A) Net income ÷ interest

B) [Net income + (interest × (1 - tax rate) ) ] ÷ interest

C) Income before interest but after taxes ÷ interest

D) Income before interest , taxes and depreciation ÷ interest

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purchase of inventory for cash will

A) increase the current ratio.

B) decrease the current ratio.

C) increase the quick ratio.

D) decrease the quick ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following descriptions best describes cross-sectional analysis?

A) converting dollar values on the financial statements to percentages of a specific base amount

B) comparing data from one company to with those of another company over the same period

C) examining company information from multiple periods

D) using historical information as a basis for predicting future outcomes

Correct Answer

verified

Correct Answer

verified

True/False

Times series analysis compares the data from one company with the data from another company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following depicts the current ratio?

A) (current assets - inventory) ÷ current liabilities

B) currents assets ÷ total assets

C) (current assets - inventory) ÷ total assets

D) current assets ÷ current liabilities

Correct Answer

verified

Correct Answer

verified

True/False

The auditor's report guarantees the accuracy of the information presented in the financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best represents a low-cost producer?

A) gourmet grocery store

B) discount grocery store

C) high end retailer

D) specialty store

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When preparing common-size analysis of a statement of income, the base is normally

A) Net income.

B) Operating expenses.

C) Revenues.

D) Cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A low-cost producer focuses on

A) providing goods and services at highest possible costs and selling at high prices.

B) providing goods and services at lowest possible costs and selling at high prices.

C) providing goods and services at highest possible costs and selling at low prices.

D) providing goods and services at lowest possible costs and selling at low prices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

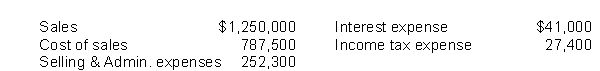

Diesel Inc. had the following activity during 2016:  The interest coverage ratio during 2016 is

The interest coverage ratio during 2016 is

A) 5.13.

B) 5.80.

C) 7.69.

D) 11.28.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lenders would be most concerned with

A) debt to equity ratio.

B) EPS.

C) inventory turnover.

D) price earnings ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cross-sectional analysis involves examining a company's financial data

A) across account classifications.

B) as percentages of net sales or total assets.

C) and comparing it with other companies.

D) across time periods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two companies have an identical amount of current assets and current liabilities. Chelmsford Inc. has 40% of its current assets invested in inventory, whereas Hanmer Corp. has 30% of its current assets invested in inventory. Which of the following statements is true?

A) Chelmsford will have the higher quick ratio.

B) Chelmsford will have the higher current ratio.

C) The companies are equally liquid because their current ratios are the same.

D) Chelmsford is less liquid than Hanmer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price investors are willing to pay for a dollar's worth of earnings is the

A) ROE

B) EPS.

C) price earnings ratio.

D) stock market price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following steps adds the most value to an analysis?

A) determine the purpose of the analysis

B) develop conclusions

C) analyze and interpret the ratios

D) prepare common-size analysis

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To see if a company's cost of sales is increasing proportionately with sales, an analyst would use

A) raw financial data.

B) common-size analysis.

C) trend analysis.

D) prospective analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best represents a company following the product differentiation strategy?

A) gourmet grocery store

B) discount grocery store

C) discount retailer

D) dollar store

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following depicts the quick ratio?

A) (cash + accounts receivable + short-term investments) ÷ current liabilities

B) (cash + accounts receivable) ÷ total assets

C) (current assets - current liabilities) ÷ total assets

D) (cash + inventory) ÷ current liabilities

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the return on investment ratios would be of most interest to the owners of a company?

A) return on assets

B) return on interest

C) return on debt

D) return on equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in the profit margin ratio could indicate changes in any of the following EXCEPT changes in

A) sales volume.

B) product profitability.

C) the cost structure.

D) the pricing policy.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 90

Related Exams