Correct Answer

verified

Correct Answer

verified

Multiple Choice

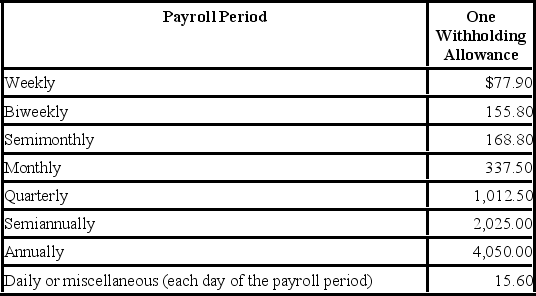

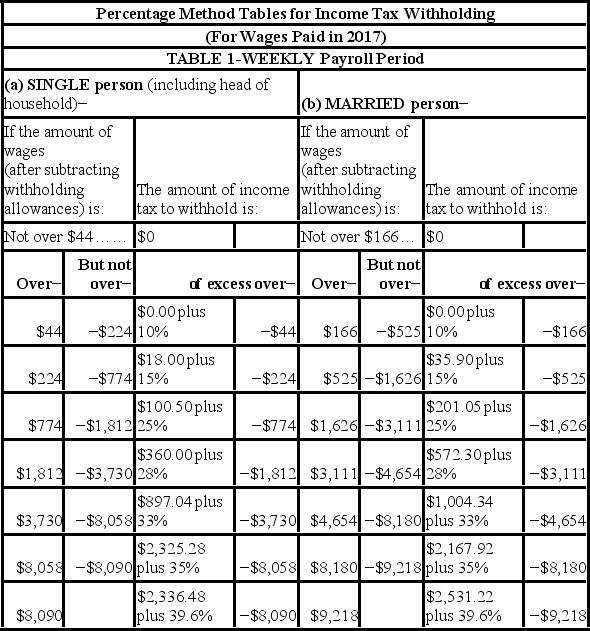

Olga earned $1,558.00 during the most recent weekly pay period. She is single with 2 withholding allowances and no pre-tax deductions. Using the percentage method, compute Olga's federal income tax for the period. (Do not round intermediate calculations. Round final answer to two decimal places.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

A) $277.93

B) $339.25

C) $257.55

D) $314.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is used in the determination of the amount of federal income tax to be withheld from an employee per pay period?

A) Date of birth

B) Annual salary

C) Marital status

D) Prior year's tax return

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of paycards as a pay method is to ________.

A) prevent employees from opening bank accounts

B) promote accessibility and portability of employee compensation

C) protect payroll processes against embezzlement

D) promote debit card use as a means of economic stimulus

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Garnishments may include deductions from employee wages on a post-tax basis for items such as: (Select all that apply.)

A) Charitable contributions.

B) Consumer Credit liens.

C) Child Support payments.

D) Union Dues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is/are true about Social Security tax deductions from gross pay? (Select all that apply.)

A) The tax rate is 6.0%.

B) The tax is computed on all earnings.

C) Section 125 deductions are not subject to Social Security tax.

D) The wage base is $127,200.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and Local Income Tax rates ________.

A) exist at the same level in every state

B) differ among states and localities

C) are mandated by Federal law

D) are paid by the employer to the Federal government

Correct Answer

verified

Correct Answer

verified

True/False

Charitable contributions are an example of post-tax voluntary deductions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

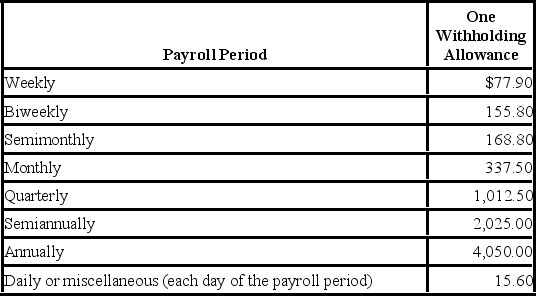

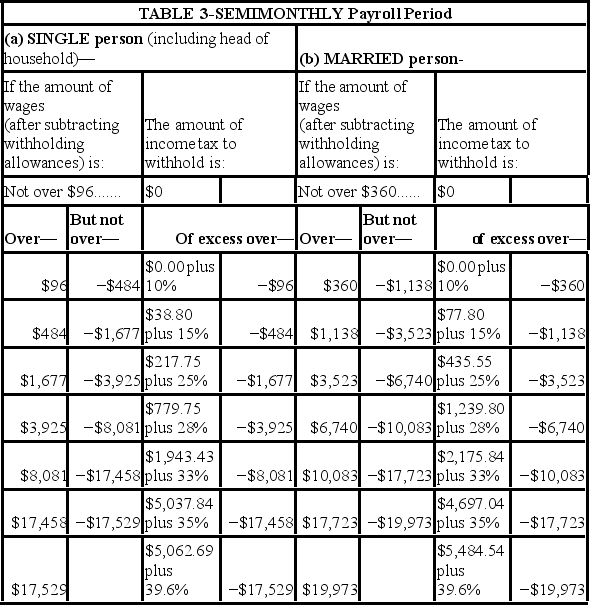

Danny is a full-time exempt employee in Alabama, where the state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) . Assuming that he has no other deductions, what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax. Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

A) $2,245.53

B) $2,403.95

C) $2,361.72

D) $2,178.90

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is an advantage of direct deposit from the employee's perspective?

A) Long processing times for pay disbursements.

B) Secure access to compensation.

C) The requirement to have a bank account.

D) Access to payroll data on non-secured website.

Correct Answer

verified

Correct Answer

verified

True/False

The amount of federal income tax decreases as the number of allowances increases.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Natalia is a full-time exempt employee who earns $215,000 annually, paid monthly. Her year-to-date pay as of November 30 is $197,083.33. How much will be withheld from Natalia for FICA taxes for the December 31 pay date? (Social Security maximum wage is $127,200. Do not round interim calculations, only round final answer to two decimal points.)

A) $292.04

B) $394.79

C) $1,370.63

D) $421.04

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adam is a part-time employee who earned $495.00 during the most recent pay period. He is married with two withholding allowances. Prior to this pay period, his year-to-date pay is $6,492.39. How much should be withheld from Adam's gross pay for Social Security tax?

A) $40.02

B) $30.69

C) $37.92

D) $28.46

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage of the Medicare tax withholding ________.

A) is the same for every employee, regardless of income

B) is subject to change based on the firm's profitability

C) changes every year in response to industry needs

D) remains the same for all employees who earn less than $200,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The factors that determine an employee's federal income tax are ________.

A) Marital status, birth date, taxable pay, and pay frequency

B) Number of children, pay frequency, marital status, and gross pay

C) Marital status, number of withholdings, taxable pay, and pay frequency

D) Pay frequency, number of dependents, taxable pay, and marital status

Correct Answer

verified

Correct Answer

verified

True/False

Garnishments are court-ordered amounts that an employer must withhold from an employee's pre-tax pay and remit to the appropriate authority.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

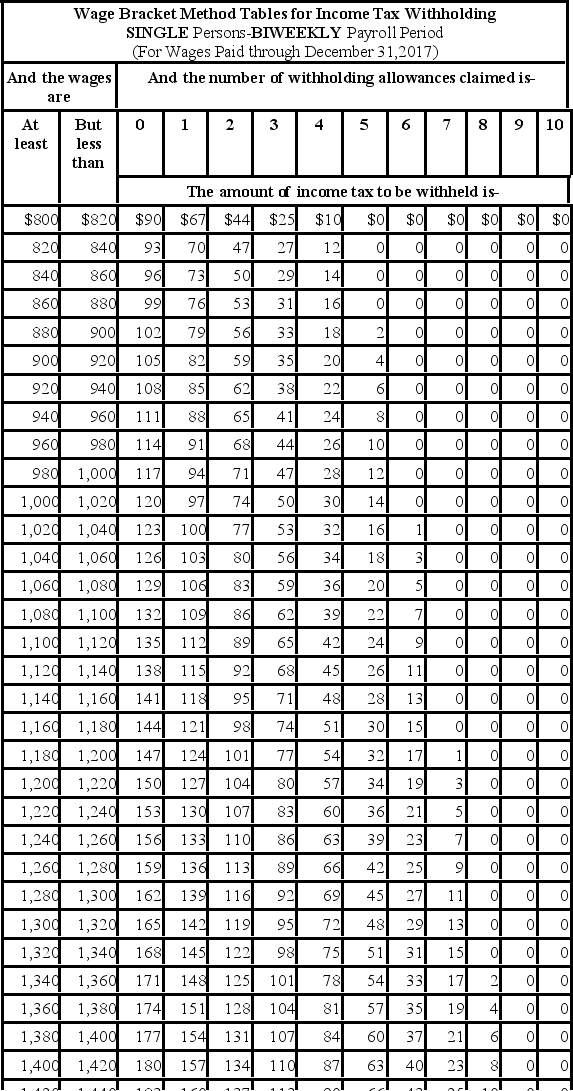

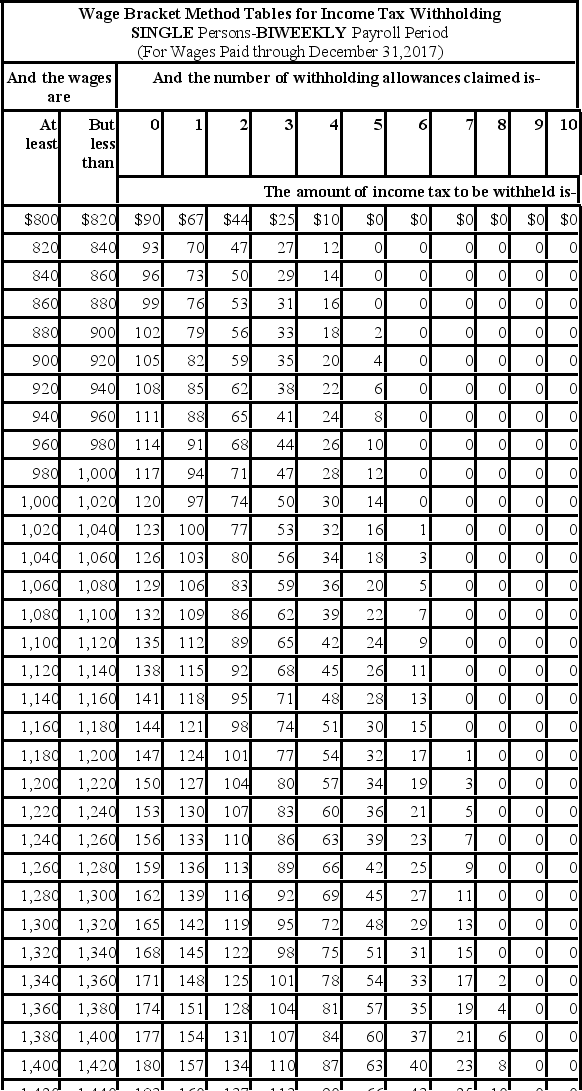

Caroljane earned $1,120 during the most recent pay biweekly pay period. She contributes 4% of her gross pay to her 401(k) plan. She is single and has 1 withholding allowance. Based on the following table, how much Federal income tax should be withheld from her pay?

A) $115.00

B) $109.00

C) $121.00

D) $106.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage method of determining an employee's Federal income tax deductions ________.

A) is used to promote complexity in payroll practices

B) allows payroll accountants to determine Federal income tax for the firm itself

C) is used primarily for high wage earners and computerized payroll programs

D) is less accurate than the results gained from using the wage-bracket method

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which body issued Regulation E to protect consumers from loss of deposited funds?

A) Department of Homeland Security

B) Internal Revenue Service

C) American Banking Association

D) Federal Deposit Insurance Corporation

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Julian is a part-time nonexempt employee in Nashville, Tennessee, who earns $21.50 per hour. During the last biweekly pay period he worked 45 hours, 5 of which are considered overtime. He is single with one withholding allowance (use the wage-bracket table) . What is his net pay? (Do not round interim calculations, only round final answer to two decimal points.)

A) $818.40

B) $797.18

C) $825.99

D) $843.12

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 70

Related Exams