A) Only portfolio A cannot lie on the efficient frontier.

B) Only portfolio B cannot lie on the efficient frontier.

C) Only portfolio C cannot lie on the efficient frontier.

D) Only portfolio D cannot lie on the efficient frontier.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an investment opportunity set formed with two securities that are perfectly negatively correlated.The global-minimum variance portfolio has a standard deviation that is always

A) greater than zero.

B) equal to zero.

C) equal to the sum of the securities' standard deviations.

D) equal to -1.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

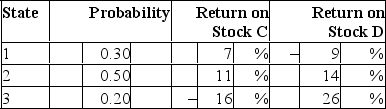

Consider the following probability distribution for stocks C and D:  The expected rates of return of stocks C and D are _____ and _____, respectively.

The expected rates of return of stocks C and D are _____ and _____, respectively.

A) 4.4%; 9.5%

B) 9.5%; 4.4%

C) 6.3%; 8.7%

D) 8.7%; 6.2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The individual investor's optimal portfolio is designated by

A) the point of tangency with the indifference curve and the capital allocation line.

B) the point of highest reward to variability ratio in the opportunity set.

C) the point of tangency with the opportunity set and the capital allocation line.

D) the point of the highest reward to variability ratio in the indifference curve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversifiable risk is also referred to as

A) systematic risk or unique risk.

B) systematic risk or market risk.

C) unique risk or market risk.

D) unique risk or firm-specific risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

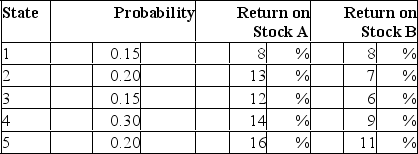

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

A) 13.2%; 9%

B) 13%; 8.4%

C) 13.2%; 7.7%

D) 7.7%; 13.2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

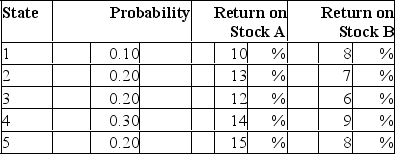

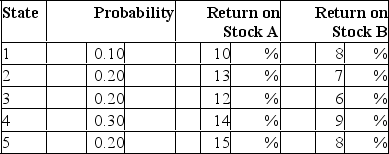

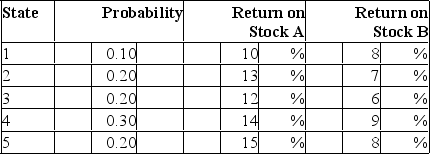

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

A) 13.2%; 9%

B) 14%; 10%

C) 13.2%; 7.7%

D) 7.7%; 13.2%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk that can be diversified away is

A) firm-specific risk.

B) beta.

C) systematic risk.

D) market risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following probability distribution for stocks A and B:  The variances of stocks A and B are _____ and _____, respectively.

The variances of stocks A and B are _____ and _____, respectively.

A) 1.5%; 1.9%

B) 2.2%; 1.2%

C) 3.2%; 2.0%

D) 1.5%; 1.1%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The efficient frontier of risky assets is

A) the portion of the investment opportunity set that lies above the global minimum variance portfolio.

B) the portion of the investment opportunity set that represents the highest standard deviations.

C) the portion of the investment opportunity set that includes the portfolios with the lowest standard deviation.

D) the set of portfolios that have zero standard deviation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Systematic risk is also referred to as

A) market risk or non-diversifiable risk.

B) market risk or diversifiable risk.

C) unique risk or non-diversifiable risk.

D) unique risk or diversifiable risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The separation property refers to the conclusion that

A) the determination of the best risky portfolio is objective, and the choice of the best complete portfolio is subjective.

B) the choice of the best complete portfolio is objective, and the determination of the best risky portfolio is objective.

C) the choice of inputs to be used to determine the efficient frontier is objective, and the choice of the best CAL is subjective.

D) the determination of the best CAL is objective, and the choice of the inputs to be used to determine the efficient frontier is subjective.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected return of a portfolio of risky securities

A) is a weighted average of the securities' returns.

B) is the sum of the securities' returns.

C) is the weighted sum of the securities' variances and covariances.

D) is a weighted average of the securities' returns and the weighted sum of the securities' variances and covariances.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Security M has expected return of 17% and standard deviation of 32%.Security S has expected return of 13% and standard deviation of 19%.If the two securities have a correlation coefficient of 0.78, what is their covariance?

A) 0.038

B) 0.049

C) 0.047

D) 0.045

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unique risk is also referred to as

A) systematic risk or diversifiable risk.

B) systematic risk or market risk.

C) diversifiable risk or market risk.

D) diversifiable risk or firm-specific risk.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following probability distribution for stocks A and B:  The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

The expected rate of return and standard deviation of the global minimum variance portfolio, G, are __________ and __________, respectively.

A) 10.07%; 1.05%

B) 8.97%; 2.03%

C) 10.07%; 3.01%

D) 8.97%; 1.05%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement(s) is(are) true regarding the variance of a portfolio of two risky securities? I) The higher the coefficient of correlation between securities, the greater the reduction in the portfolio variance. II) There is a linear relationship between the securities' coefficient of correlation and the portfolio variance. III) The degree to which the portfolio variance is reduced depends on the degree of correlation between securities.

A) I only

B) II only

C) III only

D) I and II

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given an optimal risky portfolio with expected return of 12%, standard deviation of 26%, and a risk free rate of 3%, what is the slope of the best feasible CAL?

A) 0.64

B) 0.14

C) 0.08

D) 0.35

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given an optimal risky portfolio with expected return of 12%, standard deviation of 26%, and a risk free rate of 5%, what is the slope of the best feasible CAL?

A) 0.64

B) 0.27

C) 0.08

D) 0.33

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Security X has expected return of 12% and standard deviation of 18%.Security Y has expected return of 15% and standard deviation of 26%.If the two securities have a correlation coefficient of 0.7, what is their covariance?

A) 0.038

B) 0.070

C) 0.018

D) 0.033

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 63

Related Exams