A) regressive tax principle.

B) ability-to-pay principle.

C) progressive tax principle.

D) benefits received principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

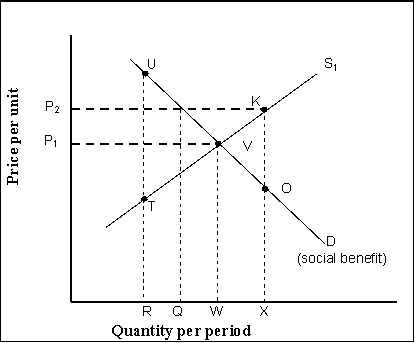

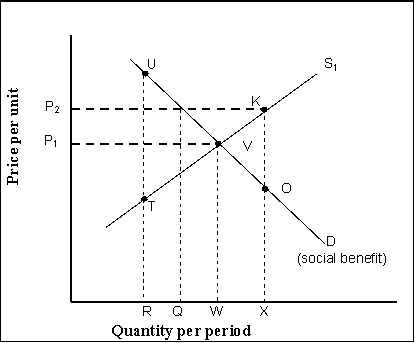

Reference: 15147  -(Exhibit: Correcting for Market Failure: A Public Good) A private market produces R units of output of a public good.If the government intervenes to provide the efficient level of a public good, the net gain will be:

-(Exhibit: Correcting for Market Failure: A Public Good) A private market produces R units of output of a public good.If the government intervenes to provide the efficient level of a public good, the net gain will be:

A) KVO

B) TUV

C) RUVW minus RTVW

D) B and C are both correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantification of benefits and costs of activity by public officials in an effort to locate the efficient solution is characteristic of the _______ approach to studying public sector choice.

A) federal budget studies

B) rational abstention

C) public interest theory

D) public choice theory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest _______ transfer payment in the United States is _______ .

A) non-means-tested; Medicaid

B) non-means-tested; Social Security payments to retired persons

C) means-tested; farmers aid

D) means-tested; Social Security payments to retired persons

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public goods are efficiently provided if the price that consumers pay is:

A) zero.

B) less than zero.

C) greater than zero but less than the marginal cost of production.

D) greater than the marginal cost of production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A condition necessary for a market to achieve economic efficiency is that the market:

A) demand curve must include all opportunity costs imposed on society of producing the good.

B) demand curve must exclude the willingness to pay of all members of society who benefit from the good.

C) supply curve must include the willingness to pay of all members of society who benefit from the good.

D) supply curve must include all opportunity costs imposed on society of producing the good.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a public good, nonpayers _______ excluded from obtaining the benefits of the good.

A) can be

B) are automatically

C) usually are

D) cannot be

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The free-rider problem is most important for:

A) public goods.

B) private goods.

C) market goods.

D) both private and public goods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study of government expenditure and tax policy and the impacts of these policies on the economy is called:

A) federal choice.

B) federal deficit.

C) public finance.

D) public debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to public choice theory, being too busy to take the time off to vote may be the result of:

A) rational participation.

B) rational abstention.

C) rent seeking.

D) ignorance in action.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determining whether the burden of taxes falls on consumers, workers, or owners of other factors of production is:

A) tax incidence analysis.

B) government spending theory.

C) public interest theory.

D) public choice theory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reference: 15147  -(Exhibit: Correcting for Market Failure: A Public Good) A private market produces R units of output of a public good.By imposing taxes to finance the public good, the government could move the production from R to the efficient level of production of :

-(Exhibit: Correcting for Market Failure: A Public Good) A private market produces R units of output of a public good.By imposing taxes to finance the public good, the government could move the production from R to the efficient level of production of :

A) Q.

B) U.

C) W.

D) X.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the case of a public good:

A) a consumer could be a free rider.

B) firms get a signal that fully reflects benefits received by consumers.

C) firms will get signals to produce more than is economically efficient.

D) it is quite costly to add consumers.

Correct Answer

verified

Correct Answer

verified

True/False

It may be rational to be ignorant about an issue if the costs of being educated about it outweigh the benefits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

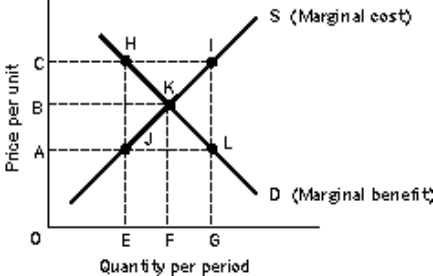

Reference: 15165  -(Exhibit: Market Failure) A competitive market, free of market failures, will achieve the equilibrium point:

-(Exhibit: Market Failure) A competitive market, free of market failures, will achieve the equilibrium point:

A) H.

B) I.

C) J.

D) K.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A progressive tax is one that takes:

A) a fixed percentage of income.

B) a lower percentage of income as income rises.

C) a higher percentage of income as income rises.

D) higher percentage of income as income falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paying a tax of $10 on an income of $100, a tax of $25 on an income of $200, and a tax of $60 on an income of $300 is an example of a(n) :

A) progressive tax.

B) proportional tax.

C) regressive tax.

D) constant-rate tax.

Correct Answer

verified

Correct Answer

verified

True/False

Public finance is the study of government expenditures and tax policy and their impact on the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purchases or the production of goods or services by government agencies are called:

A) government purchases.

B) government transfers.

C) transfer payments.

D) public taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxation according to the benefits-received principle is best illustrated by the:

A) income tax.

B) sales tax.

C) gift tax.

D) gasoline tax.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 179

Related Exams