A) profit margin and debt to total assets ratios.

B) profit margin and asset turnover ratios.

C) times interest earned and debt to total assets ratios.

D) profit margin and free cash flow.

Correct Answer

verified

Correct Answer

verified

True/False

If a company has sales of $100 in 2012 (the base period) and $560 in 2013 (the analysis period), the percentage of the base period is 460%.

Correct Answer

verified

Correct Answer

verified

True/False

Comparisons of company data with industry averages provide information about a company's relative position within the industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasper Electrical reported net credit sales of $4,500,000 and cost of goods sold of $2,700,000 for the year. The Accounts Receivable balances at the beginning and end of the year were $450,000 and $480,000, respectively. The receivables turnover ratio was

A) 5.8 times.

B) 9.4 times.

C) 9.7 times.

D) 10.0 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis of comparative financial statements includes the

A) development of vertically analyzed statements.

B) calculation of liquidity ratios.

C) calculation of dollar amount changes and percentage changes from the previous to the current year.

D) evaluation of financial statement data that expresses each item in the current period's financial statement as a percentage of a base amount.

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow is the cash available after a company pays dividends.

Correct Answer

verified

Correct Answer

verified

True/False

If a company has sales of $220 in 2012 and $560 in 2013, the percentage increase in sales from 2012 to 2013 is 155%.

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis can be carried out on statement of financial position data but not on income statement data.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset turnover measures

A) how often a company replaces its assets.

B) how efficiently a company uses its assets to generate sales.

C) the portion of the assets that have been financed by creditors.

D) the overall rate of return on assets.

Correct Answer

verified

Correct Answer

verified

True/False

Many firms today are so diversified that they cannot be classified by industry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a mandatory change in accounting policy occurs

A) all prior years' financial statements must be changed to reflect the newly adopted policy.

B) it is always accounted for prospectively.

C) the new policy is used in reporting the results of operating activities for the current year.

D) the cumulative effect of the change in policy should be reflected on the current income statement.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company with $60,000 in current assets and $40,000 in current liabilities pays a $1,000 current liability. As a result of this transaction, the current ratio and working capital will

A) both decrease.

B) both increase.

C) increase and remain the same, respectively.

D) remain the same and decrease, respectively.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements about vertical analysis are true except

A) Vertical analysis makes it easier to for intercompany comparisons.

B) Vertical analysis is seldom performed on the income statement.

C) Vertical analysis makes it easier to compare companies of different sizes.

D) Vertical analysis is seldom performed on the cash flow statement.

Correct Answer

verified

Correct Answer

verified

True/False

Ideally, all changes in accounting policy are applied retrospectively, but on occasion may be reported prospectively.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

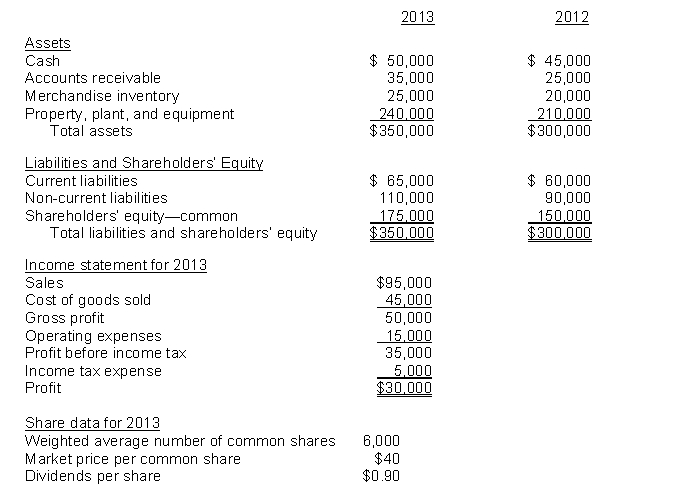

Use the following information to answer questions

Green Thumb Garden Supplies reported the following information for 2012 and 2013.  -What is the return on assets for 2013?

-What is the return on assets for 2013?

A) 27.1%

B) 10.0%

C) 9.2%

D) 8.6%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current ratio is

A) calculated by dividing current liabilities by current assets.

B) used to evaluate a company's liquidity and short-term debt paying ability.

C) used to evaluate a company's solvency and long-term debt paying ability.

D) calculated by subtracting current liabilities from current assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ideally, all changes in accounting policy are applied

A) prospectively.

B) retrospectively.

C) proactively.

D) regressively.

Correct Answer

verified

Correct Answer

verified

Short Answer

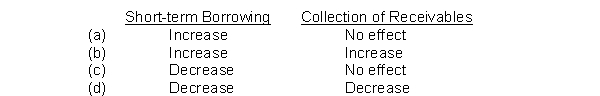

If a company has a current ratio of 1.3:1, what effects will the borrowing of cash by short-term debt and collection of accounts receivable have on the ratio?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A weakness of the current ratio is

A) the difficulty of the calculation.

B) that it doesn't take into account the composition of the current assets.

C) that it is rarely used by sophisticated analysts.

D) that it can be expressed as a percentage, as a rate, or as a proportion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements about vertical analysis are true except

A) Vertical analysis is also called common size analysis.

B) Amounts on the income statement are expressed as a percentage of net sales.

C) Vertical analysis shows the relative size of each item in the statement of financial position.

D) Vertical analysis is also called trend analysis.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 139

Related Exams