A) $2,314.07

B) $2,018.50

C) $2,428.32

D) $2,491.74

E) $2,066.67

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Today, Sweet Snacks is investing $491,000 in a new oven.As a result, the company expects its cash flows to increase by $64,000 a year for the next two years and by $98,000 a year for the following three years.How long must the firm wait until it recovers all of its initial investment?

A) 3.97 years

B) 4.18 years

C) 4.46 years

D) 4.70 years

E) The project never pays back.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) A longer payback period is preferred over a shorter payback period.

B) The payback rule states that you should accept a project if the payback period is less than one year.

C) The payback period ignores the time value of money.

D) The payback rule is biased in favor of long-term projects.

E) The payback period considers the timing and amount of all of a project's cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net present value involves discounting an investment's:

A) assets.

B) future profits.

C) liabilities.

D) costs.

E) future cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates that a project is expected to create value for its owners?

A) Profitability index less than 1.0

B) Payback period greater than the requirement

C) Positive net present value

D) Positive average accounting rate of return

E) Internal rate of return that is less than the requirement

Correct Answer

verified

Correct Answer

verified

Multiple Choice

EKG, Inc.is considering a new project that will require an initial cash investment of $419,000.The project will produce no cash flows for the first two years.The projected cash flows for Years 3 through 7 are $69,000, $98,000, $109,000, $145,000, and $165,000, respectively.How long will it take the firm to recover its initial investment in this project?

A) 3.81 years

B) 3.98 years

C) 5.57 years

D) 5.99 years

E) The project never pays back.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal rate of return is unreliable as an indicator of whether or not an investment should be accepted given which one of the following?

A) One of the time periods within the investment period has a cash flow equal to zero.

B) The initial cash flow is negative.

C) The investment has cash inflows that occur after the required payback period.

D) The investment is mutually exclusive with another investment of a different size.

E) The cash flows are conventional.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

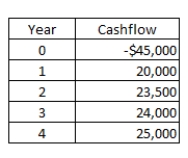

What is the net present value of the following cash flows if the relevant discount rate is 11.4 percent?

A) $4,887.26

B) $5,006.19

C) $8,215.46

D) $13,058.39

E) $18,519.71

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering the following two mutually exclusive projects.The required return on each project is 12 percent.Which project should you accept and what is the best reason for that decision?

A) Project A, because it pays back faster

B) Project A, because it has the higher internal rate of return

C) Project B, because it has the higher internal rate of return

D) Project A, because it has the higher net present value

E) Project B, because it has the higher net present value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of a project that has an initial cost of $40,000 and produces cash inflows of $ 8,500 a year for 10 years if the discount rate is 13 percent?

A) $ 4,678.09

B) $ 6,500.00

C) $ 6,123.07

D) $ 7,189.34

E) $ 6,712.03

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net present value of an investment represents the difference between the investment's:

A) cash inflows and outflows.

B) cost and its net profit.

C) cost and its market value.

D) cash flows and its profits.

E) assets and liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Nifty Fifty is considering opening a new store at a start-up cost of $628,000.The initial investment will be depreciated straight-line to zero over the 15-year life of the project.What is the average accounting rate of return given the following net income projections?

A) 16.42 percent

B) 16.68 percent

C) 17.01 percent

D) 17.18 percent

E) 16.35 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is specifically designed to compute the rate of return on a project that has a multiple negative cash flows that are interrupted by one or more positive cash flows?

A) Average accounting return

B) Profitability index

C) Internal rate of return

D) Indexed rate of return

E) Modified internal rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment has an initial cost of $462,000 and will generate the net income amounts shown below.This investment will be depreciated straight-line to zero over the four-year life of the project.Should this project be accepted based on the average accounting rate of return if the required rate is 14.75 percent? Why or why not?

A) Yes, because the AAR is equal to 14.75 percent

B) Yes, because the AAR is greater than 14.75 percent

C) Yes, because the AAR is less than 14.75 percent

D) No, because the AAR is greater than 14.75 percent

E) No, because the AAR is less than 14.75 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net present value of a project that has an initial cost of $25,000 and produces cash inflows of $ 5,500 a year for 8 years if the discount rate is 7 percent?

A) $ 3,635.04

B) $ 6,500.00

C) $ 7,842.14

D) $ 6,189.34

E) $ 5,712.03

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following indicates that a project should be rejected? Assume the cash flows are normal, i.e., the initial cash flow is negative.

A) Average accounting return that exceeds the requirement

B) Payback period that is shorter than the requirement period

C) Positive net present value

D) Profitability index less than 1.0

E) Internal rate of return that exceeds the required return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has the following cash flows.What is the payback period?

A) 1.72 years

B) 1.83 years

C) 2.06 years

D) 2.33years

E) 2.65 years

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Woodcrafters requires an average accounting return (AAR) of at least 17.5 percent on all fixed asset purchases.Currently, it is considering some new equipment costing $169,700.This equipment will have a four-year life over which time it will be depreciated on a straight-line basis to a zero book value.The annual net income from this equipment is estimated at $7,100, $13,300, $18,600, and $19,200 for the four years.Should this purchase occur based on the accounting rate of return? Why or why not?

A) Yes; because the AAR is less than 17.5 percent

B) Yes; because the AAR is equal to 17.5 percent

C) Yes; because the AAR is greater than 17.5 percent

D) No; because the AAR is less than 17.5 percent

E) No; because the AAR is greater than 17.5 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm is reviewing a project that has an initial cost of $67,000.The project will produce annual cash inflows, starting with Year 1, of $8,000, $13,400, $18,600, $24,100, and finally in Year 5, $37,900.What is the profitability index if the discount rate is 11 percent?

A) .92

B) .98

C) 1.02

D) 1.05

E) 1.09

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is generally considered to be the best form of analysis if you have to select a single method to analyze a variety of investment opportunities?

A) Payback

B) Profitability index

C) Accounting rate of return

D) Internal rate of return

E) Net present value

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 116

Related Exams