A) a credit to Interest Payable of CHF100,000.

B) a debit to Mortgage Payable of CHF152,620.

C) a debit to Interest Expense of CHF252,620.

D) a credit to Cash of CHF152,620.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the statement of financial position, the account Interest Payable is

A) added to bonds payable.

B) deducted from bonds payable.

C) classified as a current liability.

D) classified as a revenue account.

Correct Answer

verified

Correct Answer

verified

True/False

Non-current liabilities are reported in a separate section of the statement of financial position immediately before current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market rate of interest for a bond issue which sells for more than its face value is

A) independent of the interest rate stated on the bond.

B) higher than the interest rate stated on the bond.

C) equal to the interest rate stated on the bond.

D) less than the interest rate stated on the bond.

Correct Answer

verified

Correct Answer

verified

True/False

A CHF10,000,000 bond with a quoted prices of 101 ¼ is sold for CHF10,250,000.

Correct Answer

verified

Correct Answer

verified

True/False

If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all periods prior to the bond maturity date.

Correct Answer

verified

Correct Answer

verified

Not Answered

The terms of a bond issue are set forth in a formal legal document called a bond ________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1, 2013, Pennington Company issued an €80,000, 10%, nine-month interest-bearing note. Assuming interest was accrued in June 30, 2014, the entry to record the payment of the note on July 1, 2014, will include a

A) debit to Interest Expense of €2,000.

B) credit to Cash of €80,000

C) debit to Interest Payable of €6,000.

D) debit to Notes Payable of €86,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the issuance of an interest-bearing note credits Notes Payable for the note's

A) maturity value.

B) market value.

C) face value.

D) cash realizable value.

Correct Answer

verified

Correct Answer

verified

Short Answer

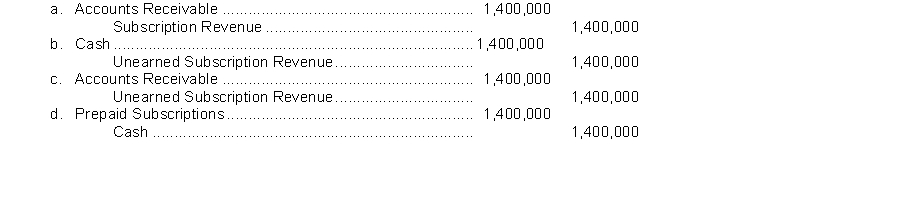

Ski Quarterly typically sells subscriptions on an annual basis, and publishes four times a year in January, April, July and October. The magazine sells 70,000 subscriptions in January at CHF20 each. What entry is made in January to record the sale of the subscriptions?

Correct Answer

verified

Correct Answer

verified

Essay

Banks Company is considering two alternatives to finance its purchase of a new $4,000,000 office building. (a) Issue 400,000 ordinary shares at $10 per share. (b) Issue 8%, 10-year bonds at par ($4,000,000). Income before interest and taxes is expected to be $3,000,000. The company has a 30% tax rate and has 800,000 ordinary shares outstanding prior to the new financing. Instructions Calculate each of the following for each alternative: (1) Net income. (2) Earnings per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In most companies, current liabilities are paid within

A) one year through the creation of other current liabilities.

B) the operating cycle through the creation of other current liabilities.

C) one year out of current assets.

D) the operating cycle out of current assets.

Correct Answer

verified

Correct Answer

verified

True/False

Interest expense on a note payable is only recorded at maturity.

Correct Answer

verified

Correct Answer

verified

Essay

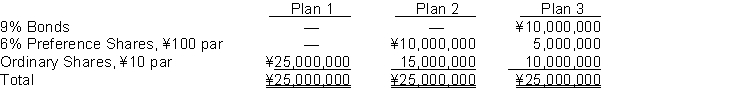

Three plans for financing a ¥25,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount and the income tax rate is estimated at 30%.  It is estimated that income before interest and taxes will be ¥5,000,000.

Instructions

Determine for each plan, the expected net income and the earnings per share.

It is estimated that income before interest and taxes will be ¥5,000,000.

Instructions

Determine for each plan, the expected net income and the earnings per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds that may be exchanged for ordinary shares at the bondholder's option are called

A) options.

B) stock bonds.

C) convertible bonds.

D) callable bonds.

Correct Answer

verified

Correct Answer

verified

Short Answer

On September 1, Joe's Painting Service borrows $250,000 from National Bank on a 4-month, $250,000, 6% note. What entry must Joe's Painting Service make on December 31 before financial statements are prepared?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation issues ¥1,000,000,000, 10%, 5-year bonds on January 1, 2014, for $958,000,000. Interest is paid annually on January 1. If the corporation uses the straight-line method of amortization of bond discount, the amount of bond interest expense to be recognized in December 31, 2014's adjusting entry is

A) ¥108,400,000.

B) ¥100,000,000.

C) ¥91,600,000.

D) ¥8,400,000.

Correct Answer

verified

Correct Answer

verified

True/False

If $150,000 face value bonds are issued at 103, the proceeds received will be $103,000.

Correct Answer

verified

Correct Answer

verified

Not Answered

Bonds that mature at a single specified future date are called _______________ bonds, whereas bonds that mature in installments are called ________________ bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

210. On January 1, Grogan Corporation issues $2,000,000, 5-year, 12% bonds at 96 with interest payable on July 1 and January 1. Grogan uses the straight-line amortization method The carrying value of the bonds at the end of the third interest period is

A) $1,944,000

B) $1,952,000

C) $1,888,000

D) $1,856,000

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 318

Related Exams