A) $520

B) $600

C) $656

D) $1,480

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reinhoff Inc. reported total assets of €2,600,000, including €435,000 for inventory, and equity of €1,690,0000 on the December 31, 2014 statement of financial position. Reinhoff subsequently determined that the ending inventory was understated by €63,000. What is the corrected amount of equity for the year?

A) €0.

B) €1,627,000.

C) €1,690,000.

D) €1,753,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At January 1, 2014, Britannica Inc. reported inventory of £425,000. At December 31, 2014, the inventory on hand was £501,000. If cost of goods sold for 2014 was £4,996,875, What is the inventory turnover ratio for the year?

A) 5.8 times.

B) 6.9 times.

C) 10.8 times.

D) 11.7 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

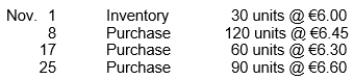

Shandy Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is

A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is

A) €657.

B) €1,268.

C) €632.

D) €1,294.

Correct Answer

verified

Correct Answer

verified

True/False

Accountants believe that the write down from cost to net realizable value should not be made in the period in which the price decline occurs.

Correct Answer

verified

Correct Answer

verified

True/False

In a period of falling prices, the average-cost method results in a lower cost of goods sold than the FIFO method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

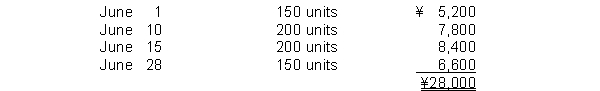

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. The inventory method which results in the highest gross profit for June is

A physical count of merchandise inventory on June 30 reveals that there are 100 units on hand. The inventory method which results in the highest gross profit for June is

A) the FIFO method.

B) the specific identification method.

C) the average-cost method.

D) not determinable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new average cost is computed each time a purchase is made in the

A) average-cost method.

B) moving-average cost method.

C) weighted-average cost method.

D) all of these methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manager of Yates Company is given a bonus based on income before income taxes. Net income, after taxes, is $10,500 for FIFO and $9,450 for average-cost. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of average-cost?

A) $375

B) $563

C) $300

D) $1,050

Correct Answer

verified

Correct Answer

verified

Multiple Choice

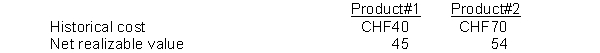

Carlsberg Corporation has 2,000 units of product#1and 4,000 units of product#2 in its inventory at December 31, 2014. Specific data with respect to each product follows:  What amount will be reported on the company statement of financial position at December 31, 2014 for ending inventory using lower-of-cost-or-net realizable value?

What amount will be reported on the company statement of financial position at December 31, 2014 for ending inventory using lower-of-cost-or-net realizable value?

A) CHF220,000.

B) CHF288,000.

C) CHF296,000.

D) CHF306,000.

Correct Answer

verified

Correct Answer

verified

Essay

In the first month of operations, Santos Company made three purchases of merchandise in the following sequence: (1) 200 units at $6, (2) 300 units at $7, and (3) 400 units at $8. Assuming there are 300 units on hand, compute the cost of the ending inventory under (1) the FIFO method and (2) the average-cost method. Santos uses a periodic inventory system.

Correct Answer

verified

Correct Answer

verified

Not Answered

It is generally recognized that a major objective of accounting for inventory is the proper determination of ______________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net realizable value refers to

A) the net amount the company expects to realize from the sale.

B) the selling price.

C) the cost to replace the item.

D) the gross profit realized from the sale.

Correct Answer

verified

Correct Answer

verified

Essay

Sauder Company reports goods available for sale at cost, $90,000. Beginning inventory at retail is $40,000 and goods purchased during the period at retail were $80,000. Sales for the period amounted to $96,000. Instructions Determine the estimated cost of the ending inventory using the retail inventory method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nolvo Company uses the periodic inventory system. For February 2014, the beginning inventory consisted of 400 units that cost CHF65 each. During the month, the company made two purchases: 1,600 units at CHF68 each and 600 units at CHF72 each. Nolvo sold 2,000 units during the month of February at CHF110 per unit. Using the average cost method, what is the amount of ending inventory at February 28, 2014?

A) CHF43,200.

B) CHF42,000.

C) CHF41,076.

D) CHF39,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased inventory as follows:  The average unit cost for inventory is

The average unit cost for inventory is

A) $5.00.

B) $5.50.

C) $5.60.

D) $6.00.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blosser Company's goods in transit at December 31 include: sales made purchases made (1) FOB destination (3) FOB destination (2) FOB shipping point (4) FOB shipping point Which items should be included in Blosser's inventory at December 31?

A) (2) and (3)

B) (1) and (4)

C) (1) and (3)

D) (2) and (4)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

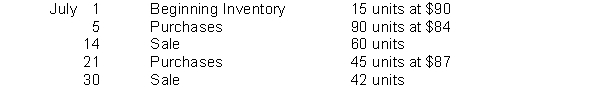

Julian Junkets has the following inventory information.  Assuming that a perpetual inventory system is used, what is the ending inventory (rounded) under the average-cost method?

Assuming that a perpetual inventory system is used, what is the ending inventory (rounded) under the average-cost method?

A) $4,125

B) $4,176

C) $3,609

D) $4,158

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturers usually classify inventory into all the following general categories except

A) work in process

B) finished goods

C) merchandise inventory

D) raw materials

Correct Answer

verified

Correct Answer

verified

Multiple Choice

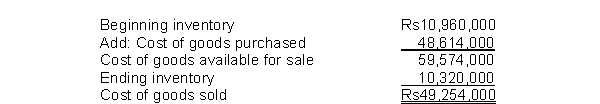

India Eastern Corporation's computation of cost of goods sold is:  The average days to sell inventory for India East is

The average days to sell inventory for India East is

A) 79.0 days.

B) 81.3 days.

C) 107.7 days.

D) 76.4 days.

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 257

Related Exams