A) $15.90.

B) $16.20.

C) $21.00.

D) $22.50.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

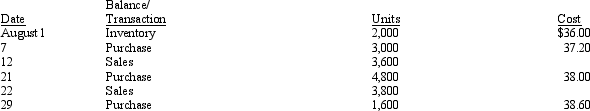

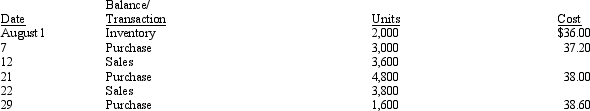

Miller Inc. is a wholesaler of office supplies. The activity for Model III calculators during August is shown below:

See information for Miller Inc. above. If Miller Inc. uses a FIFO cost perpetual inventory system, the ending inventory of Model III calculators at August 31 is reported as

See information for Miller Inc. above. If Miller Inc. uses a FIFO cost perpetual inventory system, the ending inventory of Model III calculators at August 31 is reported as

A) $150,080.

B) $150,160.

C) $152,232.

D) $152,960.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

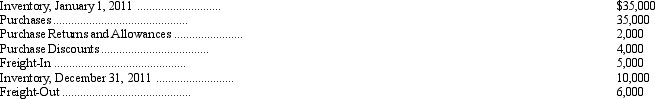

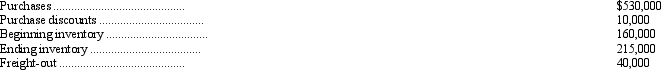

Following are the account balances from Jackson Company's income statement:

Given this information, the cost of merchandise available for sale during 2011 is

Given this information, the cost of merchandise available for sale during 2011 is

A) $65,000.

B) $59,000.

C) $69,000.

D) $61,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

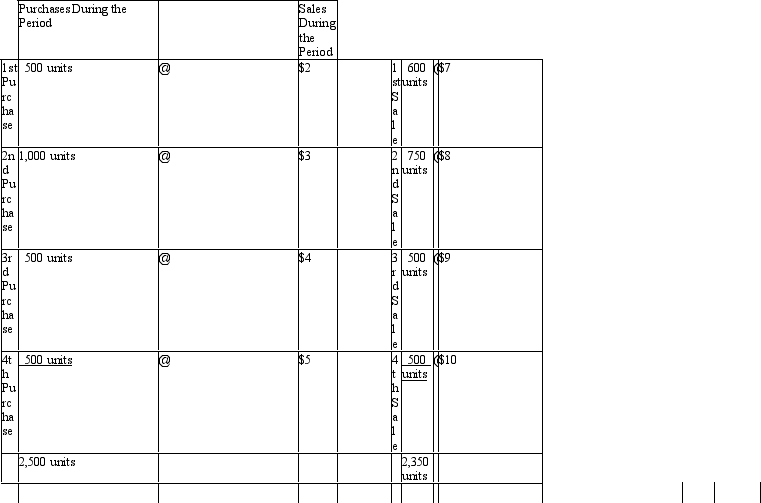

Purchases and sales during a recent period for Coleman, Inc. were:

Beginning inventory was 100 units at $1 each.

See information for Coleman, Inc.above. Given this information, what is the ending inventory if the periodic LIFO costing alternative is used?

Beginning inventory was 100 units at $1 each.

See information for Coleman, Inc.above. Given this information, what is the ending inventory if the periodic LIFO costing alternative is used?

A) $400

B) $500

C) $1,250

D) $3,100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

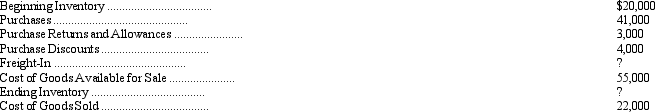

From the following information, determine the amount of freight-in.

A) $3,000

B) $4,000

C) $2,000

D) $1,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

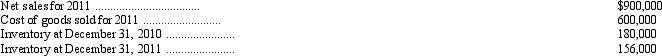

Hardy Company is a wholesale electronics distributor. On December 31, 2011, it prepared the following partial income statement: Given this information, if Hardy Company's gross margin is 30 percent of net sales, what is the correct ending inventory balance?

A) $80,000

B) $120,000

C) $180,000

D) $500,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An overstatement of ending inventory in Period 1 would result in income of Period 2 being

A) overstated.

B) understated.

C) correctly stated.

D) The answer cannot be determined from the information given.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miller Inc. is a wholesaler of office supplies. The activity for Model III calculators during August is shown below:

See information for Miller Inc. above. If Miller Inc. uses a LIFO cost perpetual inventory system, the ending inventory of Model III calculators at August 31 is reported as

See information for Miller Inc. above. If Miller Inc. uses a LIFO cost perpetual inventory system, the ending inventory of Model III calculators at August 31 is reported as

A) $146,400.

B) $150,080.

C) $150,160.

D) $152,960.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost of goods sold is equal to

A) the cost of inventory on hand at the end of a period plus net purchases minus the cost of inventory on hand at the beginning of a period.

B) the cost of inventory on hand at the beginning of a period minus net purchases plus the cost of inventory on hand at the end of a period.

C) the cost of inventory on hand at the beginning of a period plus net sales minus the cost of inventory on hand at the end of a period.

D) the cost of inventory on hand at the beginning of a period plus net purchases minus the cost of inventory on hand at the end of a period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

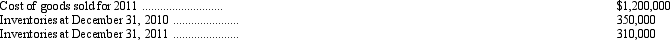

The following information is available from Preston Company's 2011 accounting records:

Preston's 2011 cost of goods sold is

Preston's 2011 cost of goods sold is

A) $465,000.

B) $475,000.

C) $505,000.

D) $585,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gross profit method of inventory valuation is not valid when

A) there is substantial increase in the quantity of inventory during the year.

B) there is substantial increase in the cost of inventory during the year.

C) the gross margin percentage changes significantly during the year.

D) all ending inventory is destroyed by fire before it can be counted.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be reported as inventory?

A) Land acquired for resale by a real estate firm

B) Stocks and bonds held for resale by a brokerage firm

C) Partially completed goods held by a manufacturing company

D) Machinery acquired by a manufacturing company for use in the production process

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miller Company needs an estimate of its ending inventory balance. The following information is available: Given this information, when using the gross margin estimation method, ending inventory is approximately

A) $1,000.

B) $9,000.

C) $19,000.

D) $11,650.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goods in transit at year-end purchased FOB shipping point were appropriately recorded in the purchases account but were incorrectly excluded from the ending inventory. What effect will this omission have on the company's assets, liabilities, and retained earnings at year-end?

A) No effect, no effect, overstated

B) No effect, no effect, understated

C) Understated, no effect, overstated

D) Understated, no effect, understated

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would cause a decrease in the cost ratio as used in the retail inventory method?

A) Higher retail prices

B) Lower net markups

C) More employee discounts given

D) Higher freight-in charges

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the current year's ending inventory amount is overstated, the

A) current year's cost of goods sold is overstated.

B) current year's total assets are understated.

C) current year's net income is overstated.

D) next year's income is overstated.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Selected information from the accounting records of Thayer Company is as follows:

Thayer's inventory turnover for 2011 is

Thayer's inventory turnover for 2011 is

A) 5.36 times.

B) 3.85 times.

C) 3.67 times.

D) 3.57 times.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm using the perpetual inventory method returned defective merchandise costing $2,000 to one of its suppliers. The entry to record this transaction will include a debit to

A) Accounts Receivable.

B) Inventory.

C) Purchase Returns and Allowances.

D) Accounts Payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available for Lyman Company:

Assuming that a business year consists of 360 days, the number of days' sales in average inventories for 2011 was

Assuming that a business year consists of 360 days, the number of days' sales in average inventories for 2011 was

A) 49.5.

B) 93.

C) 99.

D) 105.

Correct Answer

verified

Correct Answer

verified

Essay

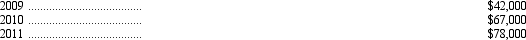

Boston Company reported the following net income amounts:

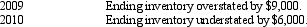

In 2012, the company discovered errors that had been made in computing the ending inventories for 2009 and 2010, as follows:

In 2012, the company discovered errors that had been made in computing the ending inventories for 2009 and 2010, as follows:

Compute the correct net incomes for (1) 2009, (2) 2010, and (3) 2011.

Compute the correct net incomes for (1) 2009, (2) 2010, and (3) 2011.

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 121

Related Exams