A) Cash

B) Notes receivable

C) Wage expense

D) Unearned revenue

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net Income refers to:

A) The difference between what was earned and the costs incurred during a period.

B) The difference between the cash received and the cash paid out during a period.

C) The difference between what is owned and what is owed at a point in time.

D) The change in the value of the company during a period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding revenues and expenses is true?

A) Both revenues and expenses typically have credit balances.

B) Revenues and expenses are considered assets and liabilities, respectively.

C) Revenue is the same as Cash.

D) Expenses decrease the amount of stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

Revenue and Expense accounts are subcategories of Retained Earnings.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During June, the Grass is Greener Company mows 100 lawns a week; the company was paid in advance during May by those customers. The company uses the accrual basis of accounting. How will these events affect the company's financial statements?

A) The income statement shows the effects of the transactions in May.

B) The income statement shows the effects of the transactions in June.

C) The balance sheet shows no effect from the transactions in May.

D) The transactions have no effect on the balance sheet.

Correct Answer

verified

Correct Answer

verified

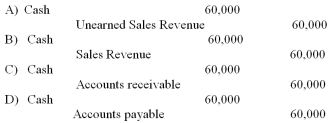

Multiple Choice

The correct entry by Seconds Best Company to record the receipt of payment in the current month is:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is not a specific account in a company's chart of accounts?

A) Income Tax Expense.

B) Sales Revenue.

C) Unearned Revenue.

D) Net Income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of Revenue for July?

A) $5,300

B) $5,700

C) $4,300

D) $7,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the ways companies can mislead investors is to inappropriately capitalize costs. When is it appropriate to capitalize costs?

A) When the work has already been performed.

B) When future economic benefits are associated with the cost.

C) When the good or service being purchased by the company has been received and used.

D) When the good or service purchased by the company has not yet been paid.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company is paid in full for services provided this month, how will the basic accounting equation be affected?

A) Liabilities will decrease.

B) Stockholders' equity will increase as revenue is recorded.

C) Liabilities will increase.

D) Assets will decrease.

Correct Answer

verified

Correct Answer

verified

True/False

Dividing up the continuing life of a company into shorter periods is called the time period assumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company received payment last month for a service that you provided this month. How will the business activity of the current month affect the basic accounting equation?

A) Assets will not change; liabilities (Unearned Revenue) will decrease; and stockholders' equity (Service Revenue) will increase.

B) Assets (Cash) will increase, liabilities (Unearned Revenue) will increase, and stockholders' equity will not change.

C) Assets (Cash) will increase, liabilities will not change, and stockholders' equity (Service Revenue) will increase.

D) Assets (Prepaid Expenses) will decrease, liabilities will not change, and stockholders' equity (Service

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company orders and receives supplies in January, pays for them in February, provides services that use those goods up in March and is paid by customers in April. Using the accrual basis of accounting:

A) expenses are recorded in February and revenues are recorded in April.

B) expenses are recorded in February and revenues are recorded in March.

C) expenses and revenues are recorded in March.

D) expenses are recorded in January and revenues are recorded in April.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is Melody's Net Income for May using the accrual basis of accounting?

A) $250

B) $300

C) $350

D) $600

Correct Answer

verified

Correct Answer

verified

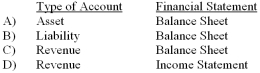

Multiple Choice

Time Warner is a publishing and communications company, specializing in magazines, cable television operation, television program development, and other telecommunication services. Its financial statements show $37,666 in an account called "Unearned Subscriber Revenue," which represents amounts that customers have paid in advance of receiving magazines, cable television, and internet services. What type of account is this and

On what statement is it reported?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts would appear on the Income Statement?

A) Accounts receivable

B) Unearned revenue

C) Service revenue

D) Accounts payable

Correct Answer

verified

Correct Answer

verified

True/False

Unearned Revenue is a liability account.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about accrual basis accounting?

A) The revenue principle is applied.

B) The matching principle is applied.

C) Required for external accounting reports.

D) Requires the timing of cash receipts be in the same period as revenues recognized.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Galvan Corporation (GC) capitalized a $20,000 automobile. Which of the following is true?

A) GC recorded a liability for $20,000.

B) GC recorded an asset for $20,000.

C) GC recorded an expense for $20,000.

D) GC recorded Contributed Capital for $20,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of the Income Statement of a company that was formed 10 years ago?

A) Reports a Net Loss for the year if expenses are more than revenues.

B) Reports the financial effects of activities that have occurred since the company's inception.

C) Reports the amount of the increase in stockholders' equity this year as a result of the company's operations.

D) Reports Net Income which is not an account in the ledger.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 137

Related Exams