A) the amounts are not material.

B) the service has not been provided yet although the cash has been received.

C) the problems measuring them are too complex.

D) all of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott Company purchased equipment on November 1, 2010 and gave a 3-month, 9 percent note with a face value of $50,000.The December 31, 2010 adjusting entry is

A) debit Interest Expense and credit Interest Payable, $4,500.

B) debit Interest Expense and credit Interest Payable, $3,750.

C) debit Interest Expense and credit Cash, $750.

D) debit Interest Expense and credit Interest Payable, $750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fischer Consulting paid $18,000 on December 1, 2010 for a three-year insurance policy (December 1, 2010 to November 30, 2013) and recorded the entire amount as prepaid insurance.The December 31, 2010 adjustment should be recorded as follows:

A) debit prepaid insurance and credit insurance expense $500.

B) debit insurance expense and credit prepaid insurance $500.

C) debit insurance expense and credit prepaid insurance $17,500.

D) debit prepaid insurance and credit insurance expense $17,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An accrued expense can best be described as an amount

A) paid and currently matched with earnings.

B) paid and not currently matched with earnings.

C) not paid and not currently matched with earnings.

D) not paid and currently matched with earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1, 2010, Mays Corp.loaned Farr $500,000 on a 12% note, payable in five annual instalments of $100,000 beginning January 2, 2011.In connection with this loan, Farr was required to deposit $6,000 in a non-interest-bearing escrow account.The amount held in escrow is to be returned to Farr after all principal and interest payments have been made.Interest on the note is payable on the first day of each month beginning July 1, 2010.Farr made timely payments through November 1, 2010.On January 2, 2011, Mays received payment of the first principal instalment plus all interest due.At December 31, 2010, Mays' interest receivable on the loan to Farr should be

A) $0.

B) $5,000.

C) $10,000.

D) $15,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are certain costs of doing business capitalized when incurred and then amortized over subsequent accounting cycles?

A) To reduce the income tax liability

B) To aid management in cash-flow analysis

C) To match the costs of production with revenues as earned

D) To adhere to the accounting constraint of conservatism

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes adjustments:

A) adjustments ensure proper matching.

B) they are used to record external events.

C) (a) and (d) .

D) they are usually prepared at the end of the accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the inventory account at the end of the year is understated, the effect will be to

A) overstate the gross profit on sales.

B) understate the net purchases.

C) overstate the cost of goods sold.

D) overstate the goods available for sale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a real (permanent) account?

A) Goodwill

B) Sales

C) Accounts Receivable

D) Both Goodwill and Accounts Receivable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following must be considered in estimating depreciation on an asset for an accounting period?

A) The original cost of the asset

B) Its useful life

C) The decline of its fair market value

D) Both the original cost of the asset and its useful life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a nominal (temporary) account?

A) Unearned Revenue

B) Salary Expense

C) Inventory

D) Retained Earnings

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjusting entries that should be reversed include those for prepaid or unearned items that

A) create an asset or a liability account.

B) were originally entered in a revenue or expense account.

C) were originally entered in an asset or liability account.

D) create an asset or a liability account and were originally entered in a revenue or

Correct Answer

verified

Correct Answer

verified

Multiple Choice

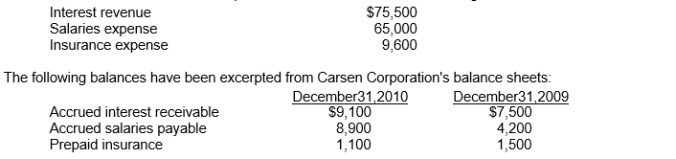

Use the following information for questions

The income statement of Carsen Corporation for 2010 included the following items:

-The cash paid for salaries during 2010 was

-The cash paid for salaries during 2010 was

A) $69,700.

B) $60,300.

C) $60,800.

D) $73,900.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A post-closing trial balance.

A) includes temporary accounts only.

B) includes permanent accounts only.

C) includes both temporary and permanent accounts.

D) may include expenses.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 54 of 54

Related Exams