A) 9.44 percent

B) 11.3 percent

C) 10.69 percent

D) 9.2 percent

E) 8.78 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has a beta of 1.32 and an expected return of 12.8 percent.The risk-free rate is 3.6 percent.What is the slope of the security market line?

A) 6.49 percent

B) 7.28 percent

C) 6.97 percent

D) 9.03 percent

E) 7.99 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has a beta of 1.10, an expected return of 12.11 percent, and lies on the security market line.A risk-free asset is yielding 3.2 percent.You want to create a portfolio valued at $12,000 consisting of Stock A and the risk-free security such that the portfolio beta is .80.What rate of return should you expect to earn on your portfolio?

A) 9.68 percent

B) 9.16 percent

C) 9.33 percent

D) 9.41 percent

E) 9.56 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock Y has a beta of 1.28 and an expected return of 13.7 percent.Stock Z has a beta of 1.02 and an expected return of 11.4 percent.What would the risk-free rate have to be for the two stocks to be correctly priced relative to each other?

A) 2.38 percent

B) 2.76 percent

C) 3.23 percent

D) 3.69 percent

E) 4.08 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard deviation measures _____ risk while beta measures _____ risk.

A) systematic; unsystematic

B) unsystematic; systematic

C) total; unsystematic

D) total; systematic

E) asset-specific; market

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has an expected return of 14.4 percent and a beta of 1.21.Stock B has an expected return of 12.87 percent and a beta of 1.06.Both stocks have the same reward-to-risk ratio.What is the risk-free rate?

A) 2.06 percent

B) 2.28 percent

C) 1.79 percent

D) 3.35 percent

E) 1.92 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southern Wear stock has an expected return of 15.1 percent.The stock is expected to lose 8 percent in a recession and earn 18 percent in a boom.The probabilities of a recession, a normal economy, and a boom are 2 percent, 87 percent, and 11 percent, respectively.What is the expected return on this stock if the economy is normal?

A) 14.79 percent

B) 17.04 percent

C) 15.26 percent

D) 16.43 percent

E) 11.08 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a portfolio that is invested as follows: $22,575 of Stock A, $3,750 of Stock B, $12,500 of Stock C, and $5,800 of Stock D. What is the portfolio weight of Stock B?

A) 8.47 percent

B) 8.40 percent

C) 10.96 percent

D) 9.66 percent

E) 13.08 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following represents the amount of compensation an investor should expect to receive for accepting the unsystematic risk associated with an individual security?

A) Security beta multiplied by the market rate of return

B) Market risk premium

C) Security beta multiplied by the market risk premium

D) Risk-free rate of return

E) Zero

Correct Answer

verified

Correct Answer

verified

Multiple Choice

World United stock currently plots on the security market line and has a beta of 1.04.Which one of the following will increase that stock's rate of return without affecting the risk level of the stock, all else constant?

A) An increase in the risk-free rate

B) Decrease in the security's beta

C) Overpricing of the stock in the marketplace

D) Increase in the market risk-to-reward ratio

E) Decrease in the market rate of return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

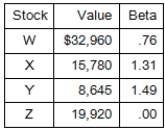

What is the beta of the following portfolio?

A) .98

B) .76

C) 1.18

D) 1.21

E) 1.13

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.09 while Stock B has a beta of .76 and an expected return of 8.2 percent.What is the expected return on Stock A if the risk-free rate is 4.6 percent and both stocks have equal reward-to-risk premiums?

A) 11.12 percent

B) 8.07 percent

C) 9.76 percent

D) 10.89 percent

E) 11.73 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk premium for an individual security is based on which one of the following types of risk?

A) Total

B) Surprise

C) Diversifiable

D) Systematic

E) Unsystematic

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a security plots to the right and below the security market line, then the security has ____ systematic risk than the market and is ____.

A) more; overpriced

B) more; underpriced

C) less; overpriced

D) less; underpriced

E) less; correctly priced

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversifying a portfolio across various sectors and industries might do more than one of the following.However, this diversification must do which one of the following?

A) Increase the expected risk premium

B) Reduce the beta of the portfolio to one

C) Increase the security's risk premium

D) Reduce the portfolio's systematic risk level

E) Reduce the portfolio's unique risks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the economy has an 18 percent chance of booming, a 3 percent chance of being recessionary, and being normal the remainder of the time.A stock is expected to return 16.8 percent in a boom, 12.9 percent in a normal economy, and -4.5 percent in a recession.What is the expected rate of return on this stock?

A) 7.98 percent

B) 8.63 percent

C) 9.17 percent

D) 13.08 percent

E) 10.68 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

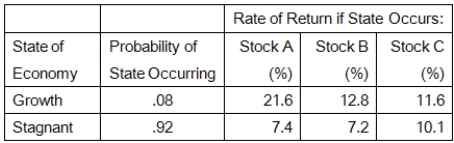

Given the following information, what is the standard deviation of the returns on a portfolio that is invested 35 percent in both Stocks A and C, and 30 percent in Stock B?

A) 1.95 percent

B) 1.13 percent

C) 3.67 percent

D) 2.91 percent

E) 2.36 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio is:

A) a single risky security.

B) any security that is equally as risky as the overall market.

C) any new issue of stock.

D) a group of assets held by an investor.

E) an investment in a risk-free security.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio has an expected return of 13.4 percent.This portfolio contains two stocks and one risk-free security.The expected return on Stock X is 12.2 percent and on Stock Y it is 19.3 percent.The risk-free rate is 4.1 percent.The portfolio value is $48,000 of which $10,000 is the risk-free security.How much is invested in Stock X?

A) $21,548.19

B) $19,514.14

C) $18,478.87

D) $22,200.14

E) $16,904.72

Correct Answer

verified

Correct Answer

verified

Showing 81 - 99 of 99

Related Exams