Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indra is an employee who is required to be on-call at her employer's site once per month for eight hours. She earns a salary of $58,750 per year for a 45-hour workweek and is paid biweekly. What is Indra's gross pay for a pay period that includes on-call time? (Do not round interim calculations. Round final answer to two decimal places.)

A) $2,447.92

B) $2,259.62

C) $2,460.47

D) $2,648.77

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Clark is a piece rate worker who earns $8.25 per completed unit. During a 40-hour workweek, Clark completed 57 units. What is Clark's hourly rate?

A) $15.21 per hour

B) $11.76 per hour

C) $13.98 per hour

D) $12.22 per hour

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor is an outside salesperson for a firm in Idaho. She earns a 10% commission on all sales she makes. During a one-week pay period, she made $2,750 in sales. What is her gross pay? How much does her employer need to contribute toward her pay to meet FLSA standards?

A) $275; $0

B) $250; $205

C) $455; $0

D) $275; $180

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brittany is a full-time college student and is 21 years of age. Her employer has the option to pay her less than the Federal minimum wage. What is the minimum hourly rate that Brittany may receive?

A) $7.25 per hour

B) $4.25 per hour

C) $6.16 per hour

D) $5.80 per hour

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cole is a minimum wage employee in Santa Fe, NM, where the minimum wage is $10.91 per hour. His employer claims that since the federal minimum wage is $7.25 per hour, Cole should only receive the federal amount. What is the correct answer in this situation?

A) The employer has the discretion to pay either the federal or the state-designated minimum wage.

B) The employer may choose to pay less than the state-designated minimum wage, based on the employee's qualifications and job description.

C) The employer is correct that the federal minimum wage overrules the state wage.

D) The employer must pay the state-designated minimum wage for the area.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Weishan is a full-time student at a vocational school where he is learning automotive repair. He works for a local car repair garage and works 21 hours per week. The minimum wage is the same as the federal minimum wage. His gross pay per week is ________. (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $89.25

B) $114.19

C) $129.41

D) $152.25

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vincent is a tipped employee who earns a wage of $2.13 per hour in a tip-credit state and works a standard 40-hour workweek. Last week, he earned $60 in tips. Which of the following is true?

A) Vincent does not have to report his tips for the week because they were less than $75.

B) Vincent's employer may not report his tips for income tax purposes.

C) Vincent's employer must pay him the tip credit because his wages and tips for the week were less than the federal minimum wage.

D) Vincent must file a request with his employer to have the tip credit applied to his wages for the week.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

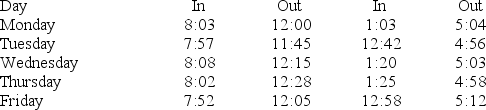

Brandie is an hourly worker whose employer uses the quarter-hour method. During a one-week period, she worked the following hours:  Using the quarter-hour method, how many hours did she work that week?

Using the quarter-hour method, how many hours did she work that week?

A) 39.50 hours

B) 39.75 hours

C) 40.00 hours

D) 40.25 hours

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lawrin is a real-estate salesperson whose compensation is commission-only. She earns a 3% commission on the sale price of each house that she sells and receives 1.5% commissions at the end of each month (the broker retains the rest per the employment agreement) . During the month of July, Lawrin sold two houses totaling $385,420. What is her gross pay for the month of July?

A) $5,620.00

B) $5,781.30

C) $11,562.00

D) $8,623.50

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mac is a cook at a local restaurant and earns $9.15 per hour. He occasionally serves as the crew chief, for which he receives an additional $2.50 per hour. During a biweekly pay period, he had the following time data: Cook: 75 hours (including 8 hours overtime) Crew chief: 13 hours His gross pay for the pay period would be ________. (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $902.58

B) $878.31

C) $874.30

D) $841.80

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robin, 18 years of age, is an hourly worker in her college's bookstore in Washington state. She works 37 hours during a two-week pay period in her second month of work for the bookstore. The minimum gross pay that she may receive for that two-week period is ________. (Round to the nearest cent)

A) $157.25

B) $228.01

C) $268.25

D) $344.84

Correct Answer

verified

Correct Answer

verified

True/False

The payroll register is a confidential company document.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lloyd is the CFO for a firm that uses ISOs as part of its executive compensation plan. He receives $150,000 annually, paid semimonthly, in base salary plus 25 shares of the firm's stock per month. The stock is omitted from gross pay calculations and is valued at $52.50 per share and he may exercise his option within five years at $0.10 per share. What is Lloyd's gross pay for mid-October?

A) $7,250

B) $6,250

C) $7,560

D) $8,250

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ronda is a college professor who earns an annual salary of $55,000. She performs an additional function as a tutor in the student center, for which she receives $21.83 per hour. During a biweekly pay period, Ronda worked 7.5 hours in the student center. What is her gross pay for the period? (Do not round intermediate calculations. Round final answer to 2 decimal places.)

A) $2,115.38

B) $2,291.67

C) $2,455.39

D) $2,279.11

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nonexempt employees are usually workers who:

A) Routinely supervise other employees.

B) Are exempt from certain company rules.

C) Occupy executive positions in the company.

D) Perform operative level tasks.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During his first month of employment, Alix took a draw of 5% against his minimum sales amount of $15,000 in monthly sales that must be deducted from his pay during the first month that he reaches his minimum sales amount. He receives $18,000 annually in base salary plus a 5% commission on his sales. He receives his base salary on a semimonthly basis and receives his commissions on the final pay date of each month. During his second month of employment, Alix sold $24,000 of equipment. What is Alix's gross pay for the end of the second month of employment?

A) $1,950.00

B) $1,500.00

C) $1,350.00

D) $1,200.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maya is compensated using a salary-plus-commission basis for her work. Her annual base salary is $32,000. During a semimonthly pay period she made $18,500 in sales, for which she receives a 2% commission. Her gross pay for the semimonthly period is ________. (Do not round interim calculations. Round final answer to 2 decimal places.)

A) $1,333.33

B) $1,523.55

C) $1,693.54

D) $1,703.33

Correct Answer

verified

Correct Answer

verified

Multiple Choice

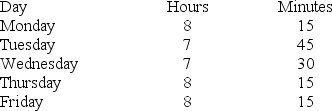

Arnelle is in her third month of work for her employer. She is 18 years of age. Her working hours, computed on a quarter-hour basis, were as follows for the current weekly pay period:  Arnelle receives the minimum wage, according to the 1996 FLSA Amendment. What is her gross pay for the week using actual hours?

Arnelle receives the minimum wage, according to the 1996 FLSA Amendment. What is her gross pay for the week using actual hours?

A) $290.00

B) $246.50

C) $145.00

D) $170.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does it mean to prove the payroll register?

A) Gaining approval to disburse payroll amounts.

B) Verifying the validity of employees' time sheets.

C) Ensuring that the sum of the column totals equals the sum of the row totals.

D) Computing the column and row totals.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 83

Related Exams