A) Initial cost increases.

B) Required return for a project increases.

C) Assigned discount rate decreases.

D) Cash inflows are moved forward in time.

E) Duration of a project is lengthened.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

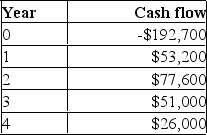

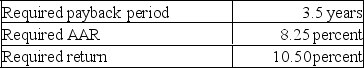

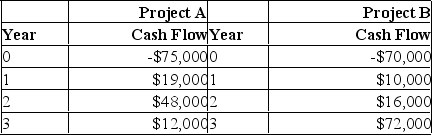

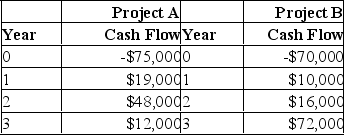

You are analyzing a project and have prepared the following data:

Based on the payback period of _____ years for this project, you should _____ the project.

Based on the payback period of _____ years for this project, you should _____ the project.

A) 3.27; accept

B) 3.27; reject

C) 3.42; accept

D) 3.42; reject

E) 3.51; reject

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following decision rules is best for evaluating projects for which cash flows beyond a specified point in time, and the time value of money, can both be ignored?

A) Payback.

B) Net present value.

C) Average accounting return.

D) Profitability index.

E) Internal rate of return.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project will produce cash inflows of $3,650 a year for four years. The start-up costs are $15,000. In year five, the project will be closed and as a result should produce a cash inflow of $7,500. What is the net present value of this project if the required rate of return is 11.5 %?

A) $487.82

B) $501.09

C) $533.23

D) $556.07

E) $608.18

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Payback is frequently used to analyze independent projects because:

A) It considers the time value of money.

B) All relevant cash flows are included in the analysis.

C) The cost of the analysis is less than the potential loss from a faulty decision.

D) It is the most desirable of all the available analytical methods from a financial perspective.

E) It produces better decisions than those made using either NPV or IRR.

Correct Answer

verified

Correct Answer

verified

Short Answer

Draw a graph that illustrates two mutually exclusive investments, A and B, with a crossover rate of return equal to 10%, and with A having the higher NPV at a discount rate of zero %. Explain the graph, including under which conditions project A or project B would be chosen using NPV and then using IRR.

Correct Answer

verified

The student should replicate Figure 9.7.

Correct Answer

verified

Multiple Choice

The discounted payback rule may cause:

A) Some positive net present value projects to be rejected.

B) The most liquid projects to be rejected in favor of less liquid projects.

C) Projects to be incorrectly accepted due to ignoring the time value of money.

D) Projects with negative net present values to be accepted.

E) Some projects to be accepted which would otherwise be rejected under the payback rule.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal rate of return should:

A) Not be used for ranking mutually exclusive projects.

B) Only be applied to small projects.

C) Be relied upon more heavily than the net present value.

D) Always result in the same decision as discounted payback.

E) Lead to correct decisions when comparing mutually exclusive projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

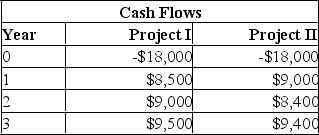

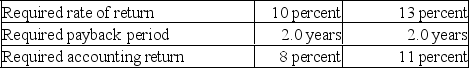

The Commodore Co. is trying to decide between the following two mutually exclusive projects:  The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

A) Both projects should be accepted because their payback periods are only about 2 years.

B) Both projects should be accepted because they have IRRs of 22.87% and 28.45%, which exceed the 11% requirement.

C) Both projects should be accepted because they both have positive NPVs.

D) Project I should be accepted because it has an NPV of $3,908.58. Project II cannot also be accepted.

E) Project II should be accepted because it has an IRR of 28.45%, which is greater than Project I's IRR.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm uses the _____________ as an investment criterion, one of the risks it takes is that it may ignore some future cash flows.

A) AAR

B) NPV

C) IRR

D) Profitability. index

E) Payback rule

Correct Answer

verified

Correct Answer

verified

Multiple Choice

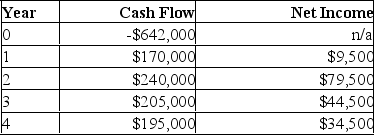

Martin is analyzing a project and has gathered the following data. Based on this data, what is the average accounting rate of return? The firm depreciates its assets using straight-line depreciation to a zero book value over the life of the asset.

A) 13.08 %

B) 15.77 %

C) 21.83 %

D) 26.17 %

E) 31.54 %

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The length of time required for an investment to generate cash flows sufficient to recover the initial cost of the investment is called the:

A) Net present value.

B) Internal rate of return.

C) Payback period.

D) Profitability index.

E) Discounted cash period.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

An advantage of the payback method is its:

A) Time value of money considerations.

B) Application of readily available accounting data.

C) Cut-off point.

D) Long-term perspective.

E) Simplicity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

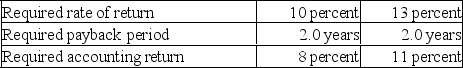

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

Based upon the internal rate of return (IRR) and the information provided in the problem, you should:

A) accept both project A and project B.

B) reject both project A and project B.

C) accept project A and reject project B.

D) accept project B and reject project A.

E) Ignore the IRR rule and use another method of analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based upon the payback period and the information provided in the problem, you should:

Based upon the payback period and the information provided in the problem, you should:

A) Accept both project A and project B.

B) Reject both project A and project B.

C) Accept project A and reject project B.

D) Accept project B and reject project A.

E) Require that management extend the payback period for project A since it has a higher initial cost.

Correct Answer

verified

Correct Answer

verified

True/False

AAR and payback use an arbitrary cutoff number in their decision rules.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an initial investment of $10,000, with $3,500 annual inflows for each of the subsequent four years. If the required return is 15%, what is the NPV?

A) ($435.26)

B) ($32.48)

C) ($7.58)

D) $4.63

E) $5.49

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project is expected to produce cash inflows of $6,500 for three years. What is the maximum amount that can be spent on costs to initiate this project and still consider the project as acceptable, given an 11% discount rate?

A) $15,884.15

B) $15,897.97

C) $15,900.00

D) $15,967.39

E) $19,500.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corey is considering two projects both of which have an initial cost of $20,000 and total cash inflows of $25,000. The cash inflows of project A are $3,000, $5,000, $8,000, and $9,000 over the next four years, respectively. The cash inflows for project B are $9,000, $8,000, $5,000, and $3,000 over the next four years, respectively. Which one of the following statements is correct if Corey requires a 10 % rate of return and has a required discounted payback period of 3 years?

A) Both projects should be accepted.

B) Both projects should be rejected.

C) Project A should be accepted and project B should be rejected.

D) Project A should be rejected and project B should be accepted.

E) You should be indifferent to accepting either or both projects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an initial cash outlay of $29,500. Cash inflows are estimated at $1,200, $6,900, $7,800, $9,500, and $4,800 for years 1 through 5, respectively. What is the net present value of this project given a 7% discount rate?

A) ($5,677.15)

B) ($5,314.82)

C) ($2,618.03)

D) $700.00

E) $1,806.33

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 415

Related Exams