A) Buying goods and services on credit.

B) Obtaining a short-term loan.

C) Issuing long-term debt.

D) Remitting sales tax to the government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company sells a bond with a face value of $10,000 and receives a premium of $800.Using the Simplified Approach (Effective-interest Method) ,the company would make the following journal entry:

A) Debit Cash for $10,800 and credit Bonds Payable,Net for $10,800.

B) Debit Cash for $10,800,credit Bonds Payable,net for $10,000,and credit Premium on Bond Payable for $800.

C) Debit Cash for $10,000,debit Interest Expense for $800,credit Bonds Payable,net for $10,000,and credit Premium on Bonds Payable for $800.

D) Debit Cash for $10,000,debit Interest Expense for $800,credit Bonds Payable for $10,000 and credit Premium on Bonds Payable for $800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%.The market interest rate is 5%.The issue price of the bond was $10,866.Using the effective-interest method of amortization and rounding to the nearest dollar,the interest expense for the first year ended December 31 would be:

A) $700.

B) $543.

C) $667.

D) $759.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%.The market interest rate is 5%.The issue price of the bond was $10,866.Your company used the effective-interest method of amortization.At the end of the first year,your company should:

A) debit Interest Expense for $543,debit Premium on Bonds Payable for $157,and credit Interest Payable for $700.

B) debit Interest Expense for $700,credit Premium on Bonds Payable for $157,and credit Interest Payable for $543.

C) debit Interest Expense for $700,debit Premium on Bonds Payable for $157,and credit Interest Payable for $543.

D) debit Interest Expense for $543 and credit Interest Payable for $543.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.If the effective interest method of amortization is used,how much total interest expense would be recorded in 2013?

A) $1,000

B) $1,080

C) $800

D) $864

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Payroll taxes paid by employees include which of the following?

A) Federal income tax,federal unemployment tax,and Medicare.

B) Social security tax,federal unemployment tax,and state unemployment tax.

C) FICA taxes,federal unemployment tax,and state unemployment tax.

D) Federal income tax,state income tax,and Medicare.

Correct Answer

verified

Correct Answer

verified

True/False

If the market rate exceeds the stated interest rate,a bond will sell at a premium.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are due:

A) but not receivable for more than one year or the current operating cycle,whichever is longer.

B) but not payable for more than one year or the current operating cycle,whichever is longer.

C) and receivable within the current operating cycle or one year,whichever is longer.

D) and payable within the current operating cycle or one year,whichever is longer.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 6%,a $10,000,10-year bond with a stated annual interest rate of 8% would be issued at an amount:

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) equal to the face value minus a discount.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

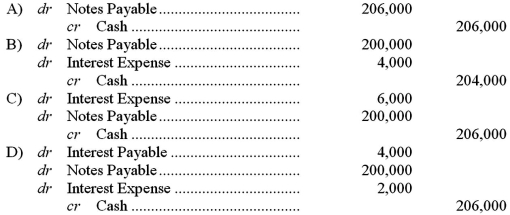

Use the information above to answer the following question.What journal entry will Backyard make when paying off the note and interest at maturity if the company's year-end is June 30? (Hint: Backyard's records were adjusted on June 30) .

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using straight-line amortization,when a bond is sold at a premium:

A) the amortized premium is added to the interest payable to calculate interest expense.

B) bonds payable rises by a constant amount each year.

C) interest expense is calculated by subtracting the amortized premium from the interest payment that is to be made.

D) interest expense rises each year.

Correct Answer

verified

Correct Answer

verified

True/False

The threshold for recording contingent liabilities under IFRS is lower than that under GAAP.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accrued liabilities could include all of the following except:

A) salaries payable.

B) current portion of long-term debt.

C) income tax payable.

D) interest payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the effective-interest method of amortization is used,what happens to interest expense as a bond moves toward maturity?

A) Interest expense falls for bonds sold at either a discount or a premium.

B) Interest expense rises for bonds sold at a discount and falls for bonds sold at a premium.

C) Interest expense rises for bonds sold at either a discount or a premium.

D) Interest expense falls for bonds sold at a discount and rises for bonds sold at a premium.

Correct Answer

verified

Correct Answer

verified

Essay

Bonds with a stated interest rate of 9% and a face value totaling $600,000 were issued at 104 on January 1,2014,implying an annual market interest rate of 8%.Assuming that interest is computed annually,at what carrying value should the total liability for these bonds be reported two years later on December 31,2015,if the effective-interest method of amortization is used?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has liquid assets of $5 million and net income of $10 million.Current liabilities total $2.5 million,interest expense is $2 million,and income tax expense is $3 million.What is the quick ratio for the company?

A) 0.5

B) 7.5

C) 0.3

D) 2.0

Correct Answer

verified

Correct Answer

verified

True/False

A contingent liability is recorded by making an appropriate journal entry if the likelihood of a loss is possible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales tax collected by a company is normally reported as:

A) a current liability.

B) income tax expense.

C) an asset.

D) an operating expense.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements regarding amortization of discounts and premiums is not true?

A) Under straight-line amortization,when a bond is sold at a premium,the annual premium amortization is the total premium divided by the number of years until bond maturity.

B) When a bond is sold at a discount,interest expense recorded using the effective-interest method is less than the interest paid on the bond.

C) The effective-interest method of amortization is considered to be conceptually superior to straight-line amortization.

D) When a bond discount is amortized using the effective-interest method,the promised interest payment is less than the interest expense,so the bond liability will increase as a result of the contra-liability account decreasing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.The entry to record the issuance of the bonds on January 1,2014,would include:

A) a credit to Discount on Bonds Payable of $57,500.

B) a debit to Cash of $442,500.

C) a debit to Bonds Payable of $500,000.

D) a credit to Premium on Bonds Payable of $90,000.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 145

Related Exams