A) required under GAAP but not under IFRS.

B) required under IFRS in the same format as under GAAP.

C) required under IFRS but not under GAAP.

D) required under IFRS with certain variations in format as compared to GAAP.

IFRS.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The closing entry process consists of closing

A) all asset and liability accounts.

B) out the retained earnings account.

C) all permanent accounts.

D) all temporary accounts.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement about long-term investments is not true?

A) They will be held for more than one year.

B) They are not currently used in the operation of the business.

C) They include investments in stock of other companies and land held for future use.

D) They can never include cash accounts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most important information needed to determine if companies can pay their current obligations is the

A) net income for this year.

B) projected net income for next year.

C) relationship between current assets and current liabilities.

D) relationship between short-term and long-term liabilities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

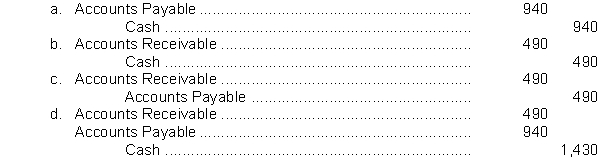

Jawbreaker Company paid $940 on account to a creditor. The transaction was erroneously recorded as a debit to Cash of $490 and a credit to Accounts Receivable, $490. The correcting entry is

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After closing entries are posted, the balance in the retained earnings account in the ledger will be equal to

A) the beginning retained earnings reported on the retained earnings statement.

B) the amount of the retained earnings reported on the balance sheet.

C) zero.

D) the net income for the period.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

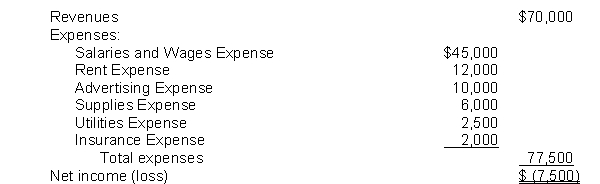

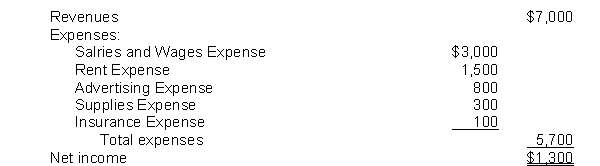

The income statement for the year 2018 of Fugazi Co. contains the following information:  The entry to close the expense accounts includes a

The entry to close the expense accounts includes a

A) debit to Income Summary for $7,500.

B) credit to Income Summary for $7,500.

C) debit to Income Summary for $77,500.

D) debit to Utilities Expense for $2,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

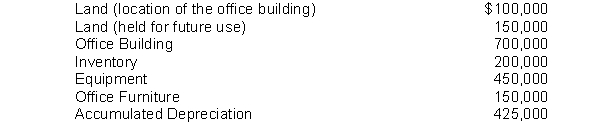

These are selected account balances on December 31, 2018.  What is the total amount of property, plant, and equipment that will appear on the balance sheet?

What is the total amount of property, plant, and equipment that will appear on the balance sheet?

A) $975,000

B) $1,125,000

C) $1,175,000

D) $1,400,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements concerning the accounting cycle is incorrect?

A) The accounting cycle includes journalizing transactions and posting to ledger accounts.

B) The accounting cycle includes only one optional step.

C) The steps in the accounting cycle are performed in sequence.

D) The steps in the accounting cycle are repeated in each accounting period.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the total debits exceed total credits in the balance sheet columns of the worksheet, stockholders' equity

A) will increase because net income has occurred.

B) will decrease because a net loss has occurred.

C) is in error because a mistake has occurred.

D) will not be affected.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

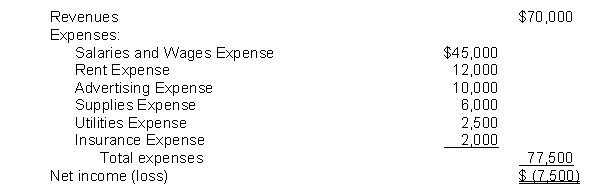

The income statement for the year 2018 of Fugazi Co. contains the following information:  After all closing entries have been posted, the revenue account will have a balance of

After all closing entries have been posted, the revenue account will have a balance of

A) $0.

B) $70,000 credit.

C) $70,000 debit.

D) $7,500 credit.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in the income summary account before it is closed will be equal to

A) the net income or loss on the income statement.

B) the beginning balance in the retained earnings account.

C) the ending balance in the retained earnings account.

D) zero.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for the month of June, 2018 of Camera Obscura Enterprises contains the following information:  At June 1, 2018, Camera Obscura reported retained earnings of $35,000. The company had no dividends during June. At June 30, 2018, the company will report retained earnings of

At June 1, 2018, Camera Obscura reported retained earnings of $35,000. The company had no dividends during June. At June 30, 2018, the company will report retained earnings of

A) $29,300.

B) $35,000.

C) $36,300.

D) $42,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The adjustments entered in the adjustments columns of a worksheet are

A) not journalized.

B) posted to the ledger but not journalized.

C) not journalized until after the financial statements are prepared.

D) journalized before the worksheet is completed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

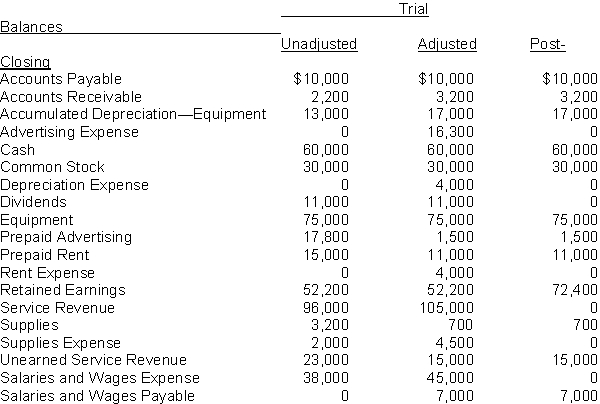

The trial balances of Orton Company follow with the accounts arranged in alphabetic order. Analyze the data and prepare (a) the adjusting entries and (b) the closing entries made by Orton Company.

Correct Answer

verified

Correct Answer

verified

Essay

Sebastien Company earned net income of $44,000 during 2018. The company paid dividends totalling $20,000 during the period. Prepare the entries to close Income Summary and the Dividends account.

Correct Answer

verified

Correct Answer

verified

True/False

Closing entries are journalized after adjusting entries have been journalized.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

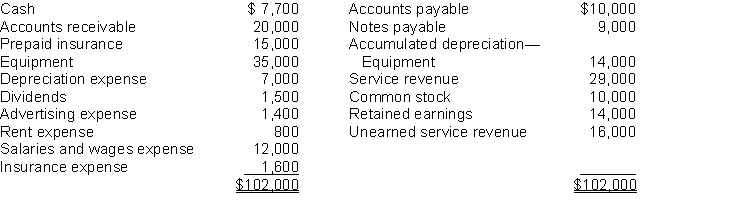

Presented below is an adjusted trial balance for Shawn Company, at December 31, 2018.  Instructions

(a) Prepare closing entries for December 31, 2018.

(b) Determine the balance in the Retained Earnings account after the entries have been posted.

Instructions

(a) Prepare closing entries for December 31, 2018.

(b) Determine the balance in the Retained Earnings account after the entries have been posted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An error has occurred in the closing entry process if

A) revenue and expense accounts have zero balances.

B) the retained earnings account is credited for the amount of net income.

C) the dividends account is closed to the retained earnings account.

D) the balance sheet accounts have zero balances.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

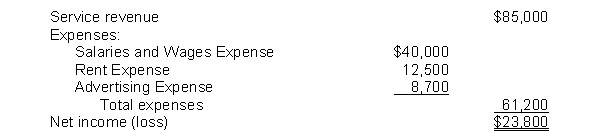

Use the following income statement for the year 2018 for Belle Company to prepare entries to close the revenue and expense accounts for the company.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 225

Related Exams