A) $95,382.

B) $93,169.

C) $93,078.

D) $90,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

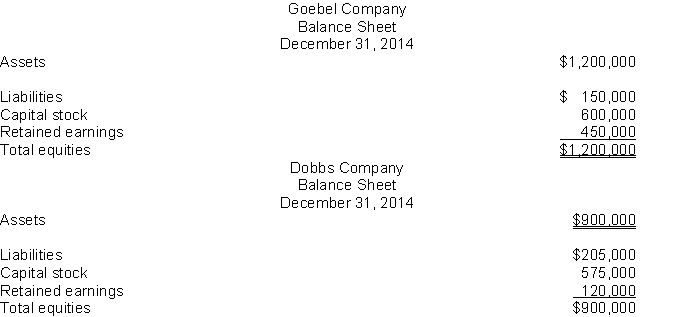

Use the following information for questions 99 through 102.

The summarized balance sheets of Goebel Company and Dobbs Company as of December 31, 2014 are as follows:  -If Goebel Company acquired a 30% interest in Dobbs Company on December 31, 2014 for $220,000 and during 2015 Dobbs Company had net income of $75,000 and paid a cash dividend of $30,000, applying the equity method would give a debit balance in the Equity Investments (Dobbs) account at the end of 2015 of

-If Goebel Company acquired a 30% interest in Dobbs Company on December 31, 2014 for $220,000 and during 2015 Dobbs Company had net income of $75,000 and paid a cash dividend of $30,000, applying the equity method would give a debit balance in the Equity Investments (Dobbs) account at the end of 2015 of

A) $220,000.

B) $233,500.

C) $242,500.

D) $211,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions 72 and 73. Patton Company purchased $900,000 of 10% bonds of Scott Company on January 1, 2015, paying $846,225. The bonds mature January 1, 2025; interest is payable each July 1 and January 1. The discount of $53,775 provides an effective yield of 11%. Patton Company uses the effective-interest method and plans to hold these bonds to maturity. -On July 1, 2015, Patton Company should increase its Debt Investments account for the Scott Company bonds by

A) $5,382.

B) $3,084.

C) $2,691.

D) $1,542.

Correct Answer

verified

Correct Answer

verified

True/False

One requirement related to fair value disclosure is that both the cost and the fair value of all instruments be reported in the notes to the financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1, 2014, Renfro Company purchased to hold to maturity, 3,000, $1,000, 9% bonds for $2,970,000 which includes $45,000 accrued interest. The bonds, which mature on February 1, 2023, pay interest semiannually on February 1 and August 1. Renfro uses the straight-line method of amortization. The bonds should be reported in the December 31, 2014 balance sheet at a carrying value of

A) $2,925,000.

B) $2,927,250.

C) $2,970,000.

D) $2,970,750.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investments in debt securities should be recorded on the date of acquisition at

A) lower of cost or market.

B) market value.

C) market value plus brokerage fees and other costs incident to the purchase.

D) face value plus brokerage fees and other costs incident to the purchase.

Correct Answer

verified

Correct Answer

verified

Short Answer

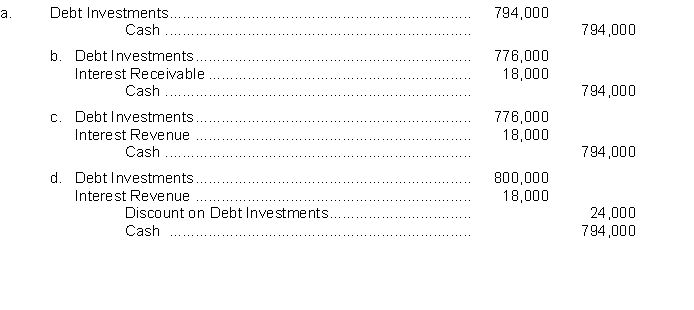

On August 1, 2014, Dambro Company acquired 800, $1,000, 9% bonds at 97 plus accrued interest. The bonds were dated May 1, 2014, and mature on April 30, 2020, with interest paid each October 31 and April 30. The bonds will be added to Dambro's available-for-sale portfolio. The preferred entry to record the purchase of the bonds onAugust 1, 2014 is

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At December 31, 2014, the fair value of the Carlin, Inc. bonds was $954,000. What should Richman Company report as other comprehensive income and as a separate component of stockholders' equity?

A) $0

B) $6,480

C) $16,578

D) $23,058

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When investments in debt securities are purchased between interest payment dates, preferably the

A) securities account should include accrued interest.

B) accrued interest is debited to Interest Expense.

C) accrued interest is debited to Interest Revenue.

D) accrued interest is debited to Interest Receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 1, 2014, Howell Company purchased 800 of the $1,000 face value, 9% bonds of Ramsey, Incorporated, for $842,000, which includes accrued interest of $12,000. The bonds, which mature on January 1, 2019, pay interest semiannually on March 1 and September 1. Assuming that Howell uses the straight-line method of amortization and that the bonds are appropriately classified as available-for-sale, the net carrying value of the bonds should be shown on Howell's December 31, 2014, balance sheet at

A) $800,000.

B) $830,000.

C) $828,800.

D) $842,000.

Correct Answer

verified

Correct Answer

verified

True/False

The Fair Value Adjustment account has a normal credit balance.

Correct Answer

verified

Correct Answer

verified

Short Answer

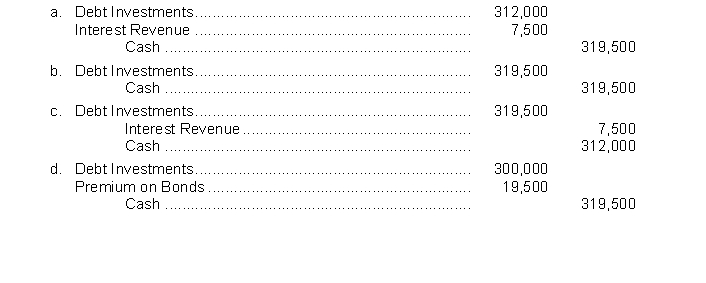

On August 1, 2014, Fowler Company acquired $300,000 face value 10% bonds of Kasnic Corporation at 104 plus accrued interest. The bonds were dated May 1, 2014, and mature on April 30, 2019, with interest payable each October 31 and April 30. The bonds will be held to maturity. What entry should Fowler make to record the purchase of the bonds on August 1, 2014?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company holds between 20% and 50% of the outstanding stock of an investee, which of the following statements applies?

A) The investor should always use the equity method to account for its investment.

B) The investor should use the equity method to account for its investment unless circum-stances indicate that it is unable to exercise "significant influence" over the investee.

C) The investor must use the fair value method unless it can clearly demonstrate the ability to exercise "significant influence" over the investee.

D) The investor should always use the fair value method to account for its investment.

Correct Answer

verified

Correct Answer

verified

Short Answer

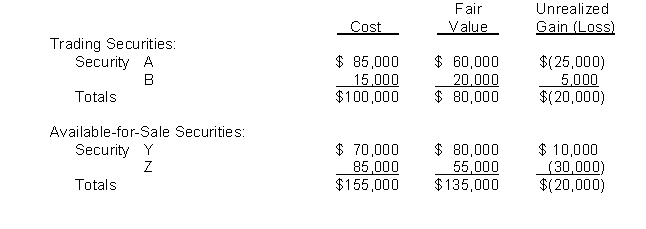

At December 31, 2015, Jeter Corporation had the following equity securities that were purchased during 2015, its first year of operation:  All market declines are considered temporary. Fair value adjustments at December 31, 2015 should be established with a corresponding charge against

All market declines are considered temporary. Fair value adjustments at December 31, 2015 should be established with a corresponding charge against

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an investment in a held-to-maturity security is transferred to an available-for-sale security, the carrying value assigned to the available-for-sale security should be

A) its original cost.

B) its fair value at the date of the transfer.

C) the lower of its original cost or its fair value at the date of the transfer.

D) the higher of its original cost or its fair value at the date of the transfer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

APB Opinion No. 21 specifies that, regarding the amortization of a premium or discount on a debt security, the

A) effective-interest method of allocation must be used.

B) straight-line method of allocation must be used.

C) effective-interest method of allocation should be used but other methods can be applied if there is no material difference in the results obtained.

D) par value method must be used and therefore no allocation is necessary.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are considered equity securities? I.Convertible debt. II.Redeemable preferred stock III.Call or put options.

A) I and II only.

B) I and III only.

C) II only.

D) III only.

Correct Answer

verified

Correct Answer

verified

Essay

On April 1, 2014, West Company purchased $400,000 of 6% bonds for $415,750 plus accrued interest as an available-for-sale security. Interest is paid on July 1 and January 1 and the bonds mature on July 1, 2019. Instructions (a) Prepare the journal entry on April 1, 2014. (b) The bonds are sold on November 1, 2015 at 103 plus accrued interest. Amortization was recorded when interest was received by the straight-line method (by months and round to the nearest dollar). Prepare all entries required to properly record the sale.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ziegler Corporation purchased 25,000 shares of common stock of the Sherman Corporation for $40 per share on January 2, 2014. Sherman Corporation had 100,000 shares of common stock outstanding during 2015, paid cash dividends of $90,000 during 2015, and reported net income of $300,000 for 2015. Ziegler Corporation should report revenue from investment for 2015 in the amount of

A) $22,500.

B) $52,500.

C) $75,000.

D) $82,500.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not correct in regard to trading securities?

A) They are held with the intention of selling them in a short period of time.

B) Unrealized holding gains and losses are reported as part of net income.

C) Any discount or premium is not amortized.

D) All of these are correct.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 141

Related Exams