A) used solely for the calculation of federal income taxes

B) used to calculate Social Security and Medicare taxes

C) used to report withheld taxes to the IRS

D) used for income tax preparation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ACME package delivery pays employees for each package they deliver. Last week Josef delivered 20 packages. Find his gross weekly earnings if he is paid at the following differential piece rate.

A) $210.00

B) $166.25

C) $157.50

D) $140.00

Correct Answer

verified

Correct Answer

verified

True/False

An employee's overtime rate of pay is normally 1.2 times the regular hourly rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

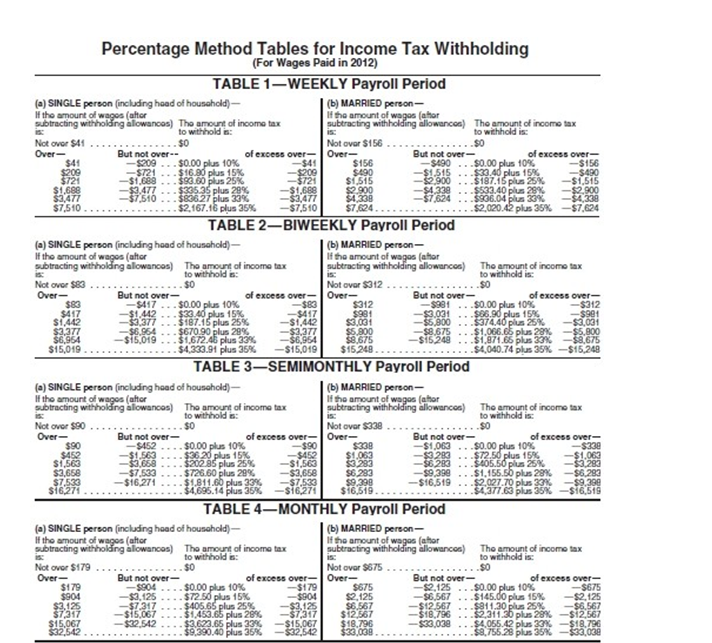

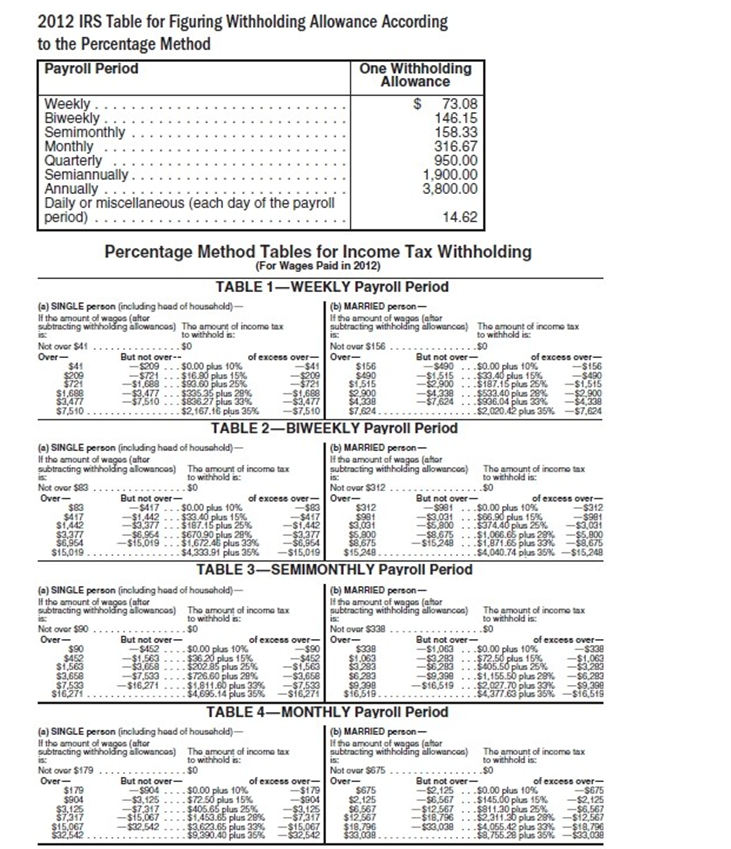

-Derek Daniels earns $22,312.15 monthly, is married, and claims 3 withholding allowances. Find his net earnings for this pay period. FICA tax is 4.2% and Medicare tax is 1.45%.

-Derek Daniels earns $22,312.15 monthly, is married, and claims 3 withholding allowances. Find his net earnings for this pay period. FICA tax is 4.2% and Medicare tax is 1.45%.

A) $17,409.90

B) $21,051.51

C) $16,149.26

D) $25,953.76

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Henry Daniels earns $2709 biweekly. He is single and claims 3 withholding allowances. He saves 2% of his salary for retirement and pays $24.50 in nonexempt insurance premiums each pay period. What are his net earnings for each pay period?

-Henry Daniels earns $2709 biweekly. He is single and claims 3 withholding allowances. He saves 2% of his salary for retirement and pays $24.50 in nonexempt insurance premiums each pay period. What are his net earnings for each pay period?

A) $2871.55

B) $2630.32

C) $2236.03

D) $2082.97

Correct Answer

verified

Correct Answer

verified

True/False

A wage is normally stated as a fixed amount of money paid each year to an employee.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jen's Cycle Shop performs maintenance on and sells bicycles and has eight employees who are paid weekly. For one payroll period the withholding tax for all employees was $1762. The total Social Security tax withheld from employees' paychecks was $1063, the employer's share of Social Security tax was $1657, and the total Medicare tax withheld was $367. What is the total tax that must be deposited by Jen?

A) Employer's tax deposit = $4849

B) Employer's tax deposit = $4153

C) Employer's tax deposit = $3786

D) Employer's tax deposit = $5216

Correct Answer

verified

Correct Answer

verified

True/False

The amount of your earnings remaining after all deductions is called gross pay.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A quota can be best defined as:

A) another term for salary

B) earnings based on sales

C) a minimum amount of sales that is required before a commission is applicable

D) a formula which determines earnings

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sybille worked 45 hours in one week. She earns $10.00 per hour with time and a half for overtime. Find her gross earnings for the week.

A) $100

B) $400

C) $450

D) $475

Correct Answer

verified

Correct Answer

verified

True/False

There are two methods, the wage bracket tables and the percentage, for calculating the amount of federal income tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

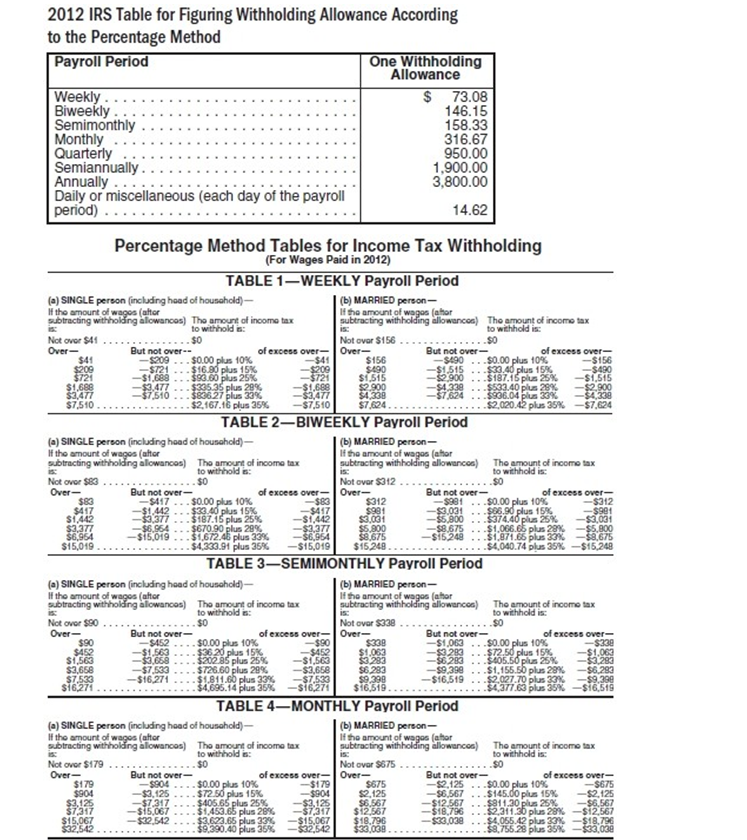

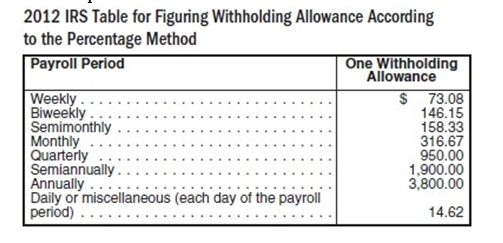

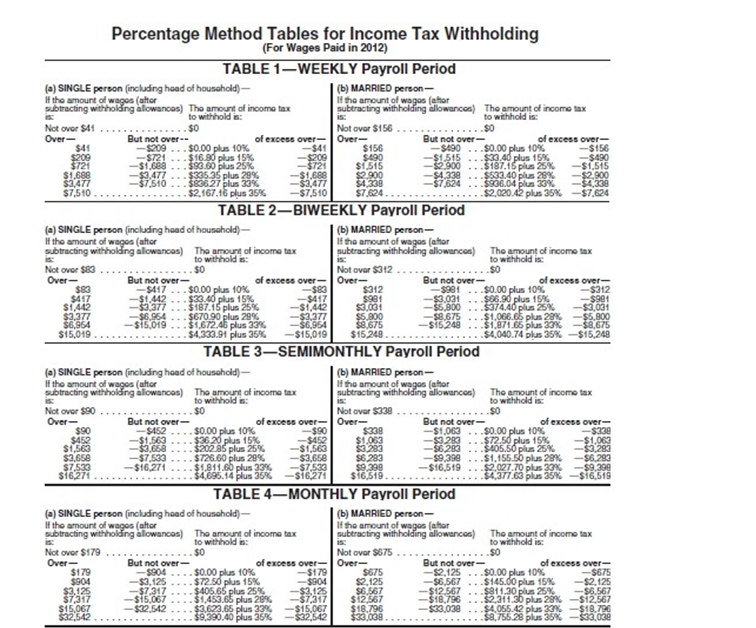

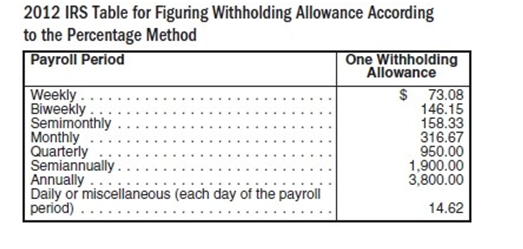

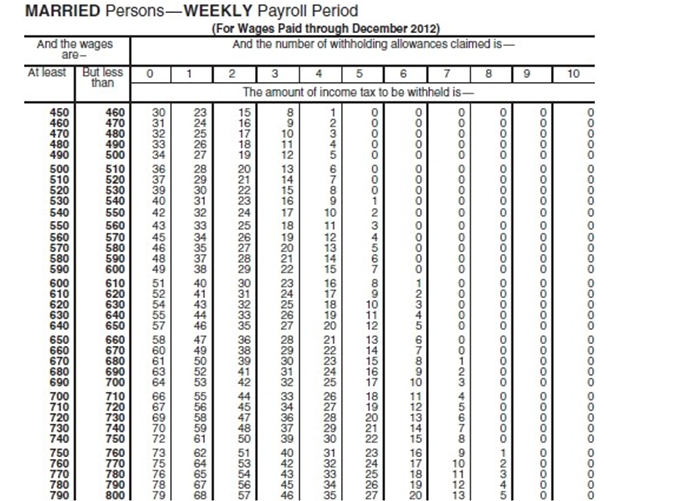

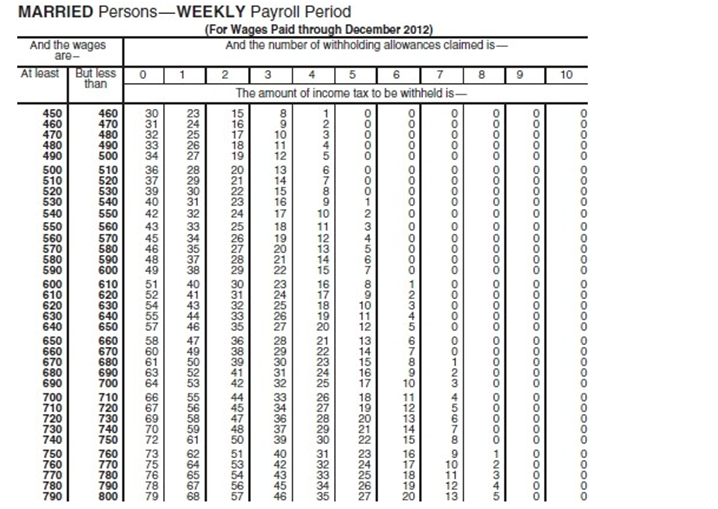

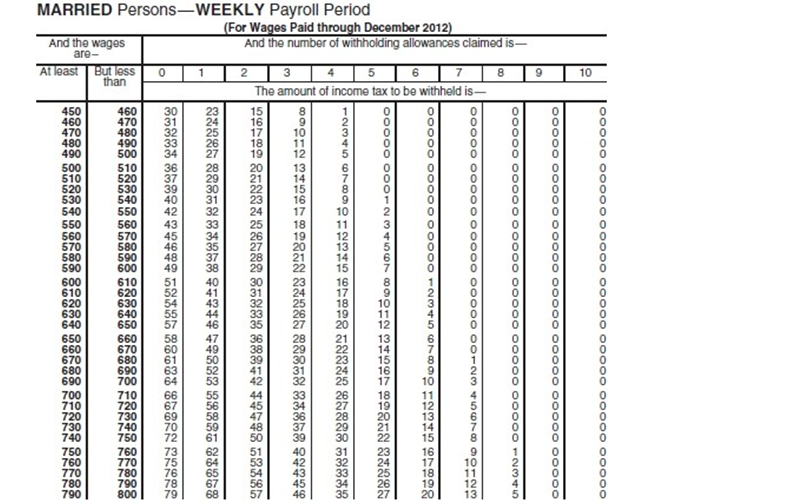

-Eric Yang earns $603.16 weekly, is married, and claims 3 withholding allowances. Find his net earnings for this pay period. FICA tax is 4.2% and Medicare tax is 1.45%.

-Eric Yang earns $603.16 weekly, is married, and claims 3 withholding allowances. Find his net earnings for this pay period. FICA tax is 4.2% and Medicare tax is 1.45%.

A) $591.87

B) $580.37

C) $569.08

D) $546.29

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Hassan Katragadda is married, has a gross weekly salary of $738.74 (all of which is taxable) , and claims 5 withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from his weekly salary.

-Hassan Katragadda is married, has a gross weekly salary of $738.74 (all of which is taxable) , and claims 5 withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from his weekly salary.

A) $20

B) $21

C) $19

D) $29

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Sun Chin earns a monthly salary of $6312.15 with no adjustments to income. She is single and claims 3 withholding allowances. Find the federal tax withholding to be deducted from her monthly paycheck using the percentage method tables.

-Sun Chin earns a monthly salary of $6312.15 with no adjustments to income. She is single and claims 3 withholding allowances. Find the federal tax withholding to be deducted from her monthly paycheck using the percentage method tables.

A) $1983.69

B) $964.94

C) $1746.19

D) $1202.44

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Steve Nyren is paid on a salary-plus-commission basis. He receives $488 weekly in salary and a commission based on 1.1% of all weekly sales over $15,000. If he sold $23,700 in merchandise in one week, find his gross earnings for the week.

A) $1445.00

B) $95.70

C) $583.70

D) $748.70

Correct Answer

verified

Correct Answer

verified

True/False

The amount of taxes withheld from your paycheck can be reduced by increasing the number of exemptions claimed on form W-2.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable) , and the number of withholding allowances she claims is 1. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary.

-Ann Preston is married, has a gross weekly salary of $543.74 (all of which is taxable) , and the number of withholding allowances she claims is 1. Use the tax tables to find the federal tax withholding to be deducted from her weekly salary.

A) $30

B) $31

C) $33

D) $32

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Peter Gabanyic is married, has a gross weekly salary of $683.21 (all of which is taxable) , and claims 4 withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from his weekly salary.

-Peter Gabanyic is married, has a gross weekly salary of $683.21 (all of which is taxable) , and claims 4 withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from his weekly salary.

A) $23

B) $24

C) $25

D) $22

Correct Answer

verified

Correct Answer

verified

True/False

The amount of Social Security tax and Medicare tax can change from year to year.

Correct Answer

verified

Correct Answer

verified

True/False

A pay system based on a percent of total dollar sales made is called an hourly rate.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 102

Related Exams