A) the rights mature.

B) the stock's price reaches a predetermined amount.

C) of grant.

D) of exercise.

Correct Answer

verified

Correct Answer

verified

True/False

The market value method is used to account for the exercise of convertible preferred stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With respect to the computation of earnings per share, which of the following would be most indicative of a simple capital structure?

A) Common stock, preferred stock, and convertible securities outstanding in lots of even thousands

B) Earnings derived from one primary line of business

C) Ownership interest consisting solely of common stock

D) None of these

Correct Answer

verified

Correct Answer

verified

Multiple Choice

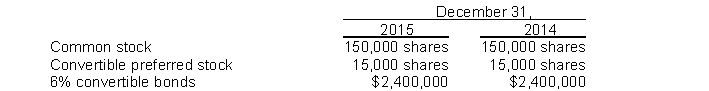

Use the following information for questions 124 and 125.

Information concerning the capital structure of Piper Corporation is as follows:  During 2015, Piper paid dividends of $0.60 per share on its common stock and $1.50 per share on its preferred stock. The preferred stock is convertible into 30,000 shares of common stock. The 6% convertible bonds are convertible into 75,000 shares of common stock. The net income for the year ended December 31, 2015, was $300,000. Assume that the income tax rate was 30%.

-What should be the diluted earnings per share for the year ended December 31, 2015, rounded to the nearest penny?

During 2015, Piper paid dividends of $0.60 per share on its common stock and $1.50 per share on its preferred stock. The preferred stock is convertible into 30,000 shares of common stock. The 6% convertible bonds are convertible into 75,000 shares of common stock. The net income for the year ended December 31, 2015, was $300,000. Assume that the income tax rate was 30%.

-What should be the diluted earnings per share for the year ended December 31, 2015, rounded to the nearest penny?

A) $1.74

B) $1.57

C) $1.33

D) $1.78

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 2, 2014, Perez Co. issued at par $10,000 of 8% bonds convertible in total into 1,000 shares of Perez's common stock. No bonds were converted during 2014. Throughout 2014, Perez had 1,000 shares of common stock outstanding. Perez's 2014 net income was $6,000, and its income tax rate is 30%. No potentially dilutive securities other than the convertible bonds were outstanding during 2014. Perez's diluted earnings per share for 2014 would be (rounded to the nearest penny)

A) $3.00.

B) $3.28.

C) $3.40.

D) $6.56.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2015, Gridley Corporation had 250,000 shares of its $2 par value common stock outstanding. On March 1, Gridley sold an additional 500,000 shares on the open market at $20 per share. Gridley issued a 20% stock dividend on May 1. On August 1, Gridley purchased 280,000 shares and immediately retired the stock. On November 1, 400,000 shares were sold for $25 per share. What is the weighted-average number of shares outstanding for 2015?

A) 1,020,000

B) 750,000

C) 477,777

D) 344,444

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When computing diluted earnings per share, convertible bonds are

A) ignored.

B) assumed converted whether they are dilutive or antidilutive.

C) assumed converted only if they are antidilutive.

D) assumed converted only if they are dilutive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

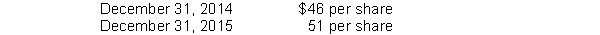

In order to retain certain key executives, Smiley Corporation granted them incentive stock options on December 31, 2013. 120,000 options were granted at an option price of $35per share. Market prices of the stock were as follows:  The options were granted as compensation for executives' services to be rendered over a two-year period beginning January 1, 2014. The Black-Scholes option pricing model determines total compensation expense to be $1,200,000. What amount of compensation expense should Smiley recognize as a result of this plan for the year ended December 31, 2014 under the fair value method?

The options were granted as compensation for executives' services to be rendered over a two-year period beginning January 1, 2014. The Black-Scholes option pricing model determines total compensation expense to be $1,200,000. What amount of compensation expense should Smiley recognize as a result of this plan for the year ended December 31, 2014 under the fair value method?

A) $2,100,000.

B) $1,320,000.

C) $1,200,000.

D) $ 600,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions 46 through 48. Chang Corporation issued $4,000,000 of 9%, ten-year convertible bonds on July 1, 2014 at 96.1 plus accrued interest. The bonds were dated April 1, 2014 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2015, $800,000 of these bonds were converted into 500 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. -If "interest payable" were credited when the bonds were issued, what should be the amount of the debit to "interest expense" on October 1, 2014?

A) $ 86,000.

B) $ 90,000.

C) $ 94,000.

D) $180,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions 46 through 48. Chang Corporation issued $4,000,000 of 9%, ten-year convertible bonds on July 1, 2014 at 96.1 plus accrued interest. The bonds were dated April 1, 2014 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2015, $800,000 of these bonds were converted into 500 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion. -What was the effective interest rate on the bonds when they were issued?

A) 9%

B) Above 9%

C) Below 9%

D) Cannot determine from the information given.

Correct Answer

verified

Correct Answer

verified

True/False

Under IFRS, convertible bonds are "bifurcated" -separated into the equity component (the value of the conversion option) of the bond issue and the debt component.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporations issue convertible debt for two main reasons. One is the desire to raise equity capital that, assuming conversion, will arise when the original debt is converted. The other is

A) the ease with which convertible debt is sold even if the company has a poor credit rating.

B) the fact that equity capital has issue costs that convertible debt does not.

C) that many corporations can obtain debt financing at lower rates.

D) that convertible bonds will always sell at a premium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2014, Sharp Corp. granted an employee an option to purchase 12,000 shares of Sharp's $5 par value common stock at $20 per share. The Black-Scholes option pricing model determines total compensation expense to be $280,000. The option became exercisable on December 31, 2015, after the employee completed two years of service. The market prices of Sharp's stock were as follows:  For 2015, should recognize compensation expense under the fair value method of

For 2015, should recognize compensation expense under the fair value method of

A) $180,000.

B) $60,000.

C) $140,000.

D) $0.

Correct Answer

verified

Correct Answer

verified

True/False

In a contingent issue agreement, the contingent shares are considered outstanding for computing diluted EPS when the earnings or market price level is met by the end of the year.

Correct Answer

verified

Correct Answer

verified

True/False

If a stock dividend occurs after year-end, but before issuing the financial statements, a company must restate the weighted-average number of shares outstanding for the year.

Correct Answer

verified

Correct Answer

verified

True/False

A company should allocate the proceeds from the sale of debt with detachable stock warrants between the two securities based on their market values.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2014, Eklund, Inc., issued for $103 per share, 70,000 shares of $100 par value convertible preferred stock. One share of preferred stock can be converted into three shares of Eklund's $25 par value common stock at the option of the preferred stockholder. In August 2015, all of the preferred stock was converted into common stock. The market value of the common stock at the date of the conversion was $30 per share. What total amount should be credited to additional paid-in capital from common stock as a result of the conversion of the preferred stock into common stock?

A) $1,190,000.

B) $ 910,000.

C) $1,750,000.

D) $1,960,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fultz Company had 300,000 shares of common stock issued and outstanding at December 31, 2014. During 2015, no additional common stock was issued. On January 1, 2015, Fultz issued 400,000 shares of nonconvertible preferred stock. During 2015, Fultz declared and paid $150,000 cash dividends on the common stock and $125,000 on the nonconvertible preferred stock. Net income for the year ended December 31, 2015, was $800,000. What should be Fultz's 2015 earnings per common share, rounded to the nearest penny?

A) $0.96

B) $1.75

C) $2.25

D) $2.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dilutive convertible securities must be used in the computation of

A) basic earnings per share only.

B) diluted earnings per share only.

C) diluted and basic earnings per share.

D) none of these.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At December 31, 2015 and 2014, Miley Corp. had 180,000 shares of common stock and 10,000 shares of 6%, $100 par value cumulative preferred stock outstanding. No dividends were declared on either the preferred or common stock in 2015 or 2014. Net income for 2015 was $375,000. For 2015, earnings per common share amounted to

A) $2.08.

B) $1.75.

C) $1.53.

D) $1.42.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 160

Related Exams