A) $1.50

B) $0.84

C) $0.21

D) $0.87

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A trend analysis to determine a year-to-year dollar amount change is calculated by:

A) subtracting the previous period amount from the current amount.

B) subtracting the current period amount from the previous period amount.

C) subtracting the current period amount from the previous period amount and then dividing the result by the previous period amount.

D) subtracting the previous period amount from the current period amount and then dividing the result by the

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you wish to examine how one aspect of a business is doing relative to other aspects of the business at the current time, you are most likely to use:

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is a solvency ratio?

A) Net profit margin ratio.

B) Current ratio.

C) Asset turnover ratio.

D) Debt to assets ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding nonrecurring and other special items is true?

A) Some special items, such as changes in the value of certain balance sheet accounts, are excluded from the calculation of net income.

B) Nonrecurring items such as discontinued operations are presented above the income tax expense line on the income statement.

C) Discontinued Operations are reported net of tax as part of the income from continuing operations.

D) Cumulative effect of change in accounting principles is reported on the income statement as part of income from continuing operations.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net sales divided by average total assets is the calculation for which of the following ratios?

A) Net profit margin

B) Asset turnover

C) Current ratio

D) Return on assets

Correct Answer

verified

Correct Answer

verified

Essay

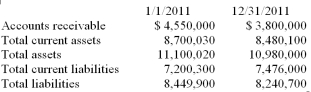

The financial information below presents selected information from the financial statements of Pelican

Company. Sales revenue in 2011 was $13,700,300.  Calculate the following:

A) Receivables turnover ratio assuming all Pelican's sales are made on account.

B) Receivables turnover ratio assuming 20% of sales are made as cash sales. C) Current ratio as of December 31, 2011.

D) Debt to assets ratio as of December 31, 2011.

Calculate the following:

A) Receivables turnover ratio assuming all Pelican's sales are made on account.

B) Receivables turnover ratio assuming 20% of sales are made as cash sales. C) Current ratio as of December 31, 2011.

D) Debt to assets ratio as of December 31, 2011.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the current ratio for 2012?

A) 2.22

B) 2.26

C) 2.57

D) 6.0

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debt to assets ratio of .45. If the company then borrows cash from the bank to finance a building acquisition, which of the following is a true statement?

A) The debt to assets ratio will be unchanged.

B) The debt to assets ratio will increase.

C) The debt to assets ratio will decrease.

D) The debt to assets ratio will increase as a result of the cash received and then decrease as a result of the

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is calculated by dividing liquid assets by current liabilities?

A) Current ratio

B) Quick ratio

C) Turnover ratio

D) Working capital ratio

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has current assets of $450,000 and a current ratio is 2.5. Assume that the company prepays rent for 9 months in the amount of $20,000. What is the amount of the current ratio after t his transaction?

A) 2.39

B) 2.61

C) 2.5

D) 2.81

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Company X has net sales revenue of $1,250,000, cost of goods sold of $760,000, and all other expenses of $290,000. The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets Is $361,000. The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000. What is the ROE ratio?

A) 0.53

B) 2.50

C) 3.33

D) 0.40

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price/earnings ratio at December 31, 2012 is:

A) 0.35

B) 1.40

C) 0.28

D) 3.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nonrecurring items reported separately on an income statement might include:

A) gains or losses on discontinued operations.

B) salaries expense.

C) sales returns and allowances.

D) gross profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a profitability measure?

A) Net income/Net sales

B) Total assets/Total stockholders' equity

C) Total liabilities/Total stockholders' equity

D) Cost of goods sold/Average inventory

Correct Answer

verified

Correct Answer

verified

True/False

Limits on the application of accounting principles include the cost-benefit constraint.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has $72,500 of inventory at the beginning of the year and $65,500 at the end of the year. Sales revenue is $986,400, cost of goods sold is $572,700, and net income is $124,200 for the year. The inventory turnover ratio is:

A) 1.8.

B) 8.3.

C) 6.0.

D) 14.3.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is generally the most useful in analyzing companies of different size?

A) Comparative financial statements

B) Audit reports

C) Common size financial statements

D) Inflation adjusted financial statements

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a common size income statement for this year, what is the percentage that would be shown for cost of goods sold?

A) 76%

B) 24%

C) 31%

D) 18%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wants to examine a company's short-run ability to survive, which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 143

Related Exams