A) GDP.

B) the price level.

C) the interest rate.

D) nominal output.

Correct Answer

verified

Correct Answer

verified

True/False

In the short run, changes in the money supply change the interest rate, but in the long run, changes in the money supply have no effect on interest rates.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario: Money and Interest Rates Banks decide to do away with fees charged when other banks' customers use the bank's own ATM. The demand for money will _____, and the supply of money will _____.

A) increase; not change

B) increase; decrease

C) decrease; not change

D) decrease; increase

Correct Answer

verified

Correct Answer

verified

Multiple Choice

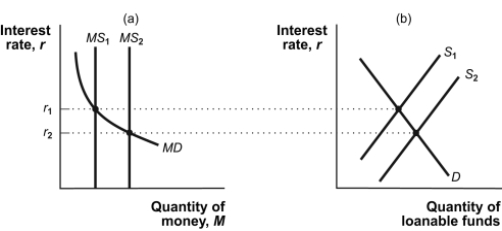

Use the following to answer questions:

Figure: Short-Run Determination of the Interest Rate  -(Figure: Short-Run Determination of the Interest Rate) Refer to Figure: Short-Run Determination of the Interest Rate. If the money supply is at MS1 and the central bank buys Treasury bills, then the resulting short-run shift in the supply of savings (loanable funds) may be represented by a shift of the:

-(Figure: Short-Run Determination of the Interest Rate) Refer to Figure: Short-Run Determination of the Interest Rate. If the money supply is at MS1 and the central bank buys Treasury bills, then the resulting short-run shift in the supply of savings (loanable funds) may be represented by a shift of the:

A) money supply curve to MS2, which raises the interest rate.

B) supply of loanable funds from S1 to S2, which lowers the interest rate.

C) supply of loanable funds from S2 to S1, which raises the interest rate.

D) interest rate from r2 to r1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Congress imposes a $5 tax on each ATM transaction, the demand for money will likely:

A) increase.

B) decrease.

C) fluctuate randomly.

D) be unaffected.

Correct Answer

verified

Correct Answer

verified

True/False

If the money supply decreases by 10%, the aggregate price level will remain constant in the long run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is at potential output and the Fed increases the money supply, in the short run interest rates will likely:

A) increase.

B) decrease.

C) remain constant.

D) fluctuate randomly.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Open Market Committee sets the target interest rate for the next:

A) three months.

B) six months.

C) three weeks.

D) six weeks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given a recessionary gap, the Federal Reserve will use monetary policy to _____ real GDP and _____ aggregate demand.

A) increase; increase

B) increase; decrease

C) decrease; increase

D) decrease; decrease

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Expansionary monetary policy causes _____ in interest rates in the short run and _____ in interest rates in the long run.

A) a fall; no change

B) a fall; a fall

C) no change; a fall

D) no change; no change

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the income-expenditure model, contractionary monetary policy leads to _____ interest rates, a(n) _____ in planned investment spending, and a(n) _____ in equilibrium GDP.

A) lower; increase; increase

B) lower; decrease; decrease

C) higher; increase; increase

D) higher; decrease; decrease

Correct Answer

verified

Correct Answer

verified

True/False

International data for 1970-2015 show that monetary neutrality occurs only in wealthy countries.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The demand for money is higher in Japan than in the United States because:

A) telecommunications and information technology is more advanced in the United States than in Japan.

B) Japanese consumers use credit cards more than people in the United States.

C) Japanese interest rates are higher than those in the United States.

D) Japanese interest rates are lower than those in the United States.

Correct Answer

verified

Correct Answer

verified

True/False

The appropriate monetary policy to stabilize the economy during a recession is an expansionary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement describes the difference between the Taylor rule and inflation targeting?

A) The Federal Reserve uses inflation targeting, and the Bank of England uses the Taylor rule.

B) The Taylor rule responds to past inflation, and inflation targeting is based on a forecast of inflation.

C) Inflation targeting responds to past inflation, and the Taylor rule is based on a forecast of inflation.

D) Inflation targeting is used in conducting fiscal policy, while the Taylor rule is used in monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money demand curve is _____ because a lower interest rate _____ the opportunity cost of holding money.

A) upward sloping; increases

B) downward sloping; increases

C) upward sloping; decreases

D) downward sloping; decreases

Correct Answer

verified

Correct Answer

verified

True/False

In the long run, changes in the money supply change prices but not real output and interest rates.

Correct Answer

verified

Correct Answer

verified

True/False

The interest rate is determined in the loanable funds market in the short run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

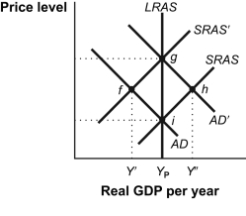

Use the following to answer questions:

Figure: Monetary Policy and the AD-SRAS Model  -(Figure: Monetary Policy and the AD-SRAS Model) Refer to Figure: Monetary Policy and the AD-SRAS Model. The economy could move from point g to point f as a result of:

-(Figure: Monetary Policy and the AD-SRAS Model) Refer to Figure: Monetary Policy and the AD-SRAS Model. The economy could move from point g to point f as a result of:

A) an increase in the money supply.

B) a reduction in the discount rate.

C) a decrease in the money supply.

D) purchases of government securities in the open market.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the loanable funds model, in the short run, expansionary monetary policy:

A) increases the supply of loanable funds.

B) increases the demand for loanable funds.

C) increases the quantity of loanable funds supplied.

D) has no effect on the supply of loanable funds.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 316

Related Exams