Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a monetarist solution for a recession?

A) Steady and predictable growth of the money supply.

B) A decrease in short-term interest rates.

C) An increase in the money supply alone.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity of money people are willing and able to hold at alternative interest rates,ceteris paribus,is known as the

A) Demand for money.

B) Supply of money.

C) Equilibrium of money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a monetarist assumption that plays a key role in explaining the ineffectiveness of fiscal policy?

A) The liquidity trap.

B) The instability in the velocity of money.

C) Crowding out.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the anticipated inflation rate is 5 percent and the nominal interest rate is 9 percent,the real interest rate will be

A) 4 percent.

B) Negative 14 percent.

C) 14 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is a constant 15 percent and anticipated inflation falls from 10 percent to 7 percent,the real interest rate would change from

A) 15 to 10 percent.

B) 5 to 8 percent.

C) 7 to 9 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decrease in aggregate demand could be caused by

A) A decrease in the value of the domestic currency.

B) A booming economy.

C) Contractionary monetary policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The In the News article titled "Prices Are low! Mortgages Cheap! But You Can't Get One" indicates that

A) Mortgage interest rates are higher,down payments are higher,and home prices are higher.

B) Mortgage interest rates are lower,down payments are lower,and home prices are lower.

C) Mortgage interest rates are lower,down payments are higher,and home prices are lower.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to Bernanke's policy guide,a half percentage point increase in long-term interest rates will

A) Increase AD by $50 billion.

B) Decrease AD by $100 billion.

C) Increase AS by $50 billion.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effectiveness of monetary policy is influenced by

A) The time it takes for lower interest rates to make investment spending more profitable.

B) The willingness of Congress to implement it.

C) How responsive the money supply is to changes in taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

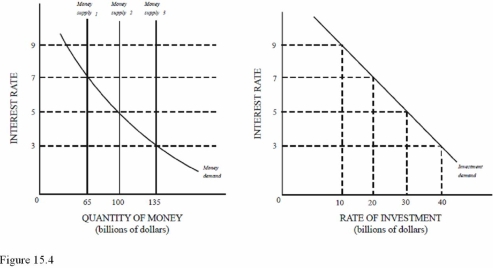

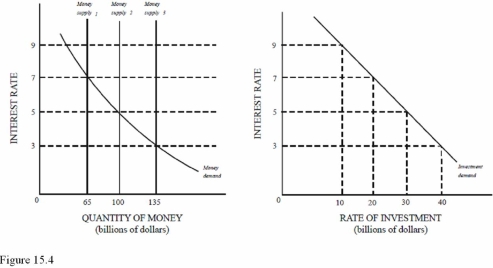

-In Figure 15.4,an increase in the money supply from $65 billion to $100 billion will cause the equilibrium rate of interest to

-In Figure 15.4,an increase in the money supply from $65 billion to $100 billion will cause the equilibrium rate of interest to

A) Decrease from 7 percent to 5 percent.

B) Increase from 5 percent to 7 percent.

C) Decrease from 7 percent to 3 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the equation of exchange and assuming full employment and a constant velocity of money,a decrease in the required reserve ratio would result in a

A) Lower velocity.

B) Lower quantity of real output.

C) Higher price level.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to Bernanke's policy guide,a full-point decrease in long-term interest rates results in a

A) $10 billion stimulus for the economy.

B) $20 billion stimulus for the economy.

C) $200 billion stimulus for the economy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In periods of restrictive monetary policy,which of the following industries are likely to feel a disproportionately large impact of the policy?

A) The auto industry.

B) Fast-food restaurants.

C) Cell phone service providers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real rate of interest is negative,then,ceteris paribus,

A) The nominal interest rate is negative.

B) Monetary policy is tight.

C) The nominal interest rate is less than the anticipated inflation rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In making monetary policy the Fed currently

A) Increases the money supply at a fixed rate each year.

B) Has adopted the monetarist view and "leans against the wind."

C) Focuses on the federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-In Figure 15.4,an increase in the money supply from $100 billion to $135 billion will cause a

-In Figure 15.4,an increase in the money supply from $100 billion to $135 billion will cause a

A) $40 billion increase in investment.

B) Decrease in the interest rate.

C) Decrease in aggregate demand.

Correct Answer

verified

Correct Answer

verified

True/False

The federal funds rate reflects the cost for banks to borrow from other banks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a series of events that accurately describes the steps by which restrictive monetary policy is effective?

A) Decrease in interest rate,decrease in M1,and increase in investment.

B) Decrease in M1,increase in interest rate,and decrease in investment.

C) Increase in M1,decrease in investment,and decrease in interest rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money held for making everyday market purchases represents the

A) Crisis demand for money.

B) Speculative demand for money.

C) Transactions demand for money.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 121

Related Exams