32,256 at the beginning of each year. The fair value of the leased equipment is $148,531.70. The interest rate implicit in the lease is 12%. The equipment has an estimated residual value of $20,000 at the end of the agreement, and the lessee does not guarantee the residual amount. Which of the following amounts should Greenway Company record as interest income at the end of the first year of the lease?

A) $13,953.08

B) $17,823.80

C) $21,694.52

D) $186,523.23

Correct Answer

verified

Correct Answer

verified

Multiple Choice

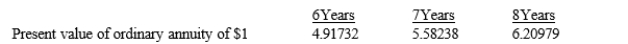

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:  What is the annual lease payment to be collected by Davis?

What is the annual lease payment to be collected by Davis?

A) $8,571.43

B) $9,115.25

C) $10,139.72

D) $11,516.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

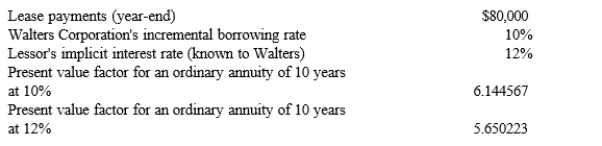

On January 3, 2016, the Walters Corporation signed a 10-year non-cancelable lease for manufacturing equipment. The fair value of the equipment at that time was $550,000. At the end of the lease period, the equipment, which has an estimated life of 15 years, will be returned to the lessor. Additional information is below:  Walters should

Walters should

A) capitalize the equipment at $550,000.

B) capitalize the equipment at $491,565.

C) capitalize the equipment at $452,018.

D) not capitalize the equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-4

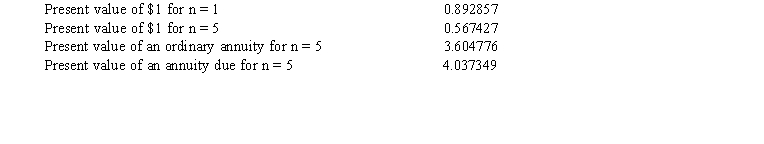

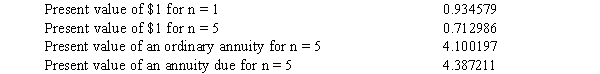

On January 1, 2016, Average Leasing Company entered into a direct financing lease with a lessee, Lenny Company. The lease agreement calls for five equal annual payments of $75,000 at the beginning of each year with the first payment due on January 1, 2016. The leased property has an estimated residual value of $10,000, which Lenny does not guarantee. The property remains the property of Average at the end of the lease term. Average desires a 12% rate of return. Present value factors for a 12% interest rate are as follows:

-Refer to Exhibit 20-4. What is the cost of the leased property to Average round the answer to the nearest dollar) ?

-Refer to Exhibit 20-4. What is the cost of the leased property to Average round the answer to the nearest dollar) ?

A) $308,475

B) $302,801

C) $276,032

D) $270,358

Correct Answer

verified

Correct Answer

verified

True/False

The existence and term of renewal or purchase options and escalation clauses are disclosed for capital leases only.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following facts would require a lessor to classify a lease as an operating lease?

A) Important uncertainties exist about unreimbursable costs yet to be incurred by the lessor.

B) No bargain purchase option is provided for by the lease agreement.

C) The lease term is 65% of the estimated economic life of the leased property.

D) The sum of the minimum lease payments is 90% of the fair value of the leased property to the lessor.

Correct Answer

verified

Correct Answer

verified

True/False

Control over the underlying asset in a lease means directing its use and obtaining substantially all economic benefit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 20-5

The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2016. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2016. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2020. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7%  -Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount of interest revenue to be recognized by Baltimore for 2016 round the answer to the nearest dollar) ?

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount of interest revenue to be recognized by Baltimore for 2016 round the answer to the nearest dollar) ?

A) $7,774

B) $7,175

C) $6,527

D) $5,928

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Kathy Corp. leased equipment by signing a five-year lease that required five payments of $60,000 due on December 31 of each year. Kathy has a 9% cost of capital and capitalized the lease on January 1, 2016, in the amount of $233,379. As of December 31, 2016, what amount is reported as the current portion of the lease obligation?

A) $60,000

B) $46,331

C) $42,506

D) $13,669

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2016, Stephen Corp., a lessor, signed a direct financing lease. Stephen was to receive annual year-end payments of $10,000 for ten years, after which there was a guaranteed residual value of $8,000. The implicit interest rate was 8%. Actuarial information for 8%, ten periods follows round to the nearest whole dollar) :  On January 1, 2016, what amount should Stephen record as a debit to Lease Receivable?

On January 1, 2016, what amount should Stephen record as a debit to Lease Receivable?

A) $67,100

B) $70,814

C) $100,000

D) $108,000

Correct Answer

verified

Correct Answer

verified

True/False

For the lessor, cash receipts for a direct financing lease are classified as inflows in the financing activities section of the cash flow statement.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 116

Related Exams