A) lengthen the cash-to-cash operating cycle.

B) take advantage of deep discounts on the cash realizable value of receivables.

C) generate cash quickly.

D) finance companies at an amount greater than cash realizable value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aging of a company's accounts receivable indicates that $9,000 are estimated to be uncollectible.If Allowance for Doubtful Accounts has a $2,400 debit balance, the adjustment to record bad debts for the period will require a

A) debit to Bad Debt Expense for $9,000.

B) debit to Allowance for Doubtful Accounts for $11,400.

C) debit to Bad Debt Expense for $11,400.

D) credit to Allowance for Doubtful Accounts for $9,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells $800,000 of accounts receivable to a factor for cash, incurring a 2% service charge.The entry to record the sale should not include a

A) debit to Interest Expense for $16,000.

B) debit to Cash for $784,000.

C) debit to Service Charge Expense for $16,000.

D) credit to Accounts Receivable for $800,000.

Correct Answer

verified

Correct Answer

verified

True/False

The interest rate on a note is always expressed as an annual rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage of receivables basis for estimating uncollectible accounts emphasizes

A) cash realizable value.

B) the relationship between accounts receivable and bad debts expense.

C) income statement relationships.

D) the relationship between sales and accounts receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maturity value of a $10,000, 6%, 60-day note receivable dated February 10th is

A) $10,100.

B) $10,050.

C) $10,000.

D) $10,600.

Correct Answer

verified

Correct Answer

verified

Short Answer

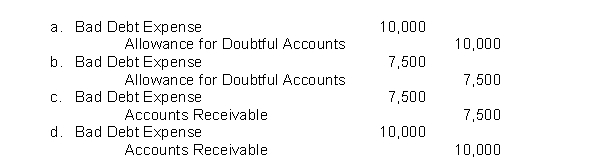

Nichols Company uses the percentage of receivables method for recording bad debts expense.The accounts receivable balance is $250,000 and credit sales are $1,000,000.Management estimates that 4% of accounts receivable will be uncollectible.What adjusting entry will Nichols Company make if the Allowance for Doubtful Accounts has a credit balance of $2,500 before adjustment?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2022, Wheeler Inc.had sales on account of $792,000, cash sales of $324,000, and collections on account of $504,000.In addition, they collected $8,700 which had been written off as uncollectible in 2021.As a result of these transactions, the change in the accounts receivable indicates a

A) $603,300 increase.

B) $288,000 increase.

C) $279,300 increase.

D) $612,000 increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is not an accounting problem (issue) associated with accounts receivable?

A) Depreciating accounts receivable

B) Recognizing accounts receivable

C) Valuing accounts receivable

D) Accelerating cash receipts from accounts receivable

Correct Answer

verified

Correct Answer

verified

True/False

The average collection period is frequently used to assess the effectiveness of a company's credit and collection policies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aging of a company's accounts receivable indicates that $9,000 are estimated to be uncollectible.If Allowance for Doubtful Accounts has a $3,200 credit balance, the adjustment to record bad debts for the period will require a

A) debit to Bad Debt Expense for $9,000.

B) debit to Allowance for Doubtful Accounts for $5,800.

C) debit to Bad Debt Expense for $5,800.

D) credit to Allowance for Doubtful Accounts for $9,000.

Correct Answer

verified

Correct Answer

verified

True/False

Bad debt expense and interest revenue are reported in the income statement under other revenues and expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net credit sales for the month are $900,000.The accounts receivable balance is $192,000.The allowance is calculated as 5% of the receivables balance using the percentage-of-receivables basis.If the Allowance for Doubtful Accounts has a credit balance of $6,000 before adjustment, what is the balance after adjustment?

A) $ 9,600

B) $ 3,600

C) $15,600

D) $ 9,900

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bad Debt Expense is reported on the income statement as

A) part of cost of goods sold.

B) an expense subtracted from net sales to determine gross profit.

C) an operating expense.

D) a contra revenue account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable turnover is computed by dividing

A) total sales by average receivables.

B) total sales by ending receivables.

C) net credit sales by average receivables.

D) net credit sales by ending receivables.

Correct Answer

verified

Correct Answer

verified

Short Answer

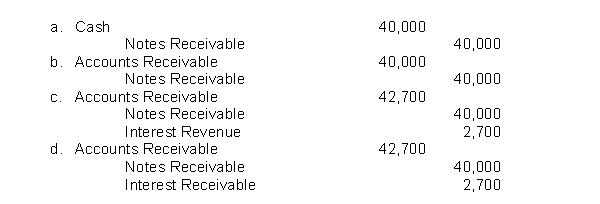

Young Company lends Dobson industries $40,000 on January 1, 2022, accepting a 9-month, 9% interest note.If Dobson dishonors the note and does not pay it in full at maturity but Young expects that it will eventually be able to collect the debt, which of the following entries should most likely be made by Young Company?

Correct Answer

verified

Correct Answer

verified

True/False

If a retailer accepts a national credit card such as Visa, the retailer must maintain detailed records of customer accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable turnover is used to analyze

A) profitability.

B) liquidity.

C) risk.

D) long-term solvency.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An alternative name for Bad Debt Expense is

A) Deadbeat Expense.

B) Uncollectible Accounts Expense.

C) Collection Expense.

D) Credit Loss Expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Non-trade receivables should be reported separately from trade receivables.Why is this statement either true or false?

A) It is true because trade receivables are current assets and non-trade receivables are long term.

B) It is false because all current receivables must be grouped together in one account.

C) It is true because non-trade receivables do not result from business operations and should not be included with accounts receivable.

D) It is false because management can decide how to report receivables.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 203

Related Exams