Correct Answer

verified

Correct Answer

verified

Multiple Choice

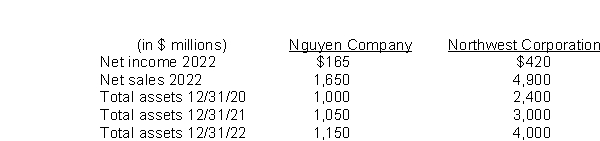

The following information is provided for Nguyen Company and Northwest Corporation.  What is Nguyen's return on assets for 2022?

What is Nguyen's return on assets for 2022?

A) 150.0%

B) 15.7%

C) 15.0%

D) 14.3%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2022, Phelps Corporation reported net sales of $2,500,000, net income of $1,320,000, and depreciation expense of $80,000.Phelps also reported beginning total assets of $1,000,000, ending total assets of $1,500,000, plant assets of $800,000, and accumulated depreciation of $500,000.Phelps's asset turnover is

A) 1.3 times.

B) 1.1 times.

C) 1.7 times.

D) 2.0 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rains Company purchased equipment on January 1 at a list price of $125,000, with credit terms 2/10, n/30.Payment was made within the discount period.Rains paid $6,250 sales tax on the equipment and paid installation charges of $2,200.Prior to installation, Rains paid $5,000 to pour a concrete slab on which to place the equipment.What is the total cost of the new equipment?

A) $131,250

B) $135,950

C) $138,450

D) $126,250

Correct Answer

verified

Correct Answer

verified

True/False

The depreciable cost of a plant asset is its original cost minus obsolescence.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If disposal of a plant asset occurs during the year, depreciation is

A) not recorded for the year.

B) recorded for the whole year.

C) recorded for the fraction of the year to the date of the disposal.

D) not recorded if the asset is scrapped.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 1, 2022, Irwin Company purchased the copyright to Quick Computer Tutorials for $120,000.It is estimated that the copyright will have a useful life of 5 years.The amount of amortization expense recognized for the year 2022 would be

A) $24,000.

B) $16,000.

C) $12,000.

D) $12,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plant asset was purchased on January 1 for $55,000 with an estimated salvage value of $5,000 at the end of its useful life.The current year's depreciation expense is $5,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $25,000.The remaining useful life of the plant asset is

A) 10 years.

B) 11 years.

C) 6 years.

D) 5 years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aber Company buys land for $145,000 in 2021.As of 3/31/22, the land has appreciated in value to $151,000.On 12/31/22, the land has an appraised value of $155,400.By what amount should the Land account be increased in 2022?

A) $0

B) $6,000

C) $4,400

D) $10,400

Correct Answer

verified

Correct Answer

verified

True/False

If a plant asset is sold at a gain, the gain on disposal should reduce the cost of goods sold section of the income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

* 205.A company purchased factory equipment for $450,000.It is estimated that the equipment will have a $45,000 salvage value at the end of its estimated 5-year useful life.If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be

A) $180,000.

B) $108,000.

C) $162,000.

D) $97,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plant asset was purchased on January 1 for $75,000 with an estimated salvage value of $15,000 at the end of its useful life.The current year's depreciation expense is $5,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $35,000.The remaining useful life of the plant asset is

A) 15 years

B) 12 years

C) 7 years

D) 5 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kathy's Blooms purchased a delivery van with a $60,000 list price.The company was given a $6,000 cash discount by the dealer and paid $3,000 sales tax.Annual insurance on the van is $1,500.As a result of the purchase, by how much will Kathy's Blooms increase its van account?

A) $60,000

B) $54,000

C) $58,500

D) $57,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company incurs legal costs in successfully defending its patent, these costs are recorded by debiting

A) Legal Expense.

B) the Intangible Loss account.

C) the Patent account.

D) a revenue expenditure account.

Correct Answer

verified

Correct Answer

verified

True/False

A change in the estimated useful life of a plant asset may cause a change in the amount of depreciation recognized in the current and future periods, but not in prior periods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mitchell Corporation bought equipment on January 1, 2022.The equipment cost $300,000 and had an expected salvage value of $50,000.The life of the equipment was estimated to be 6 years.The depreciable cost of the equipment is

A) $300,000.

B) $250,000.

C) $50,000.

D) $41,667.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A loss on disposal of a plant asset is reported in the financial statements

A) in the Other Revenues and Gains section of the income statement.

B) in the Other Expenses and Losses section of the income statement.

C) as a direct increase to the capital account on the balance sheet.

D) as a direct decrease to the capital account on the balance sheet.

Correct Answer

verified

Correct Answer

verified

True/False

Once cost is established for a plant asset, it becomes the basis of accounting for the asset unless the asset appreciates in value, in which case, market value becomes the basis for accountability.

Correct Answer

verified

Correct Answer

verified

True/False

Intangible assets are rights, privileges, and competitive advantages that result from ownership of long-lived assets without physical substance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whyte Clinic purchases land for $420,000 cash.The clinic assumes $4,500 in property taxes due on the land.The title and attorney fees totaled $3,000.The clinic had the land graded for $6,600.What amount does Whyte Clinic record as the cost for the land?

A) $426,600

B) $420,000

C) $434,100

D) $427,500

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 219

Related Exams