A) They have excess cash.

B) They want to generate earnings from investment income.

C) They invest for strategic reasons.

D) All of these answer choices are correct.

Correct Answer

verified

Correct Answer

verified

Short Answer

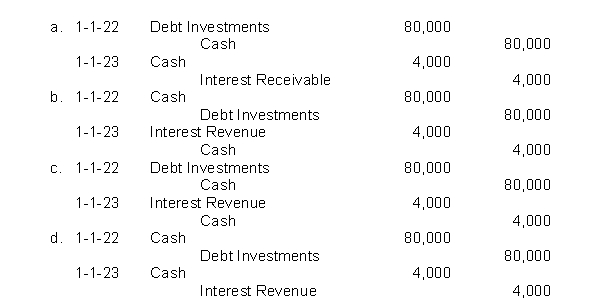

Porter Brothers Company purchased a debt investment for $80,000 on January 1, 2022.On January 1, 2023, Porter received cash interest of $4,000.Which of the following correctly presents the journal entries for the purchase and the receipt of interest?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the time of acquisition of a debt investment

A) no journal entry is required.

B) the historical cost principle applies.

C) the Stock Investments account is debited when bonds are purchased.

D) the investment account is credited for its cost plus brokerage fees.

Correct Answer

verified

Correct Answer

verified

Short Answer

On January 1, Vega Company purchased as an investment a $1,000, 6% bond for $1,000.The bond pays interest on January 1.The bond is sold on July 1 for $1,100 plus accrued interest.Interest has not been accrued since the last interest payment date.What is the entry to record the cash proceeds at the time the bond is sold?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance in the Unrealized Gain or Loss-Equity account will

A) appear on the balance sheet as a contra asset.

B) appear on the income statement under Other Expenses and Losses.

C) appear as a deduction in the stockholders' equity section.

D) not be shown on the financial statements until the securities are sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cedar Co.purchased 80, 6% LKN Company bonds for $80,000 cash.Interest is payable annually on January 1.If 40 of the securities are sold January 1 for $41,000 the entry would include a credit to Gain on Sale of Debt Investments of

A) $500.

B) $1,200.

C) $5,400.

D) $1,000.

Correct Answer

verified

Correct Answer

verified

Short Answer

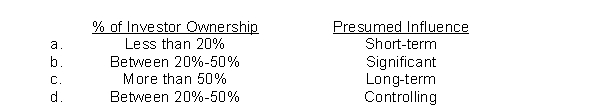

Which of the following is the correct matching concerning an investor's influence on the operations and financial affairs of an investee?

Correct Answer

verified

Correct Answer

verified

True/False

In accordance with the historical cost principle, brokerage fees should be added to the cost of an investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Peter Johnson invests $35,516.80 now for a series of $5,000 annual returns beginning one year from now.Peter will earn 10% on the initial investment.How many annual payments will Peter receive?

A) 10

B) 12

C) 13

D) 15

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If 10% of the common stock of an investee company is purchased as an investment, the appropriate method of accounting for the investment is

A) the cost method.

B) the equity method.

C) the preparation of consolidated financial statements.

D) determined by agreement with whomever owns the remaining 90% of the stock.

Correct Answer

verified

Correct Answer

verified

Short Answer

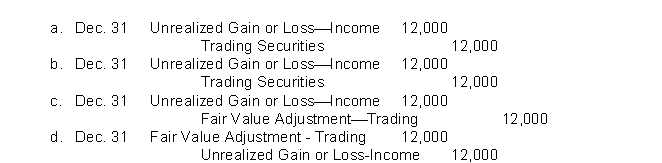

Cost and fair value data for the trading securities of Beltway Company at December 31, 2022, are $100,000 and $88,000, respectively.Which of the following correctly presents the adjusting journal entry to record the securities at fair value?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reporting investments at fair value is

A) applicable to equity securities only.

B) applicable to debt securities only.

C) applicable to both debt and equity securities.

D) a conservative approach because only losses are recognized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term investments should be valued on the balance sheet at

A) the lower of cost or fair value.

B) the higher of cost or fair value.

C) cost.

D) fair value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compound interest is the return on principal

A) only.

B) for one or more periods.

C) plus interest for two or more periods.

D) for one period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If $30,000 is deposited in a savings account at the end of each year and the account pays interest of 5% compounded annually, what will be the balance of the account at the end of 10 years?

A) $48,867

B) $315,000

C) $377,337

D) $450,000

Correct Answer

verified

Correct Answer

verified

True/False

Corporations purchase investments in debt or equity securities generally for one of two reasons.

Correct Answer

verified

Correct Answer

verified

Short Answer

Ashland Corporation sells 150 shares of common stock being held as an investment.The shares were acquired six months ago at a cost of $30 a share.Ashland sold the shares for $38 a share.The entry to record the sale is

Correct Answer

verified

Correct Answer

verified

True/False

If the cost method is used to account for an investment in stock, the Stock Investments account is increased by the amount of dividends received during the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charleston Co.purchased 60, 6% APS Company bonds on January 1, 2022 for $60,000 cash.Interest is payable annually on January 1.The entry to record the January 1, 2023 annual interest payment would include a

A) debit to Interest Receivable for $3,600.

B) credit to Interest Receivable for $3,600.

C) credit to Interest Revenue for $3,600.

D) credit to Debt Investments for $3,600.

Correct Answer

verified

Correct Answer

verified

Short Answer

Gulf Coast Corporation makes an investment in 200 shares of Eta Company's common stock.The stock is purchased for $52 a share.The entry for the purchase is

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 209

Related Exams