A) $12,930.

B) $14,190.

C) $23,730.

D) $24,990.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fraud triangle applies to

A) U.S companies but not international companies.

B) international companies but not U.S.companies.

C) U.S.and Canadian companies but not other international companies.

D) U.S and international companies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

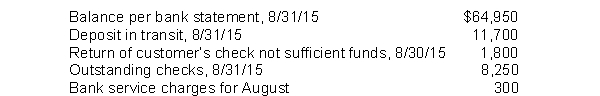

In preparing its August 31, 2015 bank reconciliation, Annie Corp. has available the following information:  At August 31, 2015, Annie's adjusted cash balance is

At August 31, 2015, Annie's adjusted cash balance is

A) $56,700.

B) $56,400.

C) $68,400.

D) $61,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Winter Gloves Company had checks outstanding totaling $12,800 on its May bank reconciliation. In June, Winter Gloves Company issued checks totaling $79,800. The July bank statement shows that $71,400 in checks cleared the bank in July. A check from one of Winter Gloves Company's customers in the amount of $2,000 was also returned marked "NSF." The amount of outstanding checks on Winter Gloves Company's July bank reconciliation should be

A) $8,400.

B) $19,200.

C) $21,200.

D) $23,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Having different individuals receive cash, record cash receipts, and hold the cash is an example of

A) establishment of responsibility.

B) segregation of duties.

C) documentation procedures.

D) independent internal verification.

Correct Answer

verified

Correct Answer

verified

True/False

A debit memorandum could show the collection of a note receivable by the bank.

Correct Answer

verified

Correct Answer

verified

True/False

Cash which is restricted for a specific use should be separately reported.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowing only designated personnel to handle cash receipts is an example of

A) establishment of responsibility.

B) segregation of duties.

C) documentation procedures.

D) independent internal verification.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

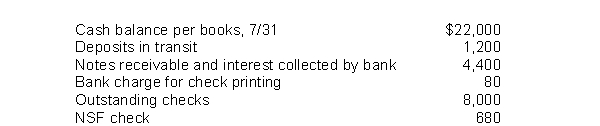

Electric Sunset Company gathered the following reconciling information in preparing its July bank reconciliation:  The adjusted cash balance per books on July 31 is

The adjusted cash balance per books on July 31 is

A) $17,640.

B) $18,840.

C) $25,640.

D) $26,840.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the month of May, Kijak Company Inc. wrote checks in the amount of $56,000. In June, checks in the amount of $76,000 were written. In May, $50,000 of these checks were presented to the bank for payment, and $66,000 in June. What is the amount of outstanding checks at the end of June?

A) $6,000

B) $10,000

C) $16,000

D) $20,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal control is defined, in part, as a plan that safeguards

A) all balance sheet accounts.

B) assets.

C) liabilities.

D) capital stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A petty cash fund should not be used for

A) postage due.

B) loans to the petty cash custodian.

C) taxi fares.

D) customer lunches.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle of establishing responsibility does not include

A) one person being responsible for one task.

B) authorization of transactions.

C) independent internal verification.

D) approval of transactions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The control principle related to not having the same person authorize and pay for goods is known as

A) establishment of responsibility.

B) independent internal verification.

C) segregation of duties.

D) rotation of duties.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a check correctly written and paid by the bank for $584 is incorrectly recorded on the company's books for $548, the appropriate treatment on the bank reconciliation would be to

A) deduct $36 from the book's balance.

B) add $36 to the book's balance.

C) deduct $36 from the bank's balance.

D) deduct $584 from the book's balance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a voucher system, a prenumbered voucher is prepared for every

A) cash receipt, regardless of source.

B) transaction entered into by the business.

C) expenditure except those made from petty cash.

D) journal entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit balance in Cash Over and Short is reported as a

A) contra asset.

B) miscellaneous asset.

C) miscellaneous expense.

D) miscellaneous revenue.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Related selling activities do not include

A) ordering the merchandise.

B) making a sale.

C) shipping the goods.

D) billing the customer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal auditors

A) are hired by CPA firms to audit business firms.

B) are employees of the IRS who evaluate the internal controls of companies filing tax returns.

C) evaluate the system of internal controls for the companies that employ them.

D) cannot evaluate the system of internal controls of the company that employs them because they are not independent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to replenish a petty cash fund includes a credit to

A) Petty Cash.

B) Cash.

C) Freight-in.

D) Postage Expense.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 164

Related Exams