A) higher prices for the products of corporations as well as higher prices for the products of partnerships and proprietorships.

B) lower prices for the products of corporations as well as lower prices for the products of partnerships and proprietorships.

C) higher prices for the products of corporations and lower prices for the products of partnerships and proprietorships.

D) lower prices for the products of corporations and higher prices for the products of partnerships and proprietorships.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The voting paradox is an example of the

A) impossibility theorem.

B) the Coase theorem.

C) Tiebout hypothesis.

D) free-rider problem.

Correct Answer

verified

Correct Answer

verified

True/False

Consumption is a flow measure.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After subtracting all deductions and exemptions from total income, you are left with

A) taxable income.

B) marginal income.

C) standardized income.

D) the tax base.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess burden of a tax is $5,000 and the tax revenue from this tax is $20,000. The total burden of this tax is

A) $4,000.

B) $5,000.

C) $15,000.

D) $25,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ principle of taxation is not often used because it is difficult to determine the values individual taxpayers place on goods and services that are produced using tax revenue.

A) vertical equity

B) ability-to-pay

C) benefits-received

D) horizontal equity

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2016, Tony's assets equal $300,000 and his net worth is $50,000. Tony's liabilities are

A) $50,000.

B) $150,000.

C) $200,000.

D) $250,000.

Correct Answer

verified

Correct Answer

verified

True/False

A retail sales tax is a proportional tax with respect to income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family that earns $20,000 a year pays $200 a year in city wage taxes. A family that earns $40,000 a year pays $1,600 a year in city wage taxes. The city wage tax is

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During 2016, Victorʹs consumption equals $30,000 and the change in his net worth is -$5,000. Victorʹs economic income for 2013 is

A) $5,000.

B) $25,000.

C) $30,000.

D) $35,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

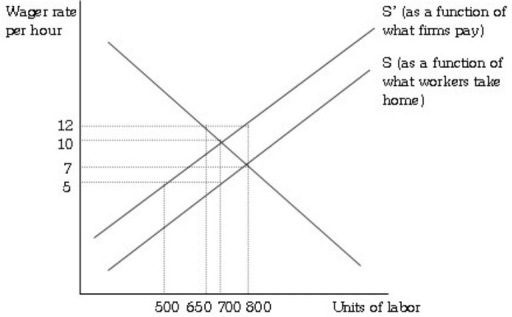

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1

-Refer to Figure 19.1. After firms can respond to the payroll tax, employment will be

Figure 19.1

-Refer to Figure 19.1. After firms can respond to the payroll tax, employment will be

A) 500.

B) 650.

C) 700.

D) 800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own stock that increases in value by $3,000 but you do not cash in the stock. The $3,000 is

A) counted as part of economic income but not part of taxable income.

B) counted as both economic and taxable income.

C) counted as taxable income but not economic income.

D) counted as neither taxable nor economic income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A theory of taxation that states that ________ is the ability-to-pay principle.

A) citizens should bear tax burdens in line with their ability to pay taxes

B) taxpayers should contribute to the government in proportion to the benefits they receive from public expenditures

C) taxpayers should contribute to the government in a greater proportion than the benefits they receive from public expenditures

D) taxpayers should contribute to the government in a smaller proportion than the benefits they receive from public expenditures

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ argued for a tax on consumption instead of on income because the standard of living depends not on income, but on how much is consumed.

A) Thomas Hobbes

B) John Rawls

C) Irving Fisher

D) Ben Bernanke

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information provided in Table 19.8 below to answer the question(s) that follow. Table 19.8 -Related to the Economics in Practice on page 393: Refer to Table 19.8. If income increases from $20,000 to $40,000, the marginal tax rate is

A) 2%.

B) 12%.

C) 14%.

D) indeterminate from this information.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is caused by the fact that taxes distort economic decisions.

A) Neutrality

B) Excess burden

C) Tax shifting

D) Market failure

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that both the corporate and noncorporate sectors are in long-run equilibrium before the imposition of a corporate profits tax. In the short run, the imposition of a corporate profits tax will

A) decrease profits in both the corporate and noncorporate sectors.

B) not change profits in either the corporate or the noncorporate sector.

C) not change profits in the noncorporate sector, but decrease profits in the corporate sector.

D) not change profits in the corporate sector, but increase profits in the noncorporate sector.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payroll tax is imposed on two types of labor: carpenters and laborers. In the short run, the elasticity of labor supply of carpenters is much less elastic than the elasticity of labor supply of laborers. Which of the following is true?

A) In the short run, carpenters will bear a larger share of the payroll tax than laborers.

B) In the short run, laborers will bear a larger share of the payroll tax than carpenters.

C) In the short run, carpenters and laborers will bear the same share of the payroll tax, but in the long run, laborers will bear a larger share of the payroll tax than carpenters.

D) There is not enough information to determine the relative shares of the payroll tax for carpenters and laborers in either the short run or the long run.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vertical equity holds that

A) those with equal ability to pay should bear equal tax burdens.

B) those who benefit the most from governmental services should bear the higher tax burden.

C) those with greater ability to pay should pay more.

D) those with equal ability to pay should bear unequal tax burdens.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the average tax rate is less than the marginal tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 281

Related Exams