Correct Answer

verified

Correct Answer

verified

True/False

_____ 13.The person giving the gift pays the gift tax.

Correct Answer

verified

Correct Answer

verified

True/False

_____ 2.The first codification of the Internal Revenue Code took place in 1954.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a tax credit allowed a corporation?

A) Foreign tax credit

B) Education credit

C) Investment tax credit

D) Orphan drug credit

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes horizontal equity?

A) All taxpayers should pay some taxes on their incomes

B) As income increases,taxes should increase

C) Persons with equal incomes should pay the same amount of taxes

D) A person with capital gains should pay less tax than a person with the same amount of salary income

Correct Answer

verified

Correct Answer

verified

True/False

_____ 16.Adam Smith's four canons of taxation are Equity,Certainty,Economy and Convenience.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When was the last time the Internal Revenue Code was recodified?

A) 1913

B) 1939

C) 1954

D) 1986

Correct Answer

verified

Correct Answer

verified

True/False

_____ 4.All interest paid to a taxpayer must be included in gross income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these entities is taxed directly on its income?

A) Limited Liability Company

B) C Corporation

C) Partnership

D) Sole Proprietorship

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Terri owns a 50 percent interest in the TT Partnership.At the beginning of the year,her basis in her partnership interest was $75,000.The partnership reports a $40,000 loss for the year and distributes $4,000 cash to Terri.What is her basis in her partnership interest at the end of the year?

A) $111,000

B) $75,000

C) $51,000

D) $31,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of an S corporation?

A) Owners have limited liability

B) The corporation is taxed directly on operating income

C) The corporation can have no more than 100 shareholders

D) Shareholders must consent to the S election by the corporation

Correct Answer

verified

Correct Answer

verified

True/False

_____ 5.A taxpayer's filing status determines the basic standard deduction allowed.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is never included in gross income?

A) Loss on stock sale

B) Social security benefits

C) Unemployment benefits

D) Gifts

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following business entities has no provision that limits some or all of the liability of the owner?

A) C Corporation

B) Sole Proprietorship

C) S Corporation

D) Limited Liability Company

Correct Answer

verified

Correct Answer

verified

Multiple Choice

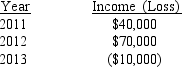

Hoku Corporation (a C corporation) had the following history of income and loss:  How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?

How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?

A) $1,500

B) $2,500

C) $3,500

D) None;it cannot carry its loss back

Correct Answer

verified

Correct Answer

verified

True/False

_____ 8.The alternative minimum tax is a tax determined on a broadened definition of income with no deductions permitted.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 56 of 56

Related Exams