A) government building a new road

B) Boeing Corporation building a new factory

C) a private citizen buying corporate stock

D) the Federal Reserve buying bonds from commercial banks

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between stocks and bonds?

A) Stocks are issued for a fixed period; bonds are not.

B) Stocks pay interest; bonds pay dividends.

C) Bond payouts are more predictable than payouts from stocks.

D) Bonds represent ownership; stocks represent debt.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The vertical intercept of the Security Market Line (SML) shows the

A) amount of arbitrage.

B) risk-free interest rate.

C) beta of the market portfolio.

D) risk premium for the market portfolio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bond payments are generally more predictable than stocks because

A) interest on bonds is not taxable.

B) stock prices and dividends exhibit little volatility.

C) bonds generate higher average rates of return.

D) bond owners know the size and timing of payments they will receive.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key reason that actively managed funds have lower returns than index funds with a similar level of risk is that

A) index funds require more buying and selling to generate their returns.

B) management and trading costs reduce the returns of actively managed funds.

C) index funds spend more on research and management.

D) diversification is more important to actively managed funds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Tani invests $100 in a financial asset earning an annually compounded interest rate of 5 percent.In about how many years will her investment be worth $150?

A) 5.2

B) 6.8

C) 8.3

D) 10

Correct Answer

verified

Correct Answer

verified

True/False

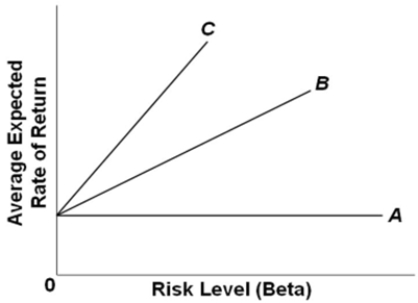

The Security Market Line depicts the inverse relationship between the average expected rates of return and risk levels of financial assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation goes bankrupt,

A) neither stockholders nor bondholders receive any money.

B) stockholders get paid from the sale of company assets before bondholders do.

C) bondholders get paid from the sale of company assets before stockholders do.

D) stockholders must honor the debts to bondholders out of personal assets if necessary.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors face the risk that the economy could go into another recession.This risk is

A) idiosyncratic.

B) diversifiable.

C) systemic.

D) time preference.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free interest rate is determined primarily by the

A) largest commercial banks.

B) Internal Revenue Service.

C) U.S.Treasury.

D) Federal Reserve.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is considered to be the best measure of the risk-free interest rate?

A) the rate of return on a corporate bond index fund

B) the rate of return on a corporate stock index fund

C) the rate of return on the Standard and Poor's 500

D) the rate of return on short-term U.S.government bonds

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor owns bond #1, which has a rate of return of 10 percent, but a similar bond #2 has an 11 percent return and equal risk.By selling bond #1 and buying bond #2 to earn a higher return, the investor is engaging in

A) pooling.

B) arbitrage.

C) diversification.

D) time preference.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graph.Which of the three Security Market Lines depicts the situation where investors most dislike risk?

Refer to the graph.Which of the three Security Market Lines depicts the situation where investors most dislike risk?

A) line A

B) line B

C) line C

D) It cannot be determined from the graph.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Standard & Poor's 500 Index measures prices of the 500

A) most purchased consumer goods in the United States.

B) stocks of the largest companies in the United States.

C) largest bonds trading in the United States.

D) largest index funds trading in the United States.

Correct Answer

verified

Correct Answer

verified

True/False

A change in investors' feelings about risk will change the intercept (and therefore shift) the Security Market Line.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The buying and selling activities that tend to equalize the rates of return on identical or nearly identical assets is called

A) beta.

B) risk.

C) arbitrage.

D) diversification.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do stocks represent?

A) shares of ownership in a corporation and a guaranteed stream of profits

B) shares of ownership in a corporation and an entitlement to its future profits

C) debt contracts with a corporation and regular interest payments on the loan

D) debt contracts with a corporation and variable interest payments on the loan

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present value model of investment states that an asset's current price should be equal to the

A) sum of the present values of all of its future payments or earnings.

B) sum of all of its future payments or earnings times the number of years of its life.

C) life of the asset times the present values of all of its future payments or earnings.

D) present values of all of its future payments or earnings divided by its life in years.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mutual funds may contain

A) stocks only.

B) bonds only.

C) either stocks or bonds.

D) neither stocks nor bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

$200 invested in a savings account paying an annual interest rate of 5 percent will be worth how much at the end of five years, assuming all interest earned remains in the account?

A) $1,250.

B) $250.

C) $267.25.

D) $255.26.

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 323

Related Exams