A) $1,264

B) $1,200

C) $1,302

D) $1,920

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An employee assigned to counting computer monitors in boxes should

A) estimate the number if there is a large quantity to be counted.

B) read each box and rely on the box description for the contents.

C) determine that the box contains a monitor.

D) rely on the warehouse records of the number of computer monitors.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

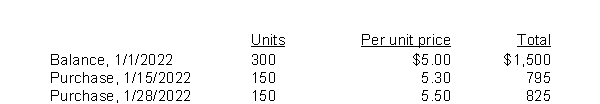

Dobler Company uses a periodic inventory system.Details for the inventory account for the month of January 2022 are as follows:  An end of the month (1/31/2022) inventory showed that 240 units were on hand.If the company uses FIFO and sells the units for $10 each, what is the gross profit for the month?

An end of the month (1/31/2022) inventory showed that 240 units were on hand.If the company uses FIFO and sells the units for $10 each, what is the gross profit for the month?

A) $1,782

B) $1,818

C) $3,600

D) $2,400

Correct Answer

verified

Correct Answer

verified

True/False

Use of the LIFO inventory valuation method enables a company to report paper or phantom profits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manager of Weiser is given a bonus based on net income before taxes.The net income after taxes is $59,500 for FIFO and $49,000 for LIFO.The tax rate is 30%.The bonus rate is 20%.How much higher is the manager's bonus if FIFO is adopted instead of LIFO?

A) $15,000

B) $21,000

C) $3,000

D) $10,500

Correct Answer

verified

Correct Answer

verified

True/False

The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goods held on consignment are

A) never owned by the consignee.

B) included in the consignee's ending inventory.

C) kept for sale on the premises of the consignor.

D) included as part of no one's ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

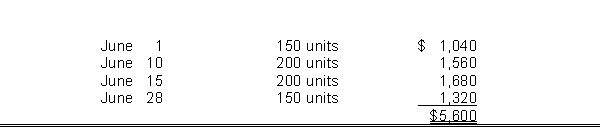

Echo Sound Company just began business and made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 210 units on hand.The inventory method which results in the highest gross profit for June is

A physical count of merchandise inventory on June 30 reveals that there are 210 units on hand.The inventory method which results in the highest gross profit for June is

A) the FIFO method.

B) the LIFO method.

C) the average cost method.

D) not determinable.

Correct Answer

verified

Correct Answer

verified

True/False

The LIFO inventory method tends to smooth out the peaks and valleys of a business cycle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

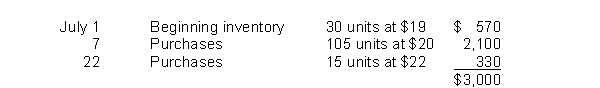

Quiet Phones Company has the following inventory data:  A physical count of merchandise inventory on July 30 reveals that there are 48 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 30 reveals that there are 48 units on hand.Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A) $930.

B) $990.

C) $2,010.

D) $2,070.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is false?

A) Taking a physical inventory involves actually counting, weighing, or measuring each kind of inventory on hand.

B) No matter whether a periodic or perpetual inventory system is used, all companies need to determine inventory quantities at the end of each accounting period.

C) An inventory count is generally more accurate when goods are not being sold or received during the counting.

D) Companies that use a perpetual inventory system must take a physical inventory to determine inventory on hand on the balance sheet date and to determine cost of goods sold for the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms best describes the assumption made in applying the four inventory methods?

A) Goods flow

B) Cost flow

C) Asset flow

D) Physical flow

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To adjust a company's LIFO cost of goods sold to FIFO cost of goods sold

A) the ending LIFO reserve is added to LIFO cost of goods sold.

B) the ending LIFO reserve is subtracted from LIFO cost of goods sold.

C) an increase in the LIFO reserve is subtracted from LIFO cost of goods sold.

D) a decrease in the LIFO reserve is subtracted from LIFO cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tidwell Company's goods in transit at December 31 include sales made (1) FOB destination (2) FOB shipping point And purchases made (3) FOB destination (4) FOB shipping point. Which items should be included in Tidwell's inventory at December 31?

A) (2) and (3)

B) (1) and (4)

C) (1) and (3)

D) (2) and (4)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After the physical inventory is completed,

A) quantities are listed on inventory summary sheets.

B) quantities are entered into various general ledger inventory accounts.

C) the accuracy of the inventory summary sheets is checked by the person listing the quantities on the sheets.

D) unit costs are determined by dividing the quantities on the summary sheets by the total inventory costs.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "FOB" denotes

A) free on board.

B) freight on board.

C) free only (to) buyer.

D) freight charge on buyer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements are true regarding the LIFO reserve except:

A) Companies using LIFO are required to report the LIFO reserve.

B) The equation (LIFO inventory - LIFO reserve = FIFO inventory) adjusts the inventory balance from LIFO to FIFO.

C) The financial statement differences of using LIFO normally increase the longer a company uses LIFO.

D) Current ratios and the inventory turnover can be significantly affected if a company has material LIFO reserves.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If companies have identical inventoriable costs but use different inventory flow assumptions when the price of goods have not been constant, then the

A) cost of goods sold of the companies will be identical.

B) cost of goods purchased during the year will be identical.

C) ending inventory of the companies will be identical.

D) net income of the companies will be identical.

Correct Answer

verified

Correct Answer

verified

True/False

Goods in transit shipped FOB shipping point should be included in the buyer's ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The factor which determines whether or not goods should be included in a physical count of inventory is

A) physical possession.

B) legal title.

C) management's judgment.

D) whether or not the purchase price has been paid.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 189

Related Exams