Correct Answer

verified

Correct Answer

verified

Multiple Choice

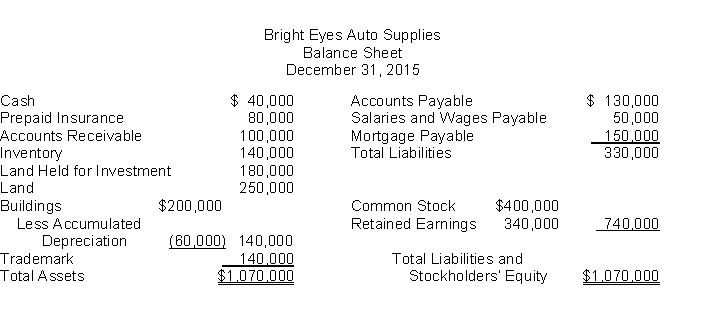

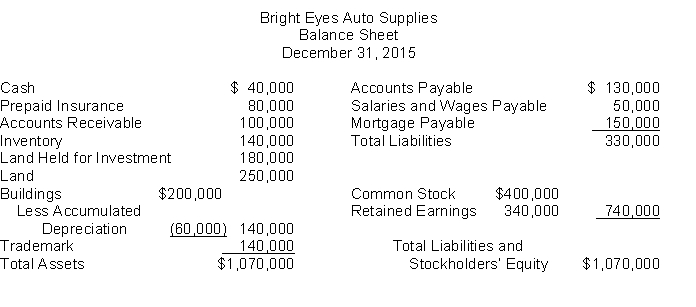

The following information is for Bright Eyes Auto Supplies:  The total dollar amount of assets to be classified as property, plant, and equipment is

The total dollar amount of assets to be classified as property, plant, and equipment is

A) $390,000.

B) $450,000.

C) $570,000.

D) $630,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is for Bright Eyes Auto Supplies:  The total dollar amount of assets to be classified as current assets is

The total dollar amount of assets to be classified as current assets is

A) $140,000.

B) $220,000.

C) $360,000.

D) $500,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

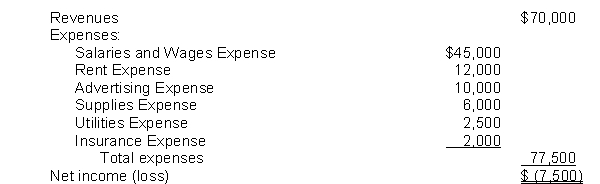

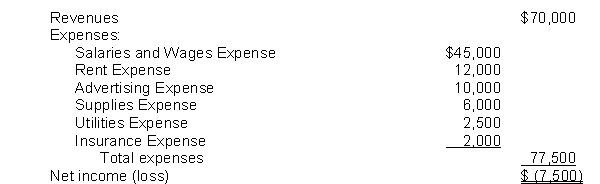

The income statement for the year 2015 of Fugazi Co. contains the following information:  After all closing entries have been posted, the revenue account will have a balance of

After all closing entries have been posted, the revenue account will have a balance of

A) $0.

B) $70,000 credit.

C) $70,000 debit.

D) $7,500 credit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The use of reversing entries

A) is a required step in the accounting cycle.

B) changes the amounts reported in the financial statements.

C) simplifies the recording of subsequent transactions.

D) is required for all adjusting entries.

Correct Answer

verified

Correct Answer

verified

True/False

Closing revenue and expense accounts to the Income Summary account is an optional bookkeeping procedure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement about long-term investments is not true?

A) They will be held for more than one year.

B) They are not currently used in the operation of the business.

C) They include investments in stock of other companies and land held for future use.

D) They can never include cash accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The heading for a post-closing trial balance has a date line that is similar to the one found on

A) a balance sheet.

B) an income statement.

C) a retained earnings statement.

D) the worksheet.

Correct Answer

verified

Correct Answer

verified

True/False

Long-term investments would appear in the property, plant, and equipment section of the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company utilizes reversing entries, they will

A) be made at the beginning of the next accounting period.

B) not actually be posted to the general ledger accounts.

C) be made before the post-closing trial balance.

D) be part of the adjusting entry process.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most efficient way to accomplish closing entries is to

A) credit the income summary account for each revenue account balance.

B) debit the income summary account for each expense account balance.

C) credit the dividends balance directly to the income summary account.

D) credit the income summary account for total revenues and debit the income summary account for total expenses.

Correct Answer

verified

Correct Answer

verified

True/False

Current liabilities are obligations that the company is to pay within the coming year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The post-closing trial balance contains only

A) income statement accounts.

B) balance sheet accounts.

C) balance sheet and income statement accounts.

D) income statement, balance sheet, and retained earnings statement accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The subtotal net assets is used in

A) both GAAP and IFRS.

B) GAAP but not IFRS.

C) IFRS but not GAAP.

D) neither IFRS nor GAAP.

Correct Answer

verified

Correct Answer

verified

True/False

In a corporation, Retained Earnings is a part of stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

Both correcting entries and adjusting entries always affect at least one balance sheet account and one income statement account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the order in which assets are generally listed on a classified balance sheet?

A) Current and long-term

B) Current; property, plant, and equipment; long-term investments; intangible assets

C) Current; property, plant, and equipment; intangible assets; long-term investments

D) Current; long-term investments; property, plant, and equipment; intangible assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

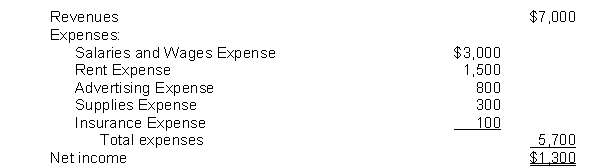

The income statement for the month of June, 2015 of Camera Obscura Enterprises contains the following information:  The entry to close Income Summary to Retained Earnings includes

The entry to close Income Summary to Retained Earnings includes

A) a debit to Revenues for $7,000.

B) credits to Expenses totalling $5,700.

C) a credit to Income Summary for $1,300

D) a credit to Retained Earnings for $1,300.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A double rule applied to accounts in the ledger during the closing process implies that

A) the account is a temporary account.

B) the account is a balance sheet account.

C) the account balance is not zero.

D) a mistake has been made, since double ruling is prescribed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for the year 2015 of Fugazi Co. contains the following information:  At January 1, 2015, Fugazi reported retained earnings of $50,000. Dividends for the year totalled $10,000. At December 31, 2015, the company will report retained earnings of

At January 1, 2015, Fugazi reported retained earnings of $50,000. Dividends for the year totalled $10,000. At December 31, 2015, the company will report retained earnings of

A) $17,500.

B) $32,500.

C) $40,000.

D) $42,500.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 170

Related Exams