A) monthly rate.

B) daily rate.

C) semiannual rate.

D) annual rate.

Correct Answer

verified

Correct Answer

verified

True/False

The effective-interest method produces a constant dollar amount of interest expense to be reported for each interest period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Norlan Company does not ring up sales taxes separately on the cash register.Total receipts for October amounted to $36,750.If the sales tax rate is 5%, what amount must be remitted to the state for October's sales taxes?

A) $1,750

B) $1,838

C) $88

D) It cannot be determined.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contractual interest rate on a bond is often referred to as the

A) callable rate.

B) the maturity rate.

C) market rate.

D) stated rate.

Correct Answer

verified

Correct Answer

verified

Short Answer

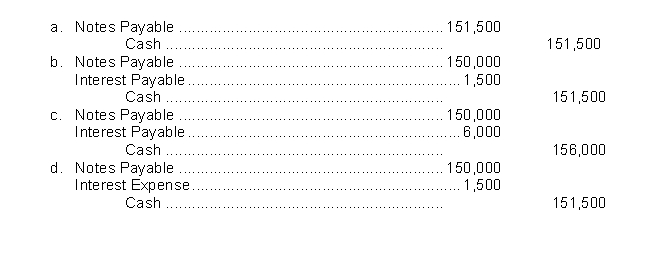

On October 1, Sam's Painting Service borrows $150,000 from National Bank on a 3-month, $150,000, 4% note.The entry by Sam's Painting Service to record payment of the note and accrued interest on January 1 is

Correct Answer

verified

Correct Answer

verified

True/False

An installment note calling for equal total payments each period will result in an interest portion that decreases in each successive period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of issuing bonds instead of common stock?

A) Stockholder control is not affected

B) Earnings per share on common stock may be lower

C) Tax savings result

D) Each of these answer choices is an advantage.

Correct Answer

verified

Correct Answer

verified

True/False

Total interest cost for a bond issued at a premium equals the total of the periodic interest payments minus the premium.

Correct Answer

verified

Correct Answer

verified

True/False

If the straight-line method of amortization is used, the amount of yearly interest expense will increase as the bonds approach maturity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market rate of interest is often called the

A) stated rate.

B) effective rate.

C) coupon rate.

D) contractual rate.

Correct Answer

verified

Correct Answer

verified

Short Answer

A company receives $348, of which $28 is for sales tax.The journal entry to record the sale would include a A) debit to Sales Taxes Expense for $28. B)debit to Sales Taxes Payable for $28. C)debit to Sales Revenue for $348. D)debit to Cash for $348.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2020, $3,000,000, 10-year, 10% bonds, were issued for $2,910,000.Interest is paid annually on January 1.If the issuing corporation uses the straight-line method to amortize discount on bonds payable, the monthly amortization amount is

A) $29,100.

B) $9,000.

C) $2,424.

D) $750.

Correct Answer

verified

Correct Answer

verified

True/False

Regardless of whether the straight-line method or the effective-interest method is used, the carrying value of a bond issued at a discount will decrease continually over the bond's life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relationship between current assets and current liabilities is

A) useful in determining income.

B) useful in evaluating a company's liquidity.

C) called the matching principle.

D) useful in determining the amount of a company's long-term debt.

Correct Answer

verified

Correct Answer

verified

True/False

Most notes are not interest bearing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Winrow Company received proceeds of $754,000 on 10-year, 8% bonds issued on January 1, 2019.The bonds had a face value of $800,000, pay interest annually on December 31, and have a call price of 101.Winrow uses the straight-line method of amortization.What is the amount of interest Winrow must pay the bondholders in 2019?

A) $60,320

B) $64,000

C) $68,600

D) $59,400

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements regarding convertible bonds are true except

A) if the market price of common stock increases substantially, bondholders with convertible bonds benefit.

B) convertible bonds can be converted into common stock at the option of the issuing company.

C) bondholders with convertible bonds receive interest on the bonds until conversion.

D) convertible bonds sell at a higher price and pay a lower rate of interest than those without the conversion option.

Correct Answer

verified

Correct Answer

verified

True/False

When the effective-interest method of amortization is used, the amount of interest expense for a given period is calculated by multiplying the face rate of interest by the bond's carrying value at the beginning of the given period.

Correct Answer

verified

Correct Answer

verified

True/False

A $150,000 bond with a quoted priced of 102 ¼ is sold for $153,375.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a recent year, Hart Corporation had net income of $155,000, interest expense of $30,000, and income tax expense of $40,000.What was Hart Corporation's times interest earned for the year?

A) 7.50

B) 5.17

C) 6.17

D) 6.50

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 246

Related Exams