A) 14.04%

B) 15.44%

C) 16.99%

D) 18.69%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

A) A project's regular IRR is found by discounting the cash inflows at the WACC to find the present value (PV) , then compounding this PV to find the IRR.

B) If a project's IRR is greater than the WACC, then its NPV must be negative.

C) To find a project's IRR, we must solve for the discount rate that causes the PV of the inflows to equal the PV of the project's costs.

D) To find a project's IRR, we must find a discount rate that is equal to the WACC.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

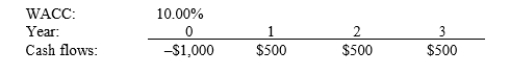

Edmondson Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected.

A) $243.43

B) $255.60

C) $268.38

D) $281.80

Correct Answer

verified

Correct Answer

verified

Multiple Choice

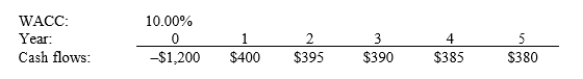

Barry Company is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected.

A) $253.81

B) $282.01

C) $310.21

D) $341.23

Correct Answer

verified

Correct Answer

verified

Multiple Choice

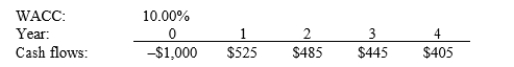

Bey Bikes is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?

A) 1.72 years

B) 1.92 years

C) 2.13 years

D) 2.36 years

Correct Answer

verified

Correct Answer

verified

True/False

In theory, any capital budgeting investment rule should depend solely on forecasted cash flows and the opportunity cost of capital. The rule itself should not be affected by managers' tastes, the choice of accounting method, or the profitability of other independent projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct? Assume that the project being considered has normal cash flows, with one cash outflow at t = 0 followed by a series of positive cash flows.

A) A project's MIRR is always greater than its regular IRR.

B) A project's MIRR is always less than its regular IRR.

C) To find a project's MIRR, we compound cash inflows at the regular IRR and then find the discount rate that causes the PV of the terminal value to equal the initial cost.

D) To find a project's MIRR, the textbook procedure compounds cash inflows at the WACC and then finds the discount rate that causes the PV of the terminal value to equal the initial cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The IRR method appeals to some managers because it gives an estimate of the rate of return on projects rather than a dollar amount, which the NPV method provides.

B) The discounted payback method eliminates all of the problems associated with the payback method.

C) When evaluating independent projects, the NPV and IRR methods often yield conflicting results regarding a project's acceptability.

D) To find the MIRR, we discount the TV at the IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

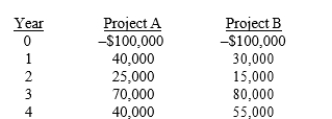

Flint Fruits is considering two equally risky, mutually exclusive projects, Projects A and B, that have the following cash flows:  At what WACC would the two projects have the same NPV?

At what WACC would the two projects have the same NPV?

A) 9.56%

B) 10.33%

C) 11.21%

D) 12.55%

Correct Answer

verified

Correct Answer

verified

True/False

The IRR is that discount rate that equates the present value of the cash outflows (or costs) with the present value of the cash inflows.

Correct Answer

verified

Correct Answer

verified

True/False

The IRR of normal Project X is greater than the IRR of normal Project Y, and both IRRs are greater than zero. Also, the NPV of X is greater than the NPV of Y at the cost of capital. If the two projects are mutually exclusive, Project X should definitely be selected, and the investment made, provided we have confidence in the data. Put another way, it is impossible to draw NPV profiles that would suggest NOT ACCEPTING Project X.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mountain Fresh Water Company is considering two mutually exclusive machines. Machine A has an up-front cost of $100,000 (CF0 = -100,000) , and it produces positive after-tax cash inflows of $40,000 a year at the end of each of the next six years. Machine B has an up-front cost of $50,000(CF0 = - 50,000) , and it produces after-tax cash inflows of $30,000 a year at the end of the next three years. The Company's cost of capital is 10.5%. Based on the equivalent annual annuity, which machine will be chosen?

A) A,$71,687

B) A,$16,702

C) B,$23,954

D) B,$9,718

Correct Answer

verified

Correct Answer

verified

True/False

Theoretically speaking, hard capital rationing does not exist.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the IRR method?

A) One defect of the IRR method is that it does not take account of cash flows over a project's full life.

B) One defect of the IRR method is that it does not take account of the time value of money.

C) One defect of the IRR method is that it does not take account of the cost of capital.

D) One defect of the IRR method is that it assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid.

Correct Answer

verified

Correct Answer

verified

True/False

A firm should never undertake an investment if accepting the project would lead to an increase in the firm's cost of capital.

Correct Answer

verified

Correct Answer

verified

True/False

Small businesses make less use of DCF capital budgeting techniques than large businesses. This may reflect a lack of knowledge on the part of small firms' managers, but it may also reflect a rational conclusion that the costs of using DCF analysis outweigh the benefits of these methods for very small firms.

Correct Answer

verified

Correct Answer

verified

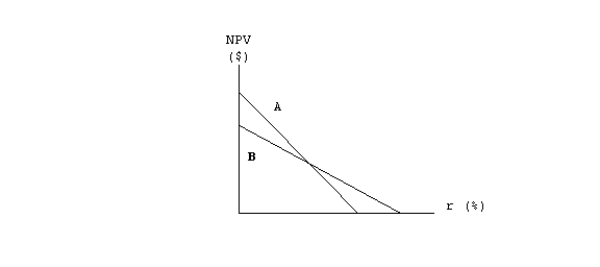

Multiple Choice

Projects A and B have identical expected lives and identical initial cash outflows (costs) . However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below:  Which of the following statements is correct?

Which of the following statements is correct?

A) More of Project A's cash flows occur in the later years.

B) More of Project B's cash flows occur in the later years.

C) We must have information on the cost of capital in order to determine which project has the larger early cash flows.

D) The NPV profile graph is inconsistent with the statement made in the problem.

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason that the NPV method is conceptually superior to the IRR method for evaluating mutually exclusive investments is that multiple IRRs may exist.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

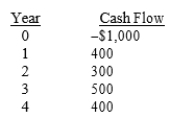

Van Auken Inc. is considering a project that has the following cash flows:  The company's WACC is 10%. What are the project's payback, IRR, and NPV?

The company's WACC is 10%. What are the project's payback, IRR, and NPV?

A) payback = 2.4, IRR = 10.00%, NPV = $600

B) payback = 2.4, IRR = 21.22%, NPV = $260

C) payback = 2.6, IRR = 21.22%, NPV = $300

D) payback = 2.6, IRR = 21.22%, NPV = $260

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the IRR.

B) The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR.

C) The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the risk-free rate.

D) The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 108

Related Exams